Question: URGENT ANSWER REQUIRED!!! I have a question regarding the Diamond & Dybvig (1983) model about Bank runs: = = = = Consider a Diamond &

URGENT ANSWER REQUIRED!!!

I have a question regarding the Diamond & Dybvig (1983) model about Bank runs:

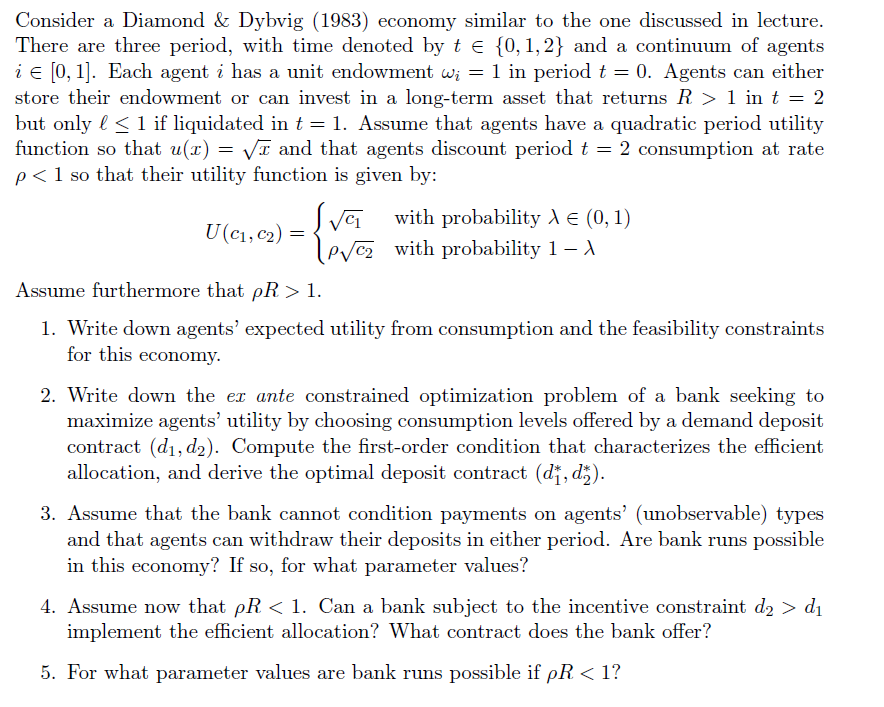

= = = = Consider a Diamond & Dybvig (1983) economy similar to the one discussed in lecture. There are three period, with time denoted by te {0, 1, 2} and a continuum of agents ie [0, 1]. Each agent i has a unit endowment wi = 1 in period t = 0. Agents can either , store their endowment or can invest in a long-term asset that returns R > 1 in t = 2 but only l 1. 1. Write down agents' expected utility from consumption and the feasibility constraints for this economy. 2. Write down the er ante constrained optimization problem of a bank seeking to maximize agents' utility by choosing consumption levels offered by a demand deposit contract (d, d2). Compute the first-order condition that characterizes the efficient allocation, and derive the optimal deposit contract (di, d). 3. Assume that the bank cannot condition payments on agents' (unobservable) types and that agents can withdraw their deposits in either period. Are bank runs possible in this economy? If so, for what parameter values? 4. Assume now that pR di implement the efficient allocation? What contract does the bank offer? 5. For what parameter values are bank runs possible if PR 1 in t = 2 but only l 1. 1. Write down agents' expected utility from consumption and the feasibility constraints for this economy. 2. Write down the er ante constrained optimization problem of a bank seeking to maximize agents' utility by choosing consumption levels offered by a demand deposit contract (d, d2). Compute the first-order condition that characterizes the efficient allocation, and derive the optimal deposit contract (di, d). 3. Assume that the bank cannot condition payments on agents' (unobservable) types and that agents can withdraw their deposits in either period. Are bank runs possible in this economy? If so, for what parameter values? 4. Assume now that pR di implement the efficient allocation? What contract does the bank offer? 5. For what parameter values are bank runs possible if PR

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts