Question: urgent!!! B D E QUESTION - PROBLEM 3 Problem 3 - 30 POINTS (approximately 30 mins) You work as a chief investment analyst in a

urgent!!!

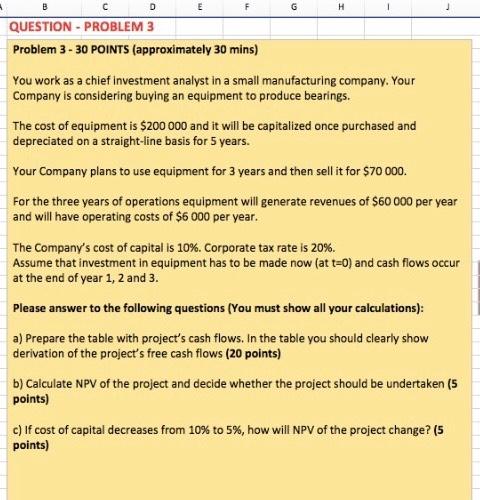

urgent!!!B D E QUESTION - PROBLEM 3 Problem 3 - 30 POINTS (approximately 30 mins) You work as a chief investment analyst in a small manufacturing company. Your Company is considering buying an equipment to produce bearings. The cost of equipment is $200 000 and it will be capitalized once purchased and depreciated on a straight-line basis for 5 years. Your Company plans to use equipment for 3 years and then sell it for $70 000. For the three years of operations equipment will generate revenues of $60 000 per year and will have operating costs of $6000 per year. The Company's cost of capital is 10%. Corporate tax rate is 20%. Assume that investment in equipment has to be made now (at t=0) and cash flows occur at the end of year 1, 2 and 3. Please answer to the following questions (You must show all your calculations): a) Prepare the table with project's cash flows. In the table you should clearly show derivation of the project's free cash flows (20 points) b) Calculate NPV of the project and decide whether the project should be undertaken (5 points) c) If cost of capital decreases from 10% to 5%, how will NPV of the project change? (5 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts