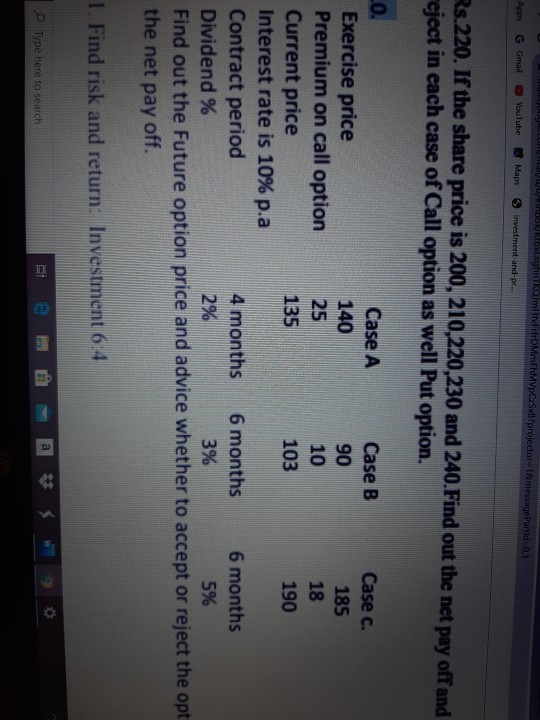

Question: Urgent .............................Case A Case B Case C Exercise price 140 90 185 Premium on call option 25 10 18 Current price 135 103 190 Interest

Urgent .............................Case A Case B Case C Exercise price 140 90 185 Premium on call option 25 10 18 Current price 135 103 190 Interest rate is 10% p.a Contract period 4 months 6 mnths 6 mnths Dividend % 2% 3% 5% Find out the Future option price and advice whether to accept or reject the option and what will be the net pay off.

DILLUNDU) VIHDOXRlbxxghnt mit FrfrDMmFhMVPC-SxB?projector=1&message Partid=0.1 YouTube Maps s investment-and-p... Apps G Gmail Rs.220. If the share price is 200, 210,220,230 and 240.Find out the net pay off and reject in each case of Call option as well Put option. 20. Case A Case B Case c. Exercise price 140 90 185 Premium on call option 25 10 18 Current price 135 103 190 Interest rate is 10% p.a Contract period 4 months 6 months 6 months Dividend % 2% 3% 5% Find out the Future option price and advice whether to accept or reject the opt the net pay off. 1. Find risk and return: Investment 6:4 Type here to search a a DILLUNDU) VIHDOXRlbxxghnt mit FrfrDMmFhMVPC-SxB?projector=1&message Partid=0.1 YouTube Maps s investment-and-p... Apps G Gmail Rs.220. If the share price is 200, 210,220,230 and 240.Find out the net pay off and reject in each case of Call option as well Put option. 20. Case A Case B Case c. Exercise price 140 90 185 Premium on call option 25 10 18 Current price 135 103 190 Interest rate is 10% p.a Contract period 4 months 6 months 6 months Dividend % 2% 3% 5% Find out the Future option price and advice whether to accept or reject the opt the net pay off. 1. Find risk and return: Investment 6:4 Type here to search a a

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts