Question: urgent Complete the case study questions using the information given in each of the 3 growth scenarios for Ace Industrial Supply. Ace Industrial Supply sells

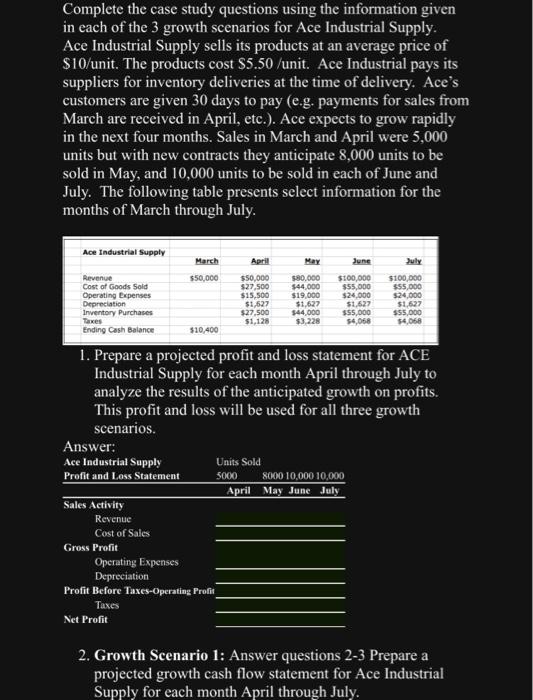

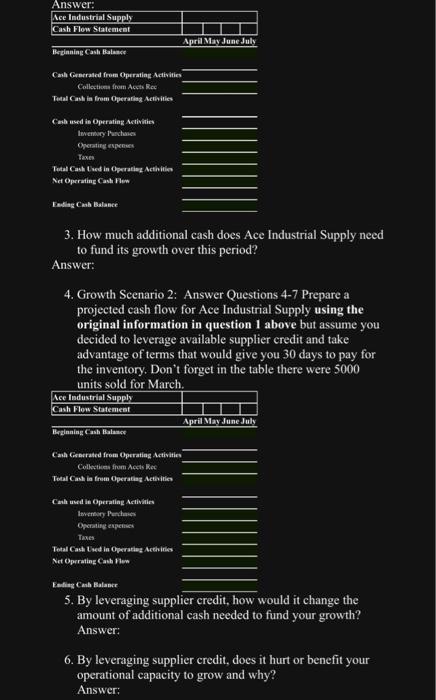

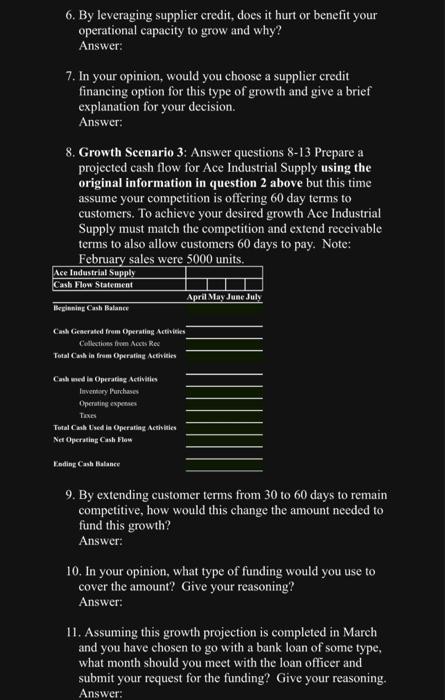

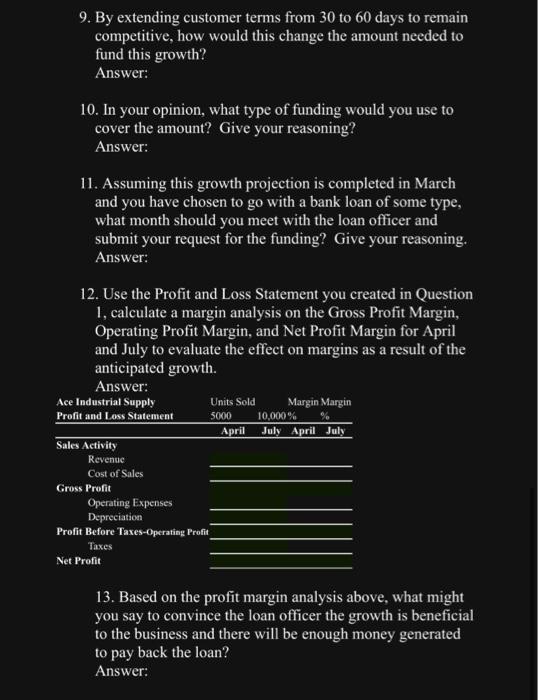

Complete the case study questions using the information given in each of the 3 growth scenarios for Ace Industrial Supply. Ace Industrial Supply sells its products at an average price of $10/ unit. The products cost $5.50 /unit. Ace Industrial pays its suppliers for inventory deliveries at the time of delivery. Ace's customers are given 30 days to pay (e.g. payments for sales from March are received in April, etc.). Ace expects to grow rapidly in the next four months. Sales in March and April were 5,000 units but with new contracts they anticipate 8,000 units to be sold in May, and 10,000 units to be sold in each of June and July. The following table presents select information for the months of March through July. 1. Prepare a projected profit and loss statement for ACE Industrial Supply for each month April through July to analyze the results of the anticipated growth on profits. This profit and loss will be used for all three growth scenarios. 2. Growth Scenario 1: Answer questions 2-3 Prepare a projected growth cash flow statement for Ace Industrial Supply for each month April through July. 3. How much additional cash does Ace Industrial Supply need to fund its growth over this period? Answer: 4. Growth Scenario 2: Answer Questions 4-7 Prepare a projected cash flow for Ace Industrial Supply using the original information in question 1 above but assume you decided to leverage available supplier credit and take advantage of terms that would give you 30 days to pay for the inventory. Don't forget in the table there were 5000 units sold for March. \begin{tabular}{|l|l|l|l|l|} \hline Ace Industrial Supply & & \\ \hline Cash Flow Statemest & & & \\ \hline \end{tabular} Bertinning Eash Balanes Canh Ceserated frem Operating Activitics Cah usa in Operating Activities OFenating expencet Tases: Tetal Cash Led in Oeraties Mcthirhes. Net Oprrating Cash 1 lew Eeling Canh Balancr 5. By leveraging supplier credit, how would it change the amount of additional cash needed to fund your growth? Answer: 6. By leveraging supplier credit, does it hurt or benefit your operational capacity to grow and why? Answer: 6. By leveraging supplier credit, does it hurt or benefit your operational capacity to grow and why? Answer: 7. In your opinion, would you choose a supplier credit financing option for this type of growth and give a brief explanation for your decision. Answer: 8. Growth Scenario 3: Answer questions 8-13 Prepare a projected cash flow for Ace Industrial Supply using the original information in question 2 above but this time assume your competition is offering 60 day terms to customers. To achieve your desired growth Ace Industrial Supply must match the competition and extend receivable terms to also allow customers 60 days to pay. Note: February sales were 5000 units. 9. By extending customer terms from 30 to 60 days to remain competitive, how would this change the amount needed to fund this growth? Answer: 10. In your opinion, what type of funding would you use to cover the amount? Give your reasoning? Answer: 11. Assuming this growth projection is completed in March and you have chosen to go with a bank loan of some type, what month should you meet with the loan officer and submit your request for the funding? Give your reasoning. Answer: 9. By extending customer terms from 30 to 60 days to remain competitive, how would this change the amount needed to fund this growth? Answer: 10. In your opinion, what type of funding would you use to cover the amount? Give your reasoning? Answer: 11. Assuming this growth projection is completed in March and you have chosen to go with a bank loan of some type, what month should you meet with the loan officer and submit your request for the funding? Give your reasoning. Answer: 12. Use the Profit and Loss Statement you created in Question 1, calculate a margin analysis on the Gross Profit Margin, Operating Profit Margin, and Net Profit Margin for April and July to evaluate the effect on margins as a result of the anticipated growth. 13. Based on the profit margin analysis above, what might you say to convince the loan officer the growth is beneficial to the business and there will be enough money generated to pay back the loan

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts