Question: Urgent Costs that differ between alternatives are: relevant to the decision not relevant to the decision sunk costs opportunity costs A cost that was incurred

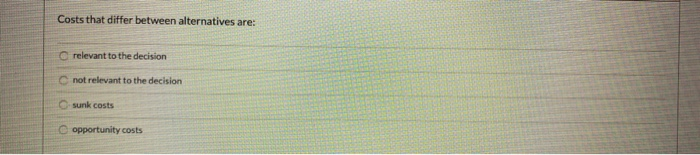

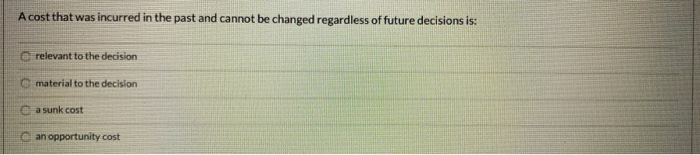

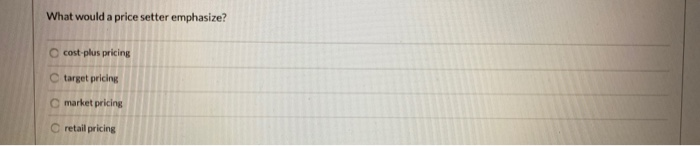

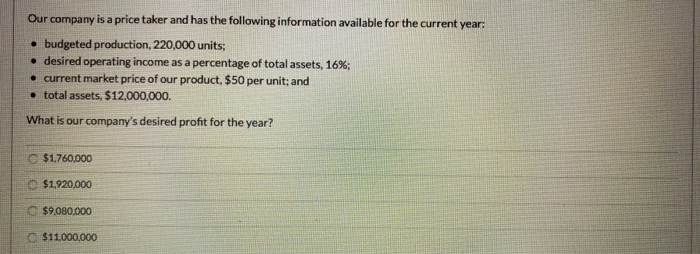

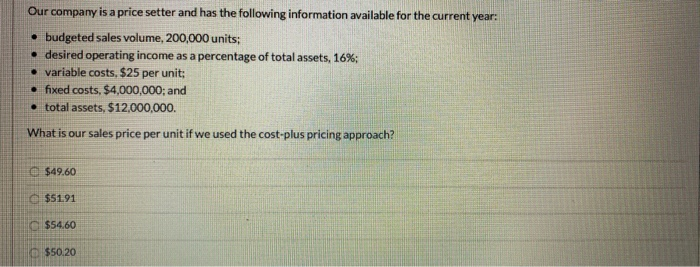

Costs that differ between alternatives are: relevant to the decision not relevant to the decision sunk costs opportunity costs A cost that was incurred in the past and cannot be changed regardless of future decisions is: relevant to the decision material to the decision a sunk cost an opportunity cost What would a price setter emphasize? cost plus pricing target pricing market pricing retail pricing Our company is a price taker and has the following information available for the current year: budgeted production, 220,000 units; desired operating income as a percentage of total assets, 16%; current market price of our product, $50 per unit; and total assets, $12,000,000 What is our company's desired profit for the year? $1.760,000 $1.920,000 C$9.080.000 $11,000,000 Our company is a price setter and has the following information available for the current year: budgeted sales volume, 200,000 units; desired operating income as a percentage of total assets, 16%; variable costs. $25 per unit; fixed costs, $4,000,000; and total assets. $12,000,000. What is our sales price per unit if we used the cost-plus pricing approach? $49.60 e $51.91 $54.60 $50.20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts