Question: Urgent help me solve this Please solve like this example 4. Solery Corp, common stock is currently selling for $50.25 per share. The stock recently

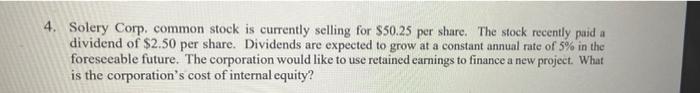

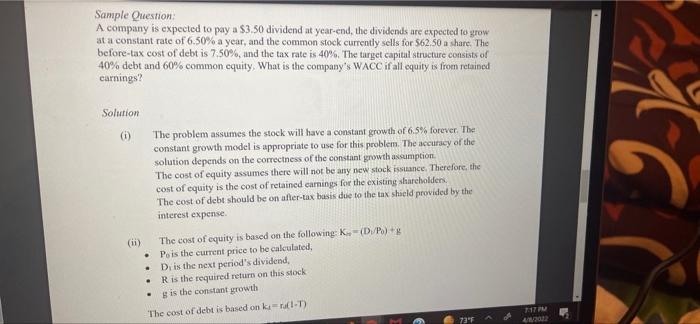

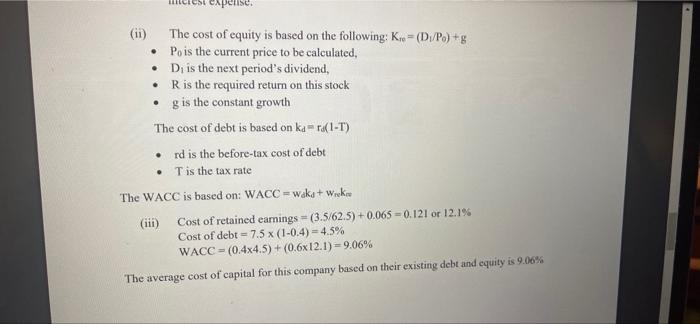

4. Solery Corp, common stock is currently selling for $50.25 per share. The stock recently paid a dividend of $2.50 per share. Dividends are expected to grow at a constant annual rate of 5% in the foreseeable future. The corporation would like to use retained earnings to finance a new project. What is the corporation's cost of internal equity? Sample Question A company is expected to pay a $3.50 dividend at year-end, the dividends are expected to grow at a constant rate of 6.50% a year, and the common stock currently sells for 562.50 a share. The before-tax cost of debt is 7.50%, and the tax rate is 40%. The target capital structure consists of 40% debt and 60% common equity, What is the company's WACC if all equity is from retained carnings? Solution (1) o The problem assumes the stock will have a constant growth of 6.5% forever. The constant growth model is appropriate to use for this problem. The accuracy of the solution depends on the correctness of the constant growth assumption. The cost of equity assumes there will not be any new stock issuance. Therefore, the cost of equity is the cost of retained camnings for the existing shareholders The cost of debt should be on after-tax basis due to the tax shield provided by the interest expense. . . (ii) The cost of equity is based on the following: K-(DPS) + Po is the current price to be calculated, D is the next period's dividend, R is the required return on this stock g is the constant growth The cost of debt is based on k-ralT 4/2012 PC| (ii) The cost of equity is based on the following: Krv = (D/P) +8 Po is the current price to be calculated, Di is the next period's dividend, Ris the required return on this stock g is the constant growth The cost of debt is based on kara(1-T) rd is the before-tax cost of debt Tis the tax rate The WACC is based on: WACC = wake+wick (iii) Cost of retained earnings = (3.5/62.5) +0.065 = 0.121 or 12.1% Cost of debt-7.5 x (1-0.4) = 4.5% WACC = (0.4x4.5) + (0.6x12.1)= 9.06% The average cost of capital for this company based on their existing debt and equity is 9.06%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts