Question: urgent help Problem 1: Evaluate the following statements.True/False/It Depends? Explain your answers briefly. a.Under perfect capital markets, investor's choice between alternative income streams depends only

urgent help

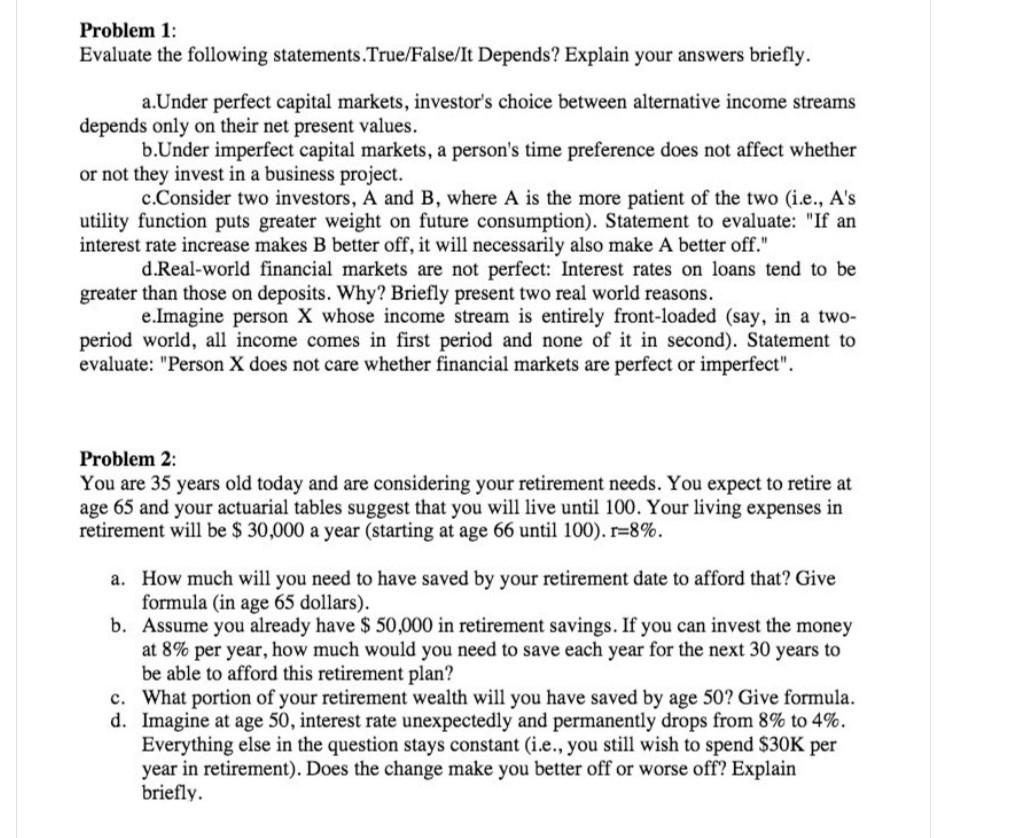

Problem 1: Evaluate the following statements.True/False/It Depends? Explain your answers briefly. a.Under perfect capital markets, investor's choice between alternative income streams depends only on their net present values. b.Under imperfect capital markets, a person's time preference does not affect whether or not they invest in a business project. c.Consider two investors, A and B, where A is the more patient of the two (i.e., A's utility function puts greater weight on future consumption). Statement to evaluate: "If an interest rate increase makes B better off, it will necessarily also make A better off." d.Real-world financial markets are not perfect: Interest rates on loans tend to be greater than those on deposits. Why? Briefly present two real world reasons. e.Imagine person X whose income stream is entirely front-loaded (say, in a two- period world, all income comes in first period and none of it in second). Statement to evaluate: "Person X does not care whether financial markets are perfect or imperfect". Problem 2: You are 35 years old today and are considering your retirement needs. You expect to retire at age 65 and your actuarial tables suggest that you will live until 100. Your living expenses in retirement will be $ 30,000 a year (starting at age 66 until 100). r=8%. a. How much will you need to have saved by your retirement date to afford that? Give formula (in age 65 dollars). b. Assume you already have $ 50,000 in retirement savings. If you can invest the money at 8% per year, how much would you need to save each year for the next 30 years to be able to afford this retirement plan? c. What portion of your retirement wealth will you have saved by age 50? Give formula. d. Imagine at age 50, interest rate unexpectedly and permanently drops from 8% to 4%. Everything else in the question stays constant (i.e., you still wish to spend $30K per year in retirement). Does the change make you better off or worse off? Explain briefly

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts