Question: urgent Help Save & E 0 Required information (The following information applies to the questions displayed below.) Bearings & Brakes Corporation (B&B) was incorporated as

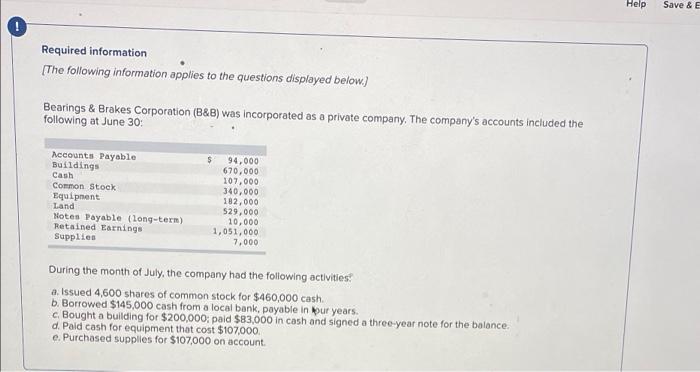

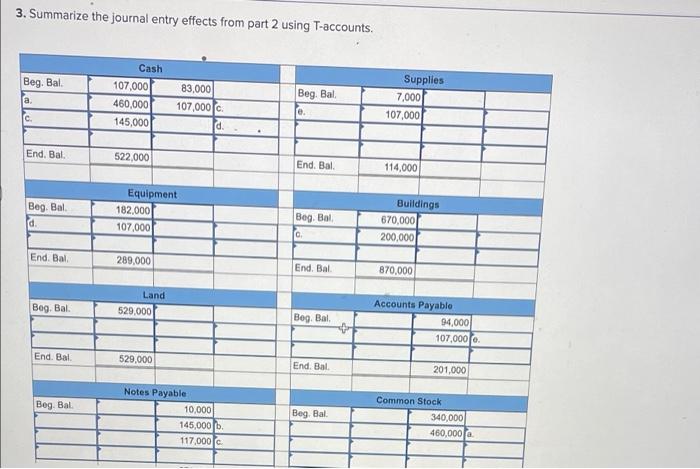

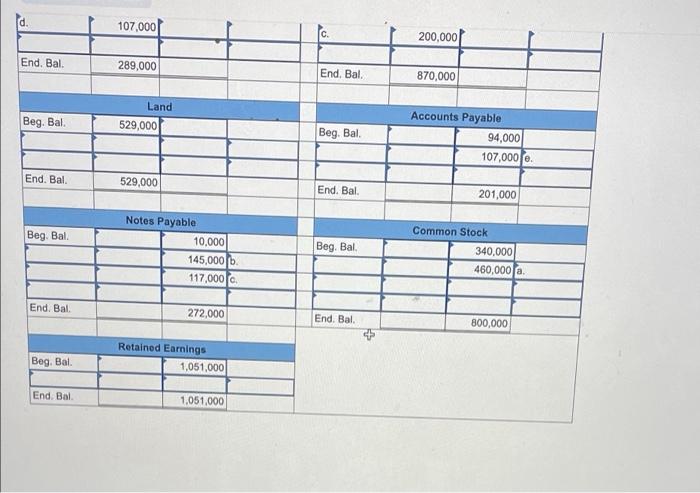

Help Save & E 0 Required information (The following information applies to the questions displayed below.) Bearings & Brakes Corporation (B&B) was incorporated as a private company. The company's accounts included the following at June 30 Accounts Payable Buildings $ Cash Common Stock Equipment Land Notes Payable (long-term) Retained Earnings Supplies 94,000 670,000 107.000 340,000 182,000 529,000 10,000 1,051,000 7,000 During the month of July, the company had the following activities a. Issued 4,600 shares of common stock for $460,000 cash. b. Borrowed $145,000 cash from a local bank, payable in our years. c. Bought a building for $200,000; paid $83,000 in cash and signed a three-year note for the balance. d. Paid cash for equipment that cost $107.000 e. Purchased supplies for $107,000 on account. 3. Summarize the journal entry effects from part 2 using T-accounts. Beg. Bal Cash 107.000 460,000 145,000 Beg. Bal a 83,000 107,000 d. Supplies 7,000 107,000 C e. End. Bal. 522,000 End. Bal 114,000 Beg Bal d. Equipment 182,000 107.000 Bog. Bol Buildings 670,000 200,000 0 End. Bal 289,000 End, Bal 870,000 Land 529.000 Bog. Bal. Bog. Bal Accounts Payable 94,000 107.000 End. Bal 529.000 End. Bal 201,000 Beg Bal Notes Payable 10,000 145,000 fb. 117,000 Beg Bal Common Stock 340,000 460,000 107.000 200,000 End, Bal 289,000 End. Bal. 870,000 Beg. Bal. Land 529,000 Beg. Bal Accounts Payable 94,000 107,000 e. End. Bal. 529,000 End. Bal. 201,000 Beg Bal. Notes Payable 10,000 145,000 lb 117,000 Beg. Bal Common Stock 340,000 460,000 a End. Bal. 272,000 End. Bal. 800,000 Retained Earnings 1,061.000 Beg. Bal End. Bal 1.051.000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts