Question: Urgent help sopve requiremnt 2, 3 and 4 i solved the requiremnt 1 Tyler Sugrue opened an accounting firm on January 1, 2018. During the

Urgent help sopve requiremnt 2,

3 and 4 i solved the requiremnt 1

3 and 4 i solved the requiremnt 1

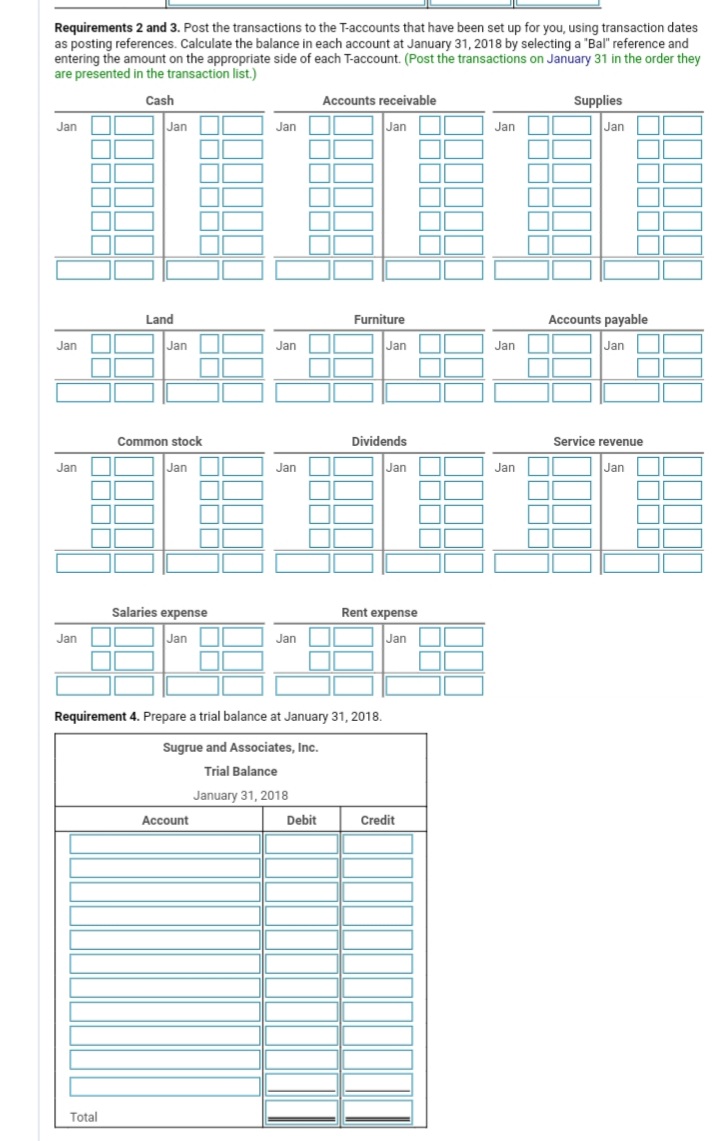

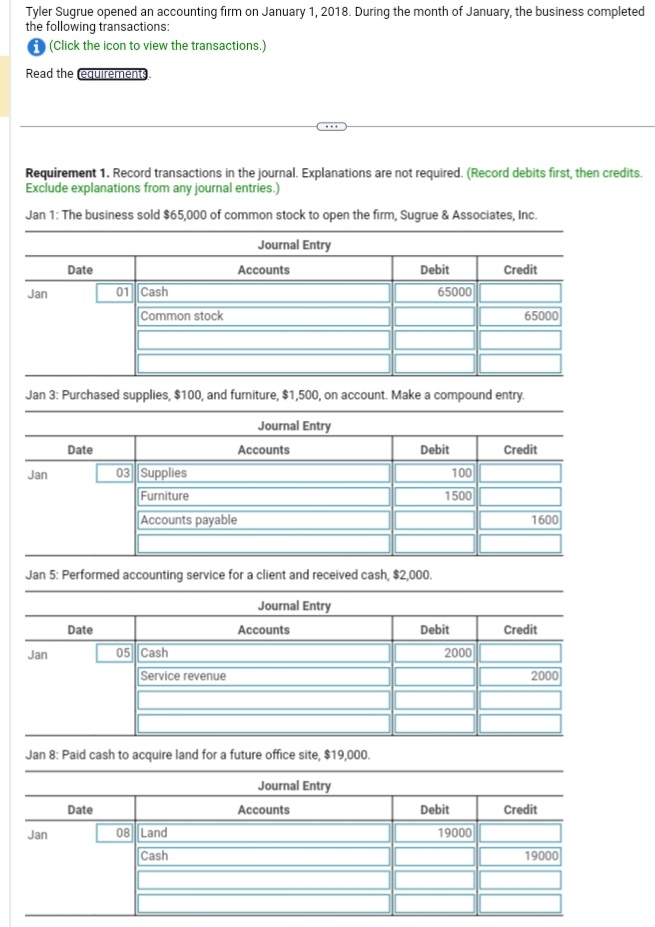

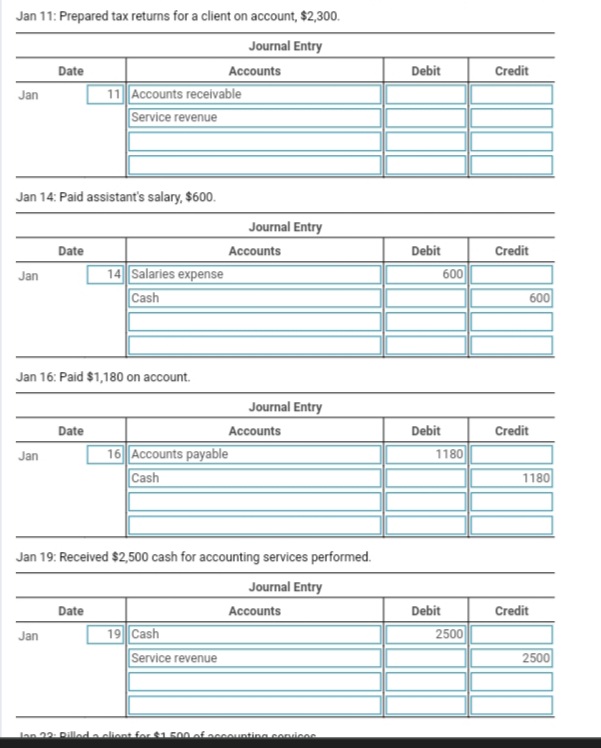

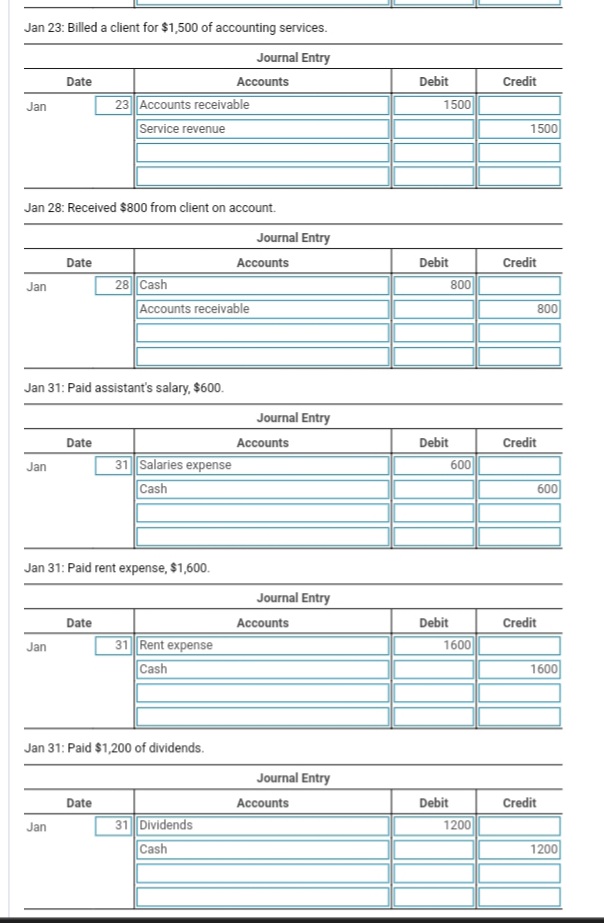

Tyler Sugrue opened an accounting firm on January 1, 2018. During the month of January, the business completed the following transactions: (Click the icon to view the transactions.) Read the , then credits. Jan 11: Prepared tax returns for a client on account, $2,300. Jan 14: Paid assistant's salary, $600. Jan 19: Received $2,500 cash for accounting services performed. Requirements 2 and 3 . Post the transactions to the T-accounts that have been set up for you, using transaction dates as posting references. Calculate the balance in each account at January 31, 2018 by selecting a "Bal" reference and entering the amount on the appropriate side of each T-account. (Post the transactions on January 31 in the order they are presented in the transaction list.) Requirement 4. Prepare a trial balance at January 31, 2018. Jan 23: Billed a client for $1,500 of accounting services. Jan 28: Received $800 from client on account. Jan 31: Paid assistant's salary, $600. Jan 31: Paid rent expense, $1,600

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts