Question: URGENT Initial cash flow: Basic calculation Cushing Comporation is considering the purchase of a new grading machine so reploce the evisting one. The existing machine

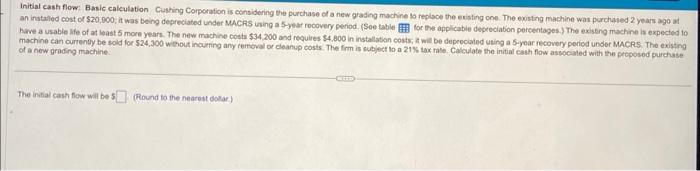

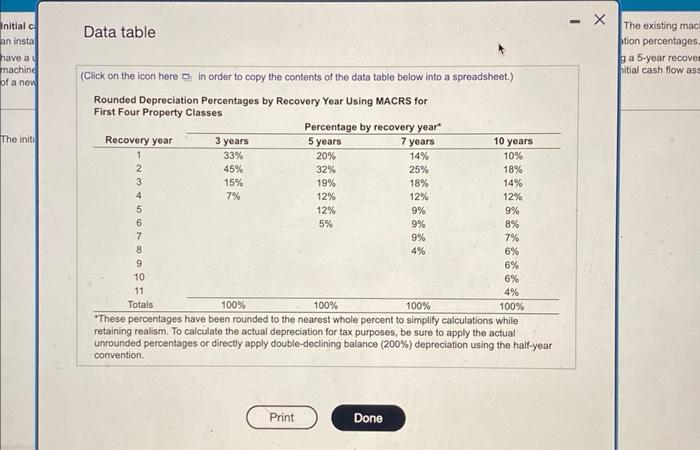

Initial cash flow: Basic calculation Cushing Comporation is considering the purchase of a new grading machine so reploce the evisting one. The existing machine was purchased 2 years ago at an irataled cost of $20,900, it was being depreciated under MACCRs using a 5-year rocovery period. (Soe table: for the applicabile depreciabion percentages.) The exiseng machine is expected to have a usable lfe of at least 5 mone years. The new machine costs $34,200 and requires $4,800 in installatian costs; It will be deprociated using a 5 -year recovery pericd under MACRS. The existing The inibial cash fow will be: (Round to the nearest dolar.) Data table (Click on the icon here D. in order to copy the contents of the data table below into a spreadsheet.) Rounded Depreciation Percentages by Recovery Year Using MACRS for First Four Property Classes - Inese percentages nave peen rounded to the nearest whole percent to simplify calculations while retaining realism. To calculate the actual depreciation for tax purposes, be sure to apply the actual unrounded percentages or directly apply double-declining balance (200%) depreciation using the half-year convention

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts