Question: Urgent! Please answer ASAP. Question 21 Tea Tree Bakery had the following cash transactions over the financial year ending 30 June 2021. Opening cash balance,

Urgent! Please answer ASAP.

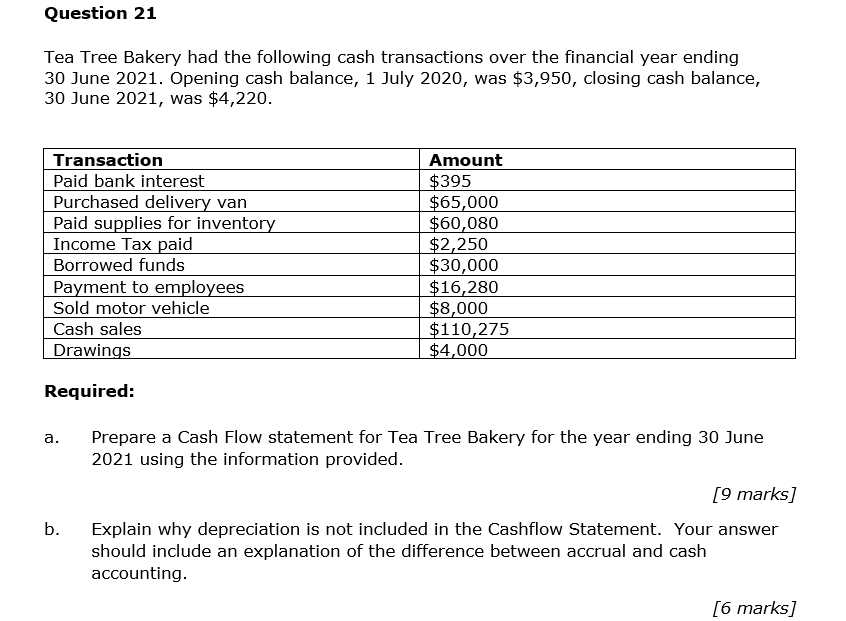

Question 21 Tea Tree Bakery had the following cash transactions over the financial year ending 30 June 2021. Opening cash balance, 1 July 2020, was $3,950, closing cash balance, 30 June 2021, was $4,220. Transaction Amount Paid bank interest $395 Purchased delivery van $65,000 Paid supplies for inventory $60,080 Income Tax paid $2,250 Borrowed funds $30,000 Payment to employees $16,280 Sold motor vehicle $8,000 Cash sales $110,275 Drawings $4,000 Required: a. Prepare a Cash Flow statement for Tea Tree Bakery for the year ending 30 June 2021 using the information provided. [9 marks] b. Explain why depreciation is not included in the Cashflow Statement. Your answer should include an explanation of the difference between accrual and cash accounting. [6 marks]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts