Question: URGENT!! please answer correctly with work shown for an upvote:) Michael and Barbara Smith are married and file a joint tax return. Together, their combined

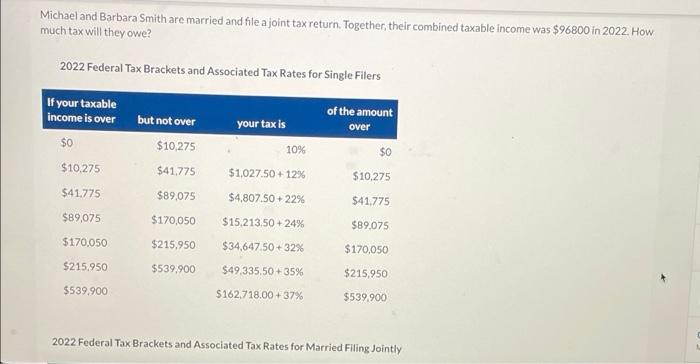

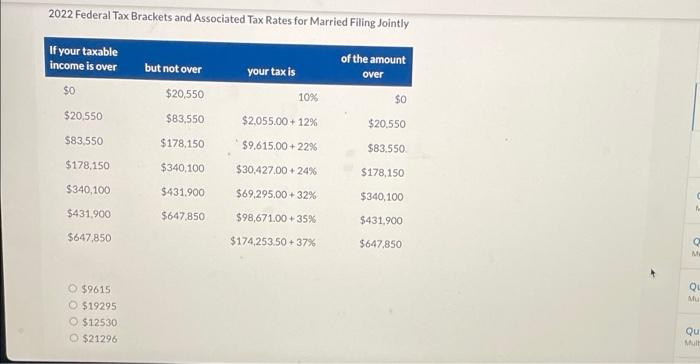

Michael and Barbara Smith are married and file a joint tax return. Together, their combined taxable income was $96800 in 2022. How much tax will they owe? 2022 Federal Tax Brackets and Associated Tax Rates for Single Filers If your taxable income is over $0 $10,275 but not over $10,275 your tax is 10% of the amount over $0 $10,275 $41.775 $1,027.50 +12% $41.775 $89,075 $4,807.50 +22% $41.775 $89,075 $170,050 $15.213.50 +24% $89,075 $170,050 $215,950 $34,647 50+32% $170,050 $215,950 $539.900 $49,335.50 +35% $215,950 $539.900 $162,718.00 +37% $539.900 2022 Federal Tax Brackets and Associated Tax Rates for Married Filing Jointly 2022 Federal Tax Brackets and Associated Tax Rates for Married Filing Jointly of the amount If your taxable income is over $0 but not over $20.550 over your tax is 10% $20.550 $0 $20.550 $83.550 $2.055.00 +12% $83.550 $178,150 $9.615.00+ 22% $83.550 $178,150 $340,100 $30,427.00 +24% $178,150 $340,100 $431.900 $69.295,00 + 32% $340,100 $431.900 $647,850 $98,671.00 +35% $431.900 $647,850 $174.253.50 +37% $647,850 M os 59615 $19295 $12530 $21296 Qu Mult

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts