Question: urgent ,please answer me now subject : financial system analysis don't use excel please answer question 3,4 question 3: Assess the company solvency: In order

urgent ,please answer me now

subject : financial system analysis

don't use excel

please answer question 3,4

question 3: Assess the company solvency:

In order to do that, calculate for the las 3 years.

-The debt-to-equity ratio.

-The times interest earned ratio

-The Debt to Assets ratio

question 4

-How is the company growing in sales during this three years?

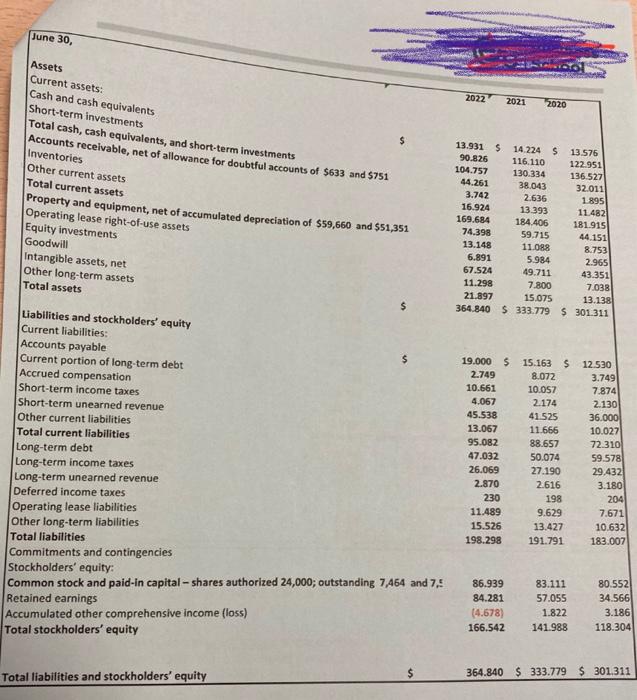

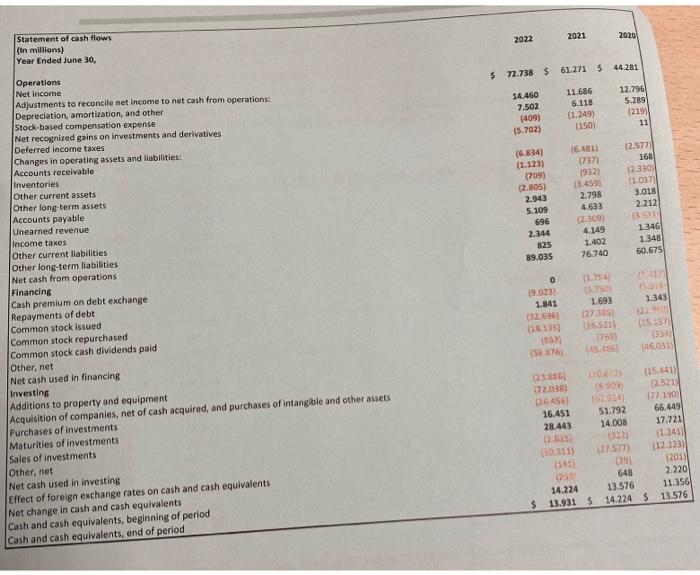

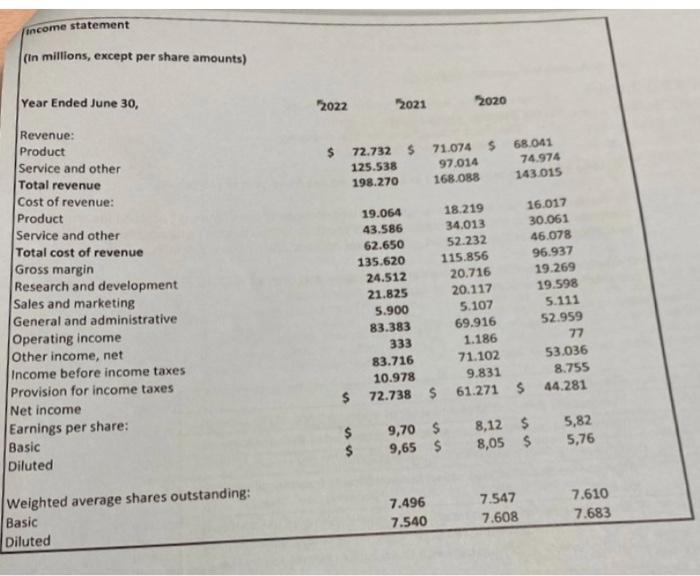

June 30 , Assets Current assets: Cash and cash equivalents Short-term investments Total cash, cash equivalents, and short-term investments Accounts receivable, Inventories Goodwill Intangible assets, net Other long-term assets Total assets Equity investments Current liabilities: Accounts payable. Current portion of long-term debt Accrued compensation Short-term income taxes Short-term unearned revenue Other current liabilities Total current liabilities Long-term debt Long-term income taxes Long-term unearned revenue Deferred income taxes Operating lease liabilities Other long-term liabilities: Total liabilities Commitments and contingencies Stockholders' equity: Common stock and paid-in capital - shares authorized 24,000 ; outstanding 7,464 and 7,5 Retained earnings Accumulated other comprehensive income (loss) Total stockholders' equity \begin{tabular}{rrr} 86.939 & 83.111 & 80.552 \\ 84.281 & 57.055 & 34.566 \\ (4.678) & 1.822 & 3.186 \\ 166.542 & 141.988 & 118.304 \\ & & \\ 364.840 & $333.779 & $301.311 \\ \hline \end{tabular} Statement of cash flows (In millions) Year Ended June 30, Operations Net income Adjustments to reconcile net income to net cash from operations: Depreciation, amortiration, and other stock-based compensation expense Net recognized gains on investments and derivatives Deferred income taxes Changes in operating assets and liabilities: Accounts receivable Inventories Other current assets Other long term assets Accounts payable Unearned revenue Income taxes Other current liabilities Other long-term liabilities Net cash from operations Financing Cash premium on debt exchange Repayments of debt Common stock issued Common stock repurchased Common stock cash dividends paid Other, net Net cash used in financing Investine Additions to property and equipment Acquisition of companies, net of cash acquired, and purchases of intangible and other assets Purchases of investments Maturities of investments Sales of investments Other, net Net cash used in investing Effect of foreign exchange rates on cash and cash equivalents Net change in cash and cash equivalents Cash and cash equivalents, beginning of period Cash and cash equivalents, and of period [income statement (in millions, except per share amounts) Year Ended June 30, 202220212020 Revenue: Product Service and other Total revenue Cost of revenue: Product Service and other Total cost of revenue Gross margin Research and development Sales and marketing General and administrative Operating income Other income, net Income before income taxes Provision for income taxes Net income Earnings per share: Basic Diluted Weighted average shares outstanding: Basic Diluted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts