Question: URGENT: Please answer quick Statement I: Under a job costing system actual manufacturing cverhead costs should be charged to the Work in Process Inventory account

URGENT: Please answer quick

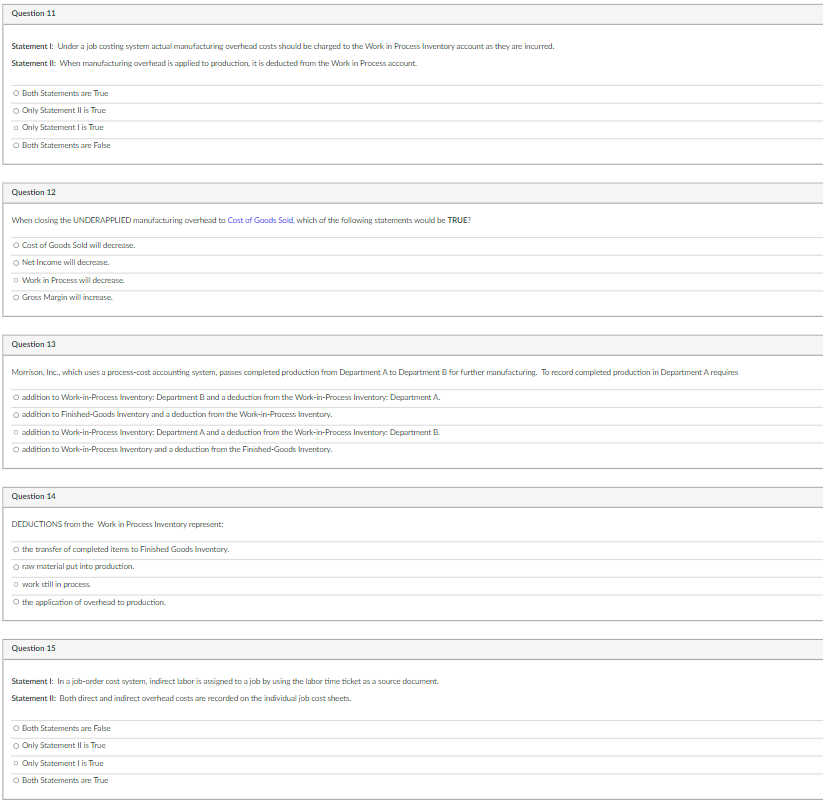

Statement I: Under a job costing system actual manufacturing cverhead costs should be charged to the Work in Process Inventory account as they are incurred. Statement II: When manufscturing averhead is applied to production, it is deducted fram the Work in Process sccount. Bath Statements are True Orily Statement II is True Only Statement I is True Bath Statements are False Question 12 When closing the UNDERAPPLIED manufacturing overtwad to Cost of Goods Sold, which of the following statements wauld be TRUE? Cast of Goods Sold will decrease. Net Income will decrease. Work in Process will decrease Gross Margin will increase Question 13 sddition to Work-in-Process Irventary: Department B and a deduction from the Work-in-Process Irwertary: Department A. addition to Finished-Goods Irventary and a deduction from the Work-in-Pracess Inventery. addition to Work-in-Process Irventary: Department A and a deduction from the Wark-in-Process Inventory: Department B. addition to Work-in-Process Irventary and a deduction from the Finiahed-Goods lrventery. Question 14 DEDUCTIONS from the Wark in Process Invertary represent: the transfer of completed iterrs to Finished Goods lnventery. raw material put into production. wark still in process. the application of overhesd to productian. Question 15 Statement I: In a job-crifer cast system, indirect bbar is assigned to a job by using the labor time tichet as a source document. Statement II: Both direct and indirect overhead costs are recarded an the individual job cost sheets. Bath Statements are False Only Statement II is True Only Statement I is True Bath Statements are True

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts