Question: URGENT: Please answer the full question for a Thumbs Up! Thank you so much in advance.. The percentage of receivables approach to estimating bad debts

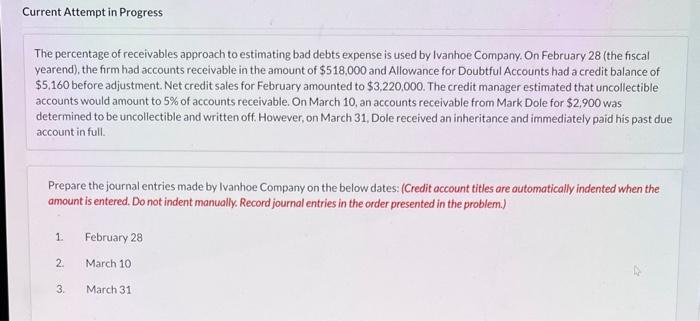

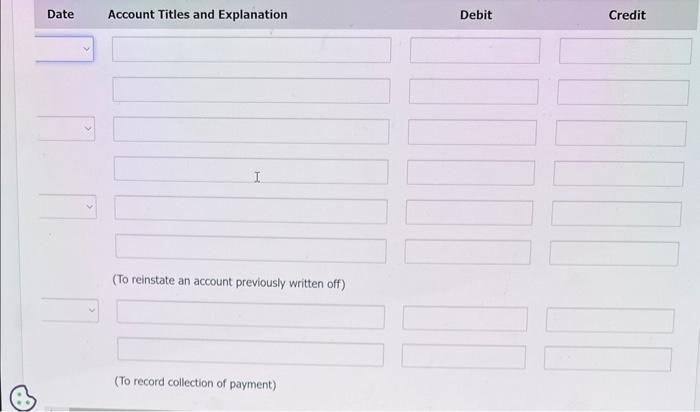

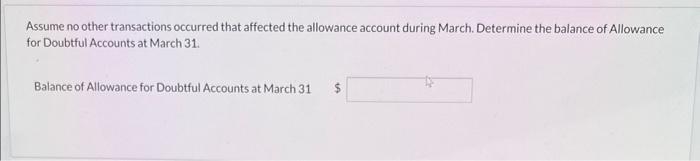

The percentage of receivables approach to estimating bad debts expense is used by Ivanhoe Company. On February 28 (the fiscal yearend), the firm had accounts receivable in the amount of $518,000 and Allowance for Doubtful Accounts had a credit balance of $5,160 before adjustment. Net credit sales for February amounted to $3,220,000. The credit manager estimated that uncollectible accounts would amount to 5% of accounts receivable. On March 10, an accounts receivable from Mark Dole for $2,900 was determined to be uncollectible and written off. However, on March 31, Dole received an inheritance and immediately paid his past due account in full. Prepare the journal entries made by Ivanhoe Company on the below dates: (Credit account titles are outomatically indented when the amount is entered. Do not indent manually. Record journal entries in the order presented in the problem.) 1. February 28 2. March 10 3. March 31 Date Account Titles and Explanation Debit Credit (To reinstate an account previously written off) (To record collection of payment) Assume no other transactions occurred that affected the allowance account during March. Determine the balance of Allowance for Doubtful Accounts at March 31. Balance of Allowance for Doubtful Accounts at March 31

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts