Question: Urgent: please help me solve this. Please only do part a of both. Thank you!! Munoz Company is considering investing in two new vans that

Urgent: please help me solve this. Please only do part a of both. Thank you!!

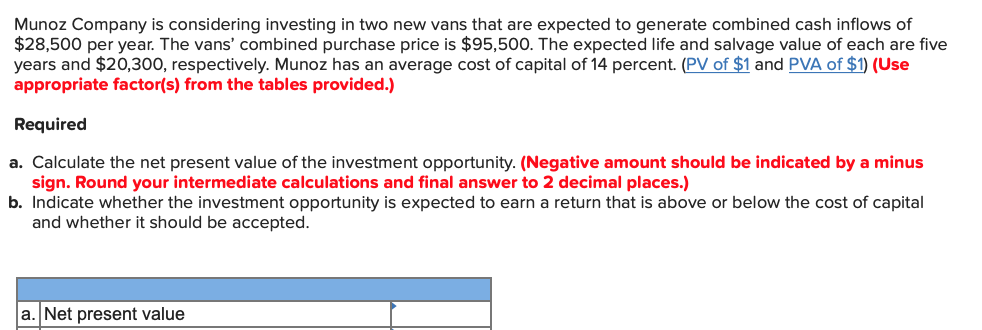

Munoz Company is considering investing in two new vans that are expected to generate combined cash inflows of $28,500 per year. The vans' combined purchase price is $95,500. The expected life and salvage value of each are five years and $20,300, respectively. Munoz has an average cost of capital of 14 percent. (PV of $1 and PVA of $1) (Use appropriate factor(s) from the tables provided.) Required a. Calculate the net present value of the investment opportunity. (Negative amount should be indicated by a minus sign. Round your intermediate calculations and final answer to 2 decimal places.) b. Indicate whether the investment opportunity is expected to earn a return that is above or below the cost of capital and whether it should be accepted. a. Net present value

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts