Question: Urgent!!!, please help Q2 Risk, Return and diversification (10 marks) Jayne wants to invest her money to meet a liability of $12,000.00 six months from

Urgent!!!, please help

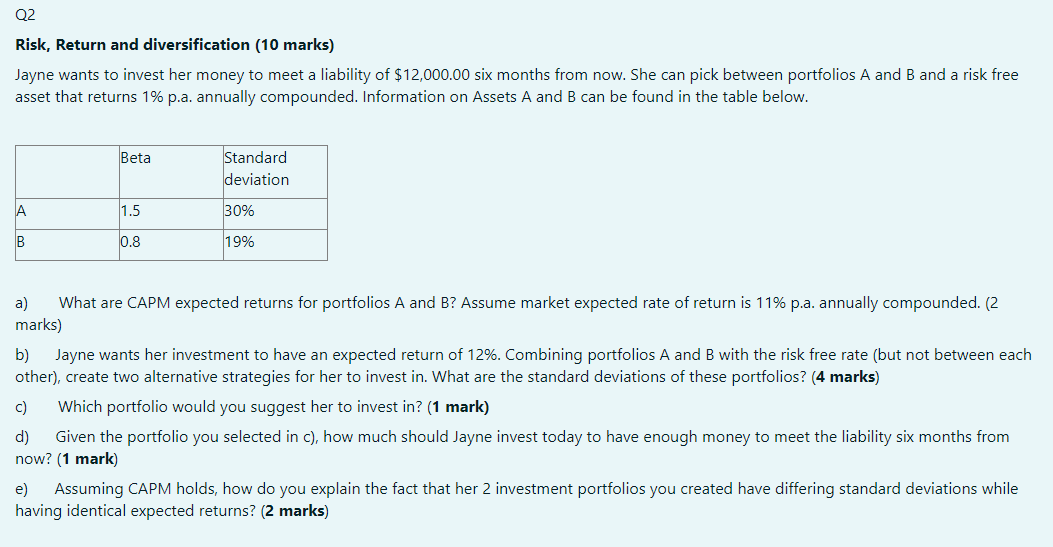

Q2 Risk, Return and diversification (10 marks) Jayne wants to invest her money to meet a liability of $12,000.00 six months from now. She can pick between portfolios A and B and a risk free asset that returns 1% p.a. annually compounded. Information on Assets A and B can be found in the table below. Beta Standard deviation A 1.5 30% B 0.8 19% a) What are CAPM expected returns for portfolios A and B? Assume market expected rate of return is 11% p.a. annually compounded. (2 marks) b) Jayne wants her investment to have an expected return of 12%. Combining portfolios A and B with the risk free rate (but not between each other), create two alternative strategies for her to invest in. What are the standard deviations of these portfolios? (4 marks) c) Which portfolio would you suggest her to invest in? (1 mark) d) Given the portfolio you selected in c), how much should Jayne invest today to have enough money to meet the liability six months from now? (1 mark) e) Assuming CAPM holds, how do you explain the fact that her 2 investment portfolios you created have differing standard deviations while having identical expected returns? (2 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts