Question: URGENT PLEASE HELP. THERE WILL BE C, D FOR PELLAH I WILL ASK IN THE COMMENT PLEASE ANSWERS AS WELL, THANK YOUU The adjusted trial

URGENT PLEASE HELP. THERE WILL BE C, D FOR PELLAH I WILL ASK IN THE COMMENT PLEASE ANSWERS AS WELL, THANK YOUU

URGENT PLEASE HELP. THERE WILL BE C, D FOR PELLAH I WILL ASK IN THE COMMENT PLEASE ANSWERS AS WELL, THANK YOUU

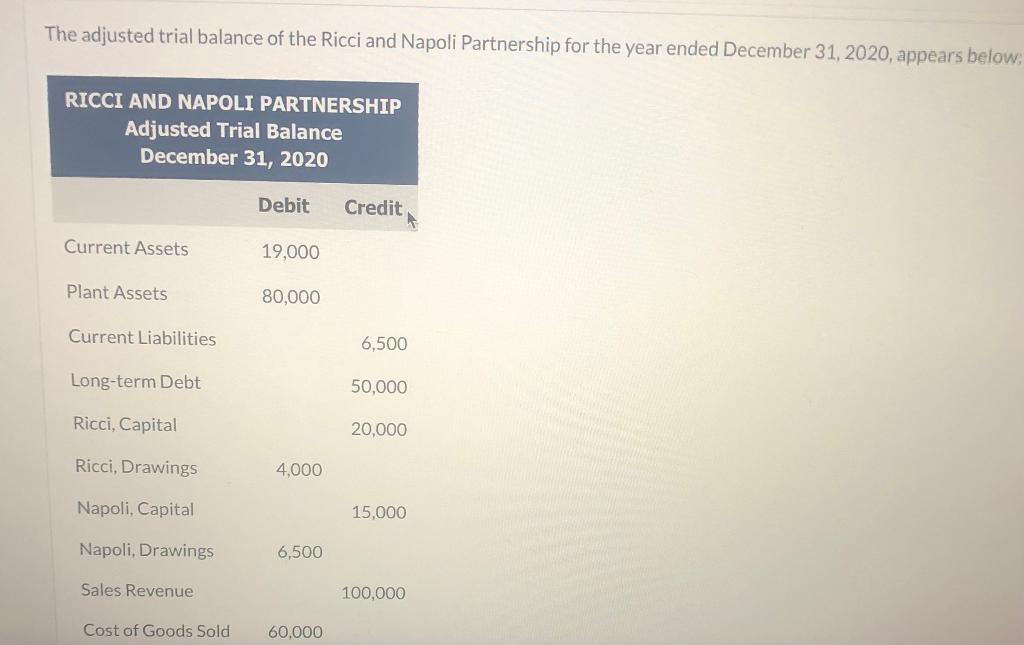

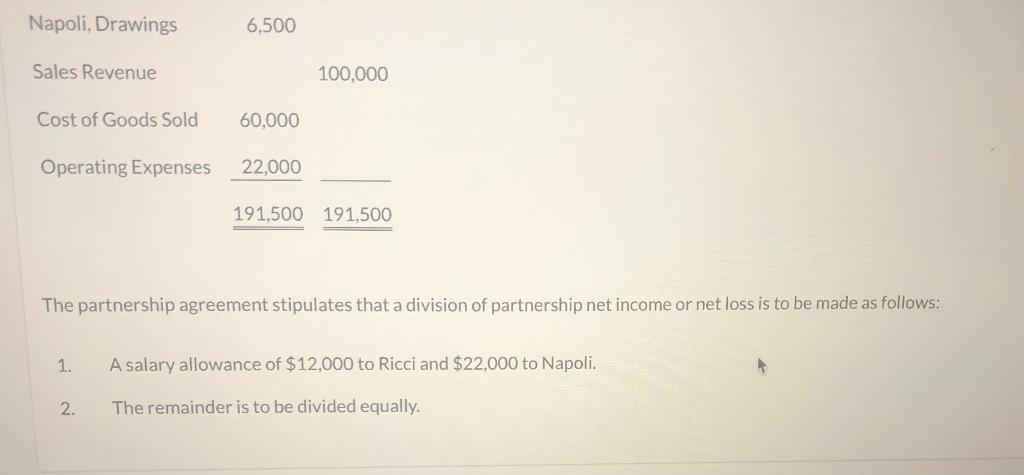

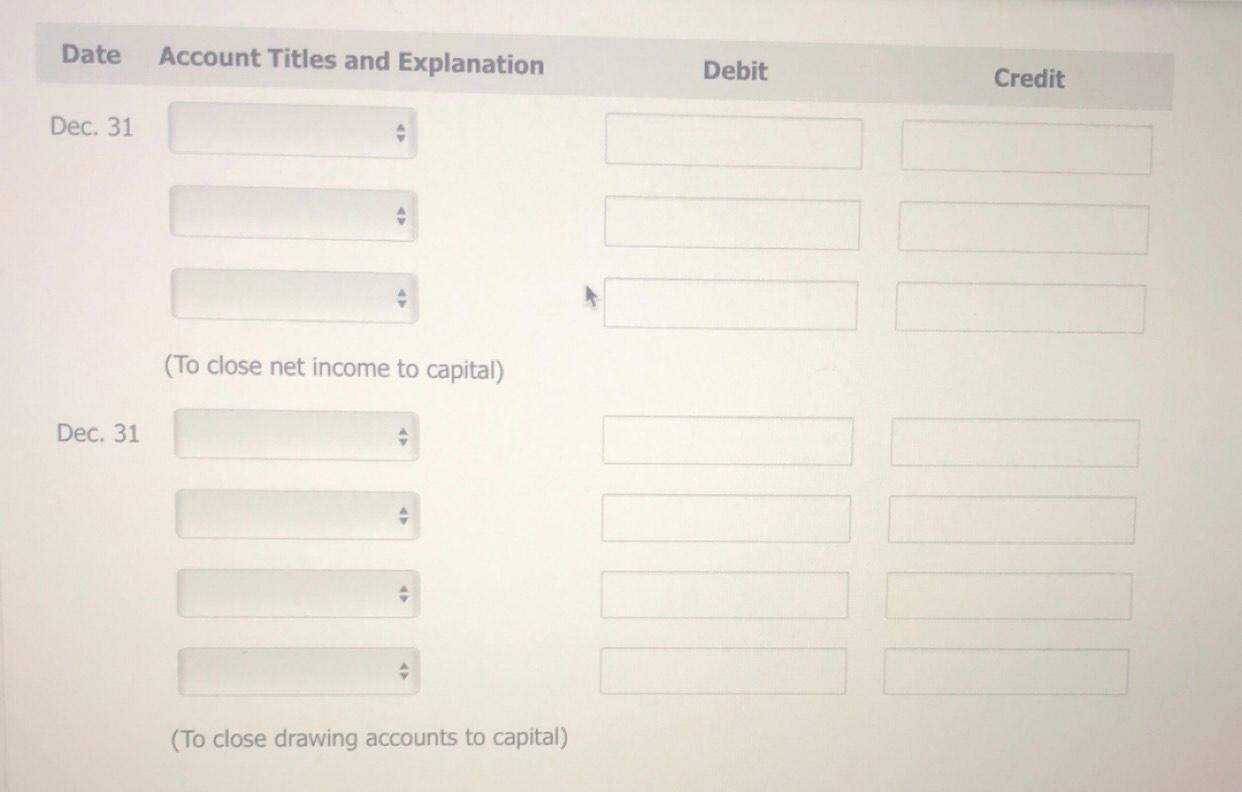

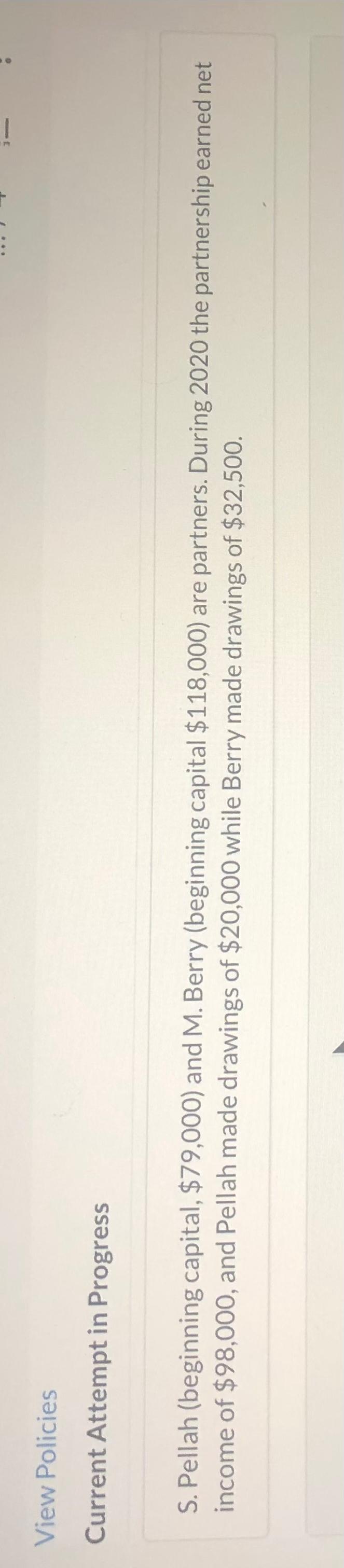

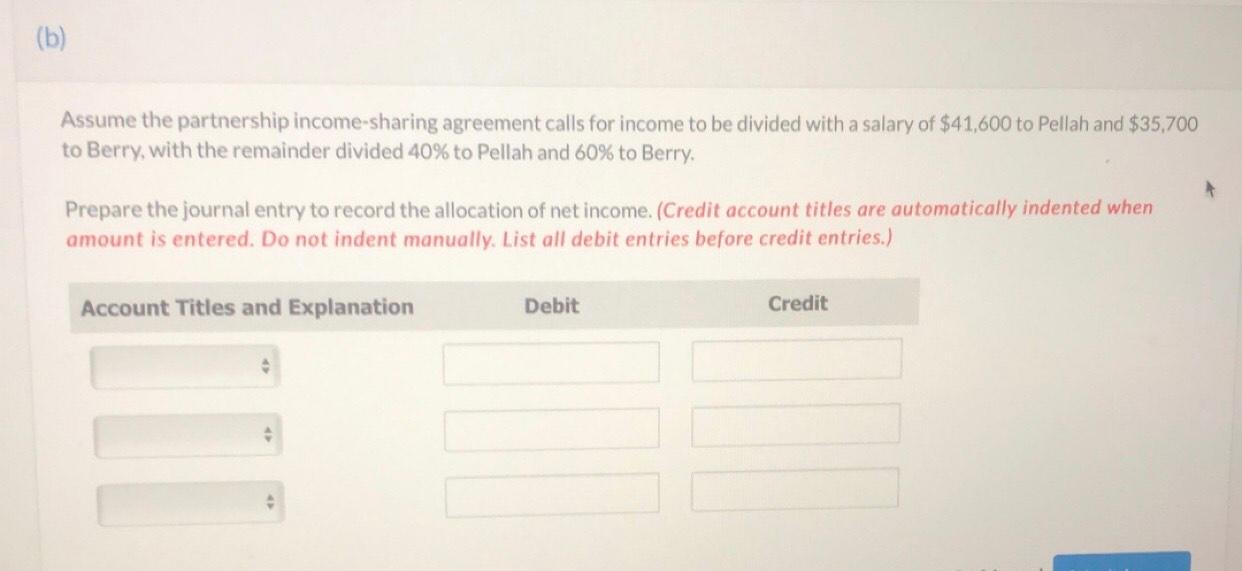

The adjusted trial balance of the Ricci and Napoli Partnership for the year ended December 31, 2020, appears below: RICCI AND NAPOLI PARTNERSHIP Adjusted Trial Balance December 31, 2020 Debit Credit Current Assets Plant Assets Current Liabilities Long-term Debt Ricci, Capital Ricci, Drawings Napoli, Capital Napoli, Drawings Sales Revenue Cost of Goods Sold 19,000 80,000 4,000 6,500 60,000 6,500 50,000 20,000 15,000 100,000 Napoli, Drawings 6,500 Sales Revenue 100,000 Cost of Goods Sold 60,000 Operating Expenses 22,000 191,500 191,500 The partnership agreement stipulates that a division of partnership net income or net loss is to be made as follows: 1. A salary allowance of $12,000 to Ricci and $22,000 to Napoli. The remainder is to be divided equally. 2. Date Account Titles and Explanation Dec. 31 (To close net income to capital) (To close drawing accounts to capital) Dec. 31 Debit Credit 1 View Policies Current Attempt in Progress S. Pellah (beginning capital, $79,000) and M. Berry (beginning capital $118,000) are partners. During 2020 the partnership earned net income of $98,000, and Pellah made drawings of $20,000 while Berry made drawings of $32,500. (b) Assume the partnership income-sharing agreement calls for income to be divided with a salary of $41,600 to Pellah and $35,700 to Berry, with the remainder divided 40% to Pellah and 60% to Berry. Prepare the journal entry to record the allocation of net income. (Credit account titles are automatically indented when amount is entered. Do not indent manually. List all debit entries before credit entries.) Account Titles and Explanation Debit Credit

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts