Question: urgent please, I will give u 2 likes Pro forma balance sheet Peabody & Peabody has 2022 sales of $10.6 milion. li wishes to analyze

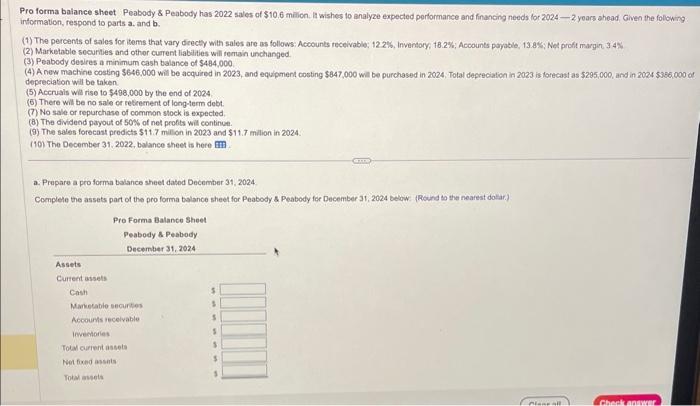

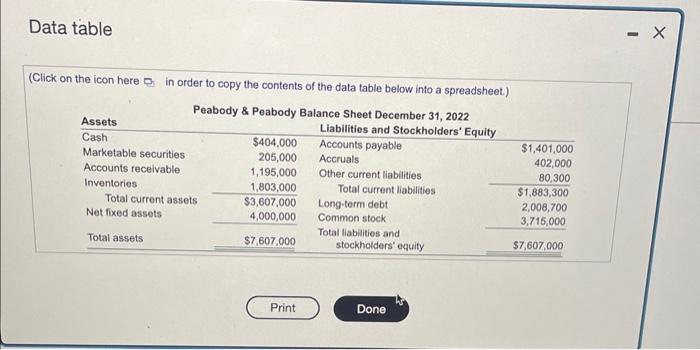

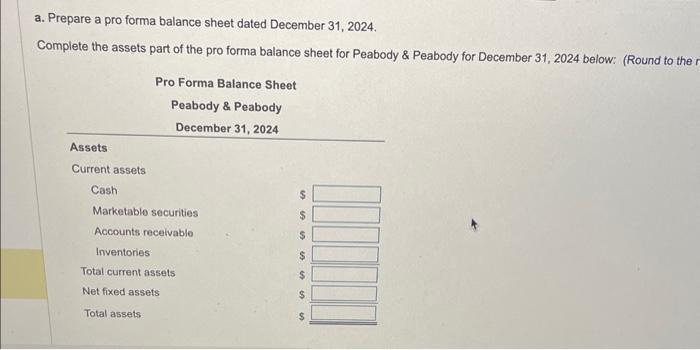

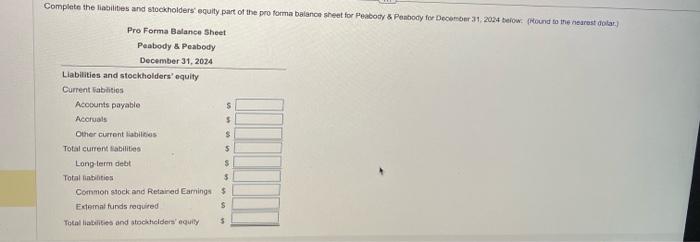

Pro forma balance sheet Peabody & Peabody has 2022 sales of $10.6 milion. li wishes to analyze expected performance and financing needs for 2024 - 2 years ahead, Given the folowing intormation, respond to parts a. and b. (1) The percents of sales for items that vary diectly with sales are as follows: Accounts receivable; 12.2\%, Inveritory, 18.2\%; Accounts papable, 13.8\%; Ned proft margin, 34% (2) Markbtable securties and othor current liablities will temain unchanged. (3) Peabody desires a minimum cash balance of $484,000. (4) A new machine costing 3646,000 will be acquired in 2023 , and equipment costing $847,000 will be purchased in 2024 . Total depreciation in 2023 is forecas as $295,000, and in 2024 5396,000 of depreciation will be taken. (5) Accruais wal rise to $498,000 by the end of 2024 () There will be no sale or retieement of long-term debt. (7) No sale or repurchase of common stock is expected. (8) The dividend payout of 50% of net profts wit continue. (9) The sales forecast predicts $11.7 millon in 2023 and $11.7 milion in 2024 . (10) The December 31. 2022, bolance sheet is here iff a. Prepare a pro forma balance sheet dated December 31, 2024. Coenplele the assets part of the pro forma balance sheet for Peabody s Peabody for December 31,2024 below: (Rourd so the nearest dolar.) Data table (Click on the icon here p in order to copy the contents of the data table below into a spreadsheet.) a. Prepare a pro forma balance sheet dated December 31, 2024. Complete the assets part of the pro forma balance sheet for Peabody \& Peabody for December 31,2024 below: (Round to the Pro Forma Balance sheet Peabody \& Peabody December 31,2024 Liabilities and stockholders' equity Current Fabiitios Acoounts payable Acoruals Other current llabilioies Total current Labilites Long-tern debt Total inbilities Common sock and Retared Eamings $ Extemal funds nequired Treal liataites and atodkiders' equity

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts