Question: URGENT!!! PLEASE SOLVE ON PAPER, THUMBS UP WILL BE GIVEN THANKS 6. A Company is faced with two proposed methods for making one of their

URGENT!!! PLEASE SOLVE ON PAPER, THUMBS UP WILL BE GIVEN THANKS

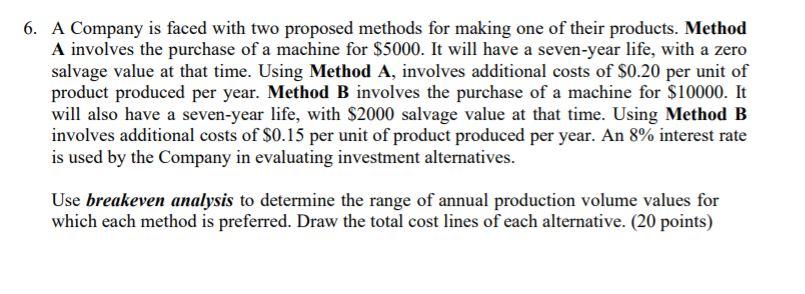

6. A Company is faced with two proposed methods for making one of their products. Method A involves the purchase of a machine for $5000. It will have a seven-year life, with a zero salvage value at that time. Using Method A, involves additional costs of $0.20 per unit of product produced per year. Method B involves the purchase of a machine for $10000. It will also have a seven-year life, with $2000 salvage value at that time. Using Method B involves additional costs of $0.15 per unit of product produced per year. An 8% interest rate is used by the Company in evaluating investment alternatives. Use breakeven analysis to determine the range of annual production volume values for which each method is preferred. Draw the total cost lines of each alternative. (20 points) 6. A Company is faced with two proposed methods for making one of their products. Method A involves the purchase of a machine for $5000. It will have a seven-year life, with a zero salvage value at that time. Using Method A, involves additional costs of $0.20 per unit of product produced per year. Method B involves the purchase of a machine for $10000. It will also have a seven-year life, with $2000 salvage value at that time. Using Method B involves additional costs of $0.15 per unit of product produced per year. An 8% interest rate is used by the Company in evaluating investment alternatives. Use breakeven analysis to determine the range of annual production volume values for which each method is preferred. Draw the total cost lines of each alternative. (20 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts