Question: Urgent!!!! Please solve without excel or other software 2) Congratulations on starting your new business that offers financial advising services for individuals and families. Your

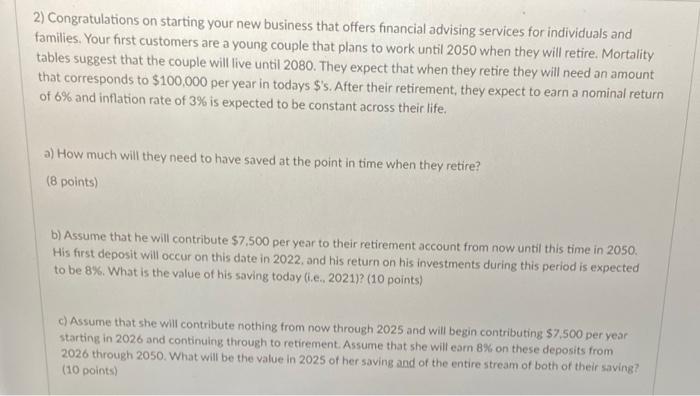

2) Congratulations on starting your new business that offers financial advising services for individuals and families. Your first customers are a young couple that plans to work until 2050 when they will retire. Mortality tables suggest that the couple will live until 2080. They expect that when they retire they will need an amount that corresponds to $100,000 per year in todays $'s. After their retirement, they expect to earn a nominal return of 6% and inflation rate of 3% is expected to be constant across their life. a) How much will they need to have saved at the point in time when they retire? (8 points) b) Assume that he will contribute $7,500 per year to their retirement account from now until this time in 2050. His first deposit will occur on this date in 2022, and his return on his investments during this period is expected to be 8%. What is the value of his saving today (ie, 2021)? (10 points) c) Assume that she will contribute nothing from now through 2025 and will begin contributing $7,500 per year starting in 2026 and continuing through to retirement. Assume that she will earn 8% on these deposits from 2026 through 2050. What will be the value in 2025 of her saving and of the entire stream of both of their saving? (10 points) 2) Congratulations on starting your new business that offers financial advising services for individuals and families. Your first customers are a young couple that plans to work until 2050 when they will retire. Mortality tables suggest that the couple will live until 2080. They expect that when they retire they will need an amount that corresponds to $100,000 per year in todays $'s. After their retirement, they expect to earn a nominal return of 6% and inflation rate of 3% is expected to be constant across their life. a) How much will they need to have saved at the point in time when they retire? (8 points) b) Assume that he will contribute $7,500 per year to their retirement account from now until this time in 2050. His first deposit will occur on this date in 2022, and his return on his investments during this period is expected to be 8%. What is the value of his saving today (ie, 2021)? (10 points) c) Assume that she will contribute nothing from now through 2025 and will begin contributing $7,500 per year starting in 2026 and continuing through to retirement. Assume that she will earn 8% on these deposits from 2026 through 2050. What will be the value in 2025 of her saving and of the entire stream of both of their saving? (10 points)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts