Question: URGENT !!!!!!!!!!!!!! PLEASE TYPE AND ANSWER ASAP PLEASEEEEEEEE !!!!!!!!!!!!! Question 3 Debt: A firm can sell 15,000 bonds 25 year at 108% of par value.

URGENT !!!!!!!!!!!!!! PLEASE TYPE AND ANSWER ASAP PLEASEEEEEEEE !!!!!!!!!!!!!

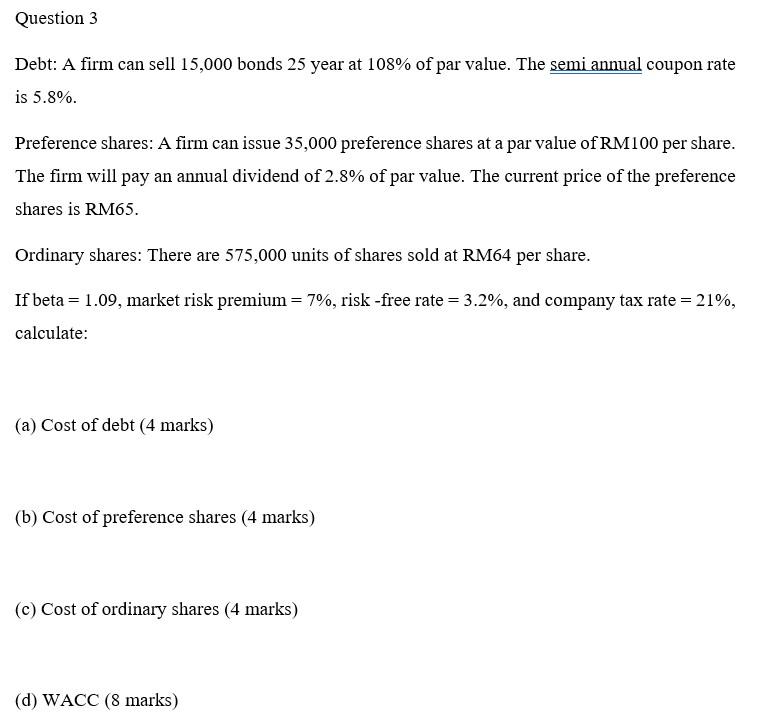

Question 3 Debt: A firm can sell 15,000 bonds 25 year at 108% of par value. The semi annual coupon rate is 5.8%. Preference shares: A firm can issue 35,000 preference shares at a par value of RM100 per share. The firm will pay an annual dividend of 2.8% of par value. The current price of the preference shares is RM65. Ordinary shares: There are 575,000 units of shares sold at RM64 per share. If beta =1.09, market risk premium =7%, risk -free rate =3.2%, and company tax rate =21%, calculate: (a) Cost of debt (4 marks) (b) Cost of preference shares ( 4 marks) (c) Cost of ordinary shares (4 marks) (d) WACC (8 marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts