Question: Urgent ! Tips on how to solve: There are 3 components: Find the markets value of 3 components - 1) Debt 2) Lease 3 Equity

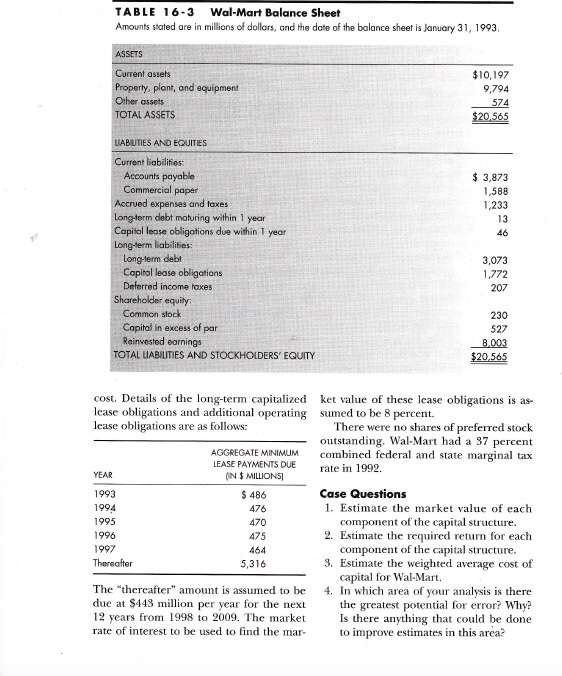

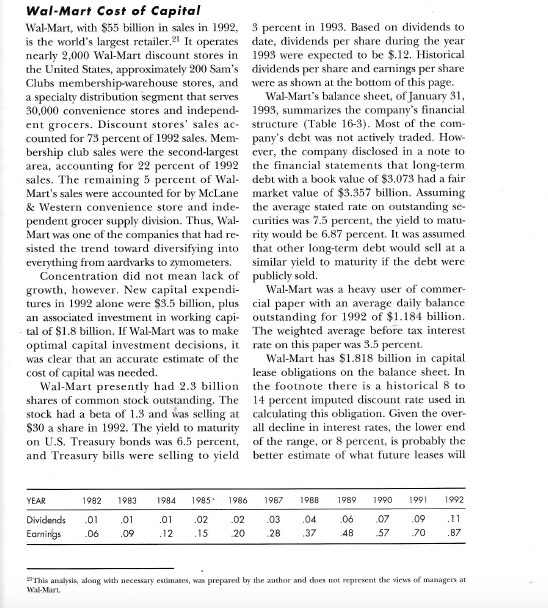

TABLE 16-3 Wal-Mart Balance Sheet Amounts stated are in millions of dollars, and the date of the balance sheet is January 31, 1993 ASSETS Current assets $10,197 9,794 ty, plant, and equipment assets AL ASSETS $20,565 BUTIES AND EQUITIES Accounts payable Commercial paper $ 3,873 1,588 1,233 expenses and taxes m debt maturing within 1 year lease obligations due within 1 year 46 liabiliies Long-lerm debt Capitol lease obligations Deferred income toxes 3,073 1,772 207 equity: Common slock Capital in excess of par Rainvested earnings TAL LIABIUTIES AND STOCKHOLDERS EQUITY 230 527 $20,565 cost. Details of the long-term capitalized lease obligations and additional operating sumed to be 8 percent lease obligations are as follows: ket value of these lease obligations is as- There were no shares of preferred stock AGGREGATE MINIMUM LEASE PAYMENTS DUE N $ MILLIONSI outstanding. Wal-Mart had a 37 percent combined federal and state marginal tax rate in 1992. YEAR Case Questions 1993 1994 1995 1996 1997 Thereafter 486 476 470 475 464 5,316 1. Estimate the market value of each 2. Estimate the required return for each 3. Estimate the weighted average cost of 4. In which area of your analysis is there component of the capital structure compo capital for Wal-Mart. nent of the capital structure The "thereafter" amount is assumed to be due at $443 million per year for the next 12 years from 1998 to 2009. The market rate of interest to be used to find the mar- the greatest potential for error? Why? Is there anything that could be done to improve estimates in this area

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts