Question: URGENTLY NEEDED 1. What is the expected return on the market portfolio if the required rate of return on Asset A is 15%, the risk-free

URGENTLY NEEDED

URGENTLY NEEDED

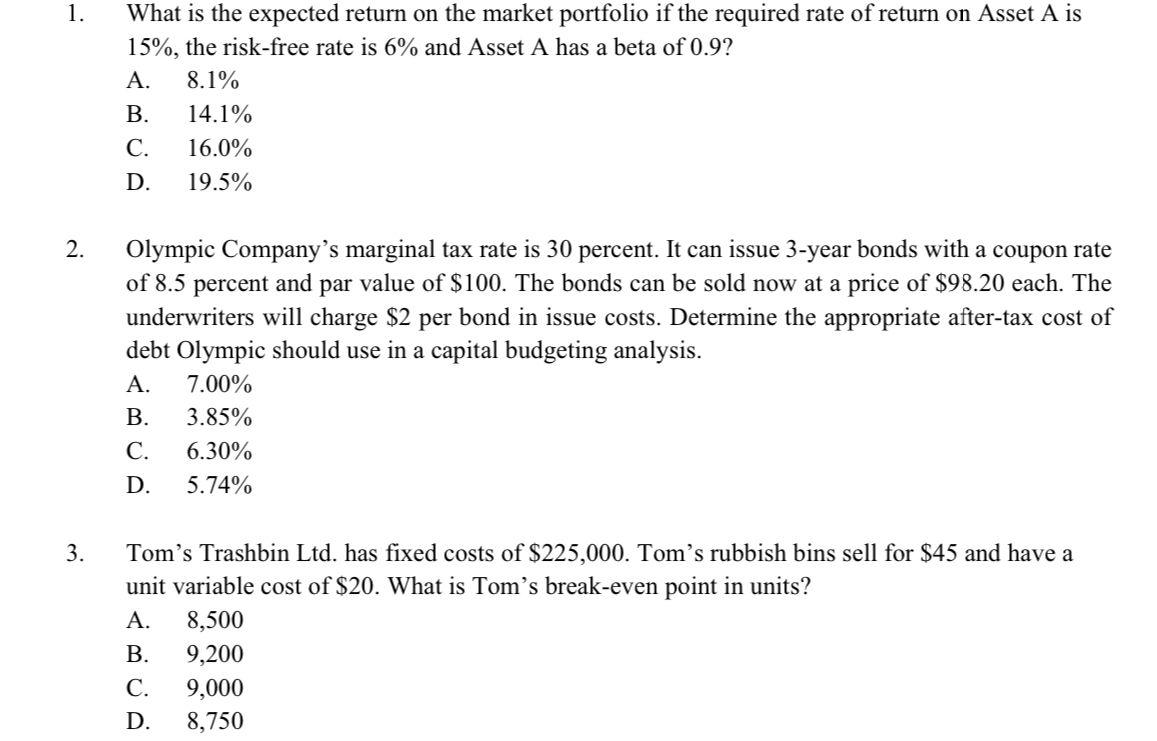

1. What is the expected return on the market portfolio if the required rate of return on Asset A is 15%, the risk-free rate is 6% and Asset A has a beta of 0.9 ? A. 8.1% B. 14.1% C. 16.0% D. 19.5% 2. Olympic Company's marginal tax rate is 30 percent. It can issue 3-year bonds with a coupon rate of 8.5 percent and par value of $100. The bonds can be sold now at a price of $98.20 each. The underwriters will charge $2 per bond in issue costs. Determine the appropriate after-tax cost of debt Olympic should use in a capital budgeting analysis. A. 7.00% B. 3.85% C. 6.30% D. 5.74% 3. Tom's Trashbin Ltd. has fixed costs of $225,000. Tom's rubbish bins sell for $45 and have a unit variable cost of $20. What is Tom's break-even point in units? A. 8,500 B. 9,200 C. 9,000 D. 8,750

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts