Question: urgently require help. Defence Electronics Inc. is considering the purchase of a new machine for $325,000. The firm's old machines a book si 570,000 can

urgently require help.

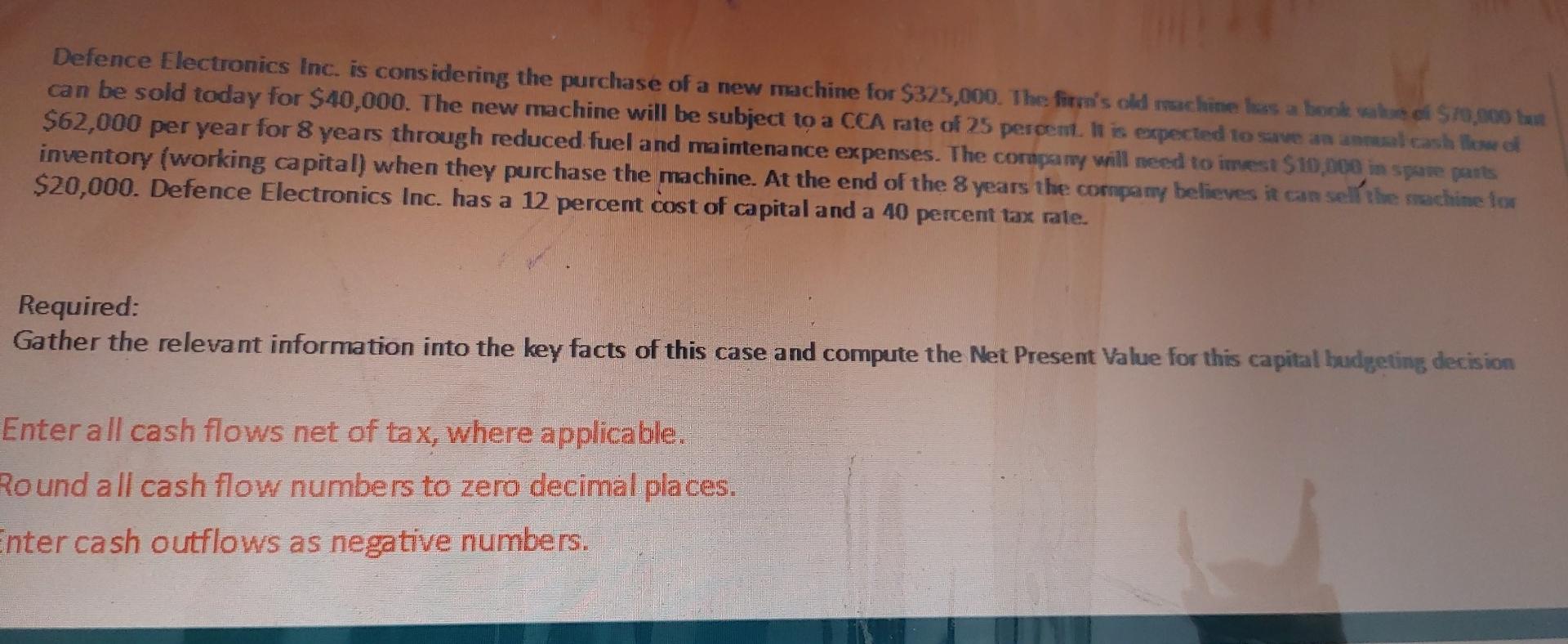

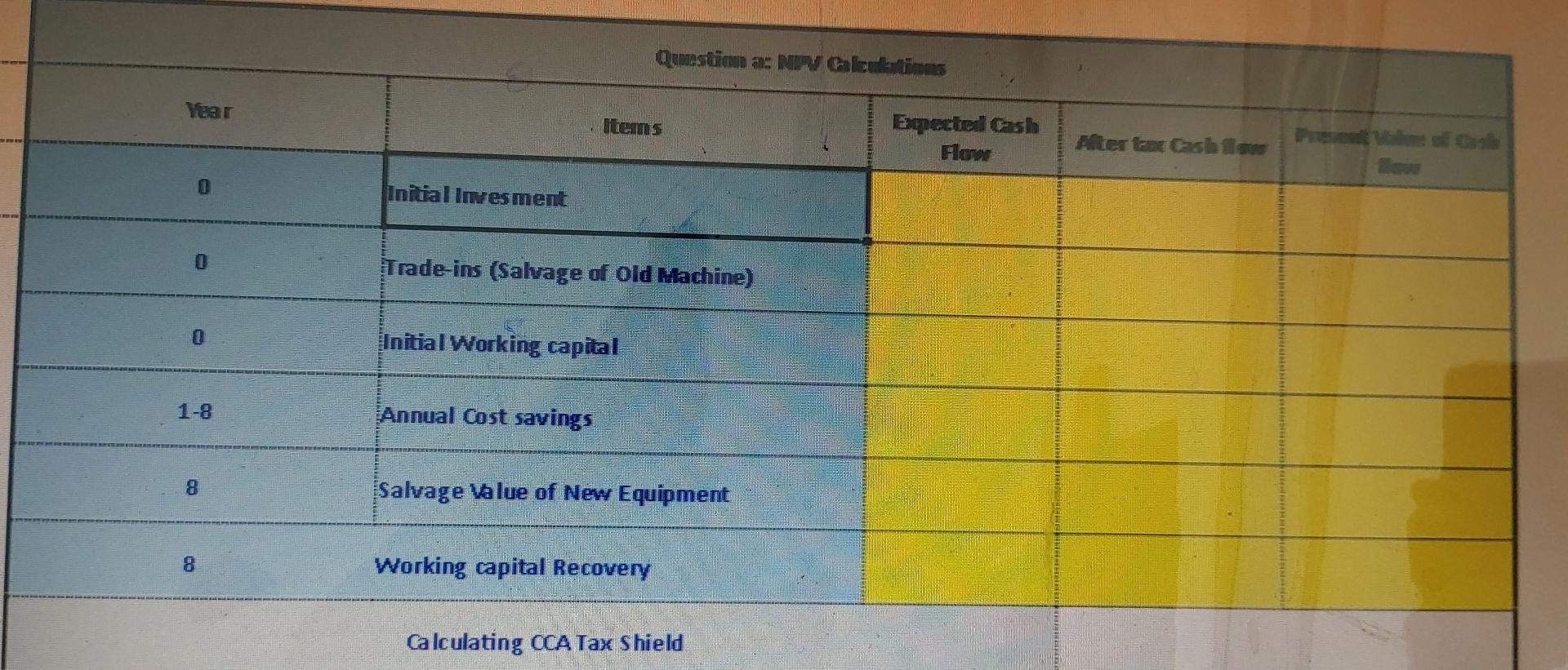

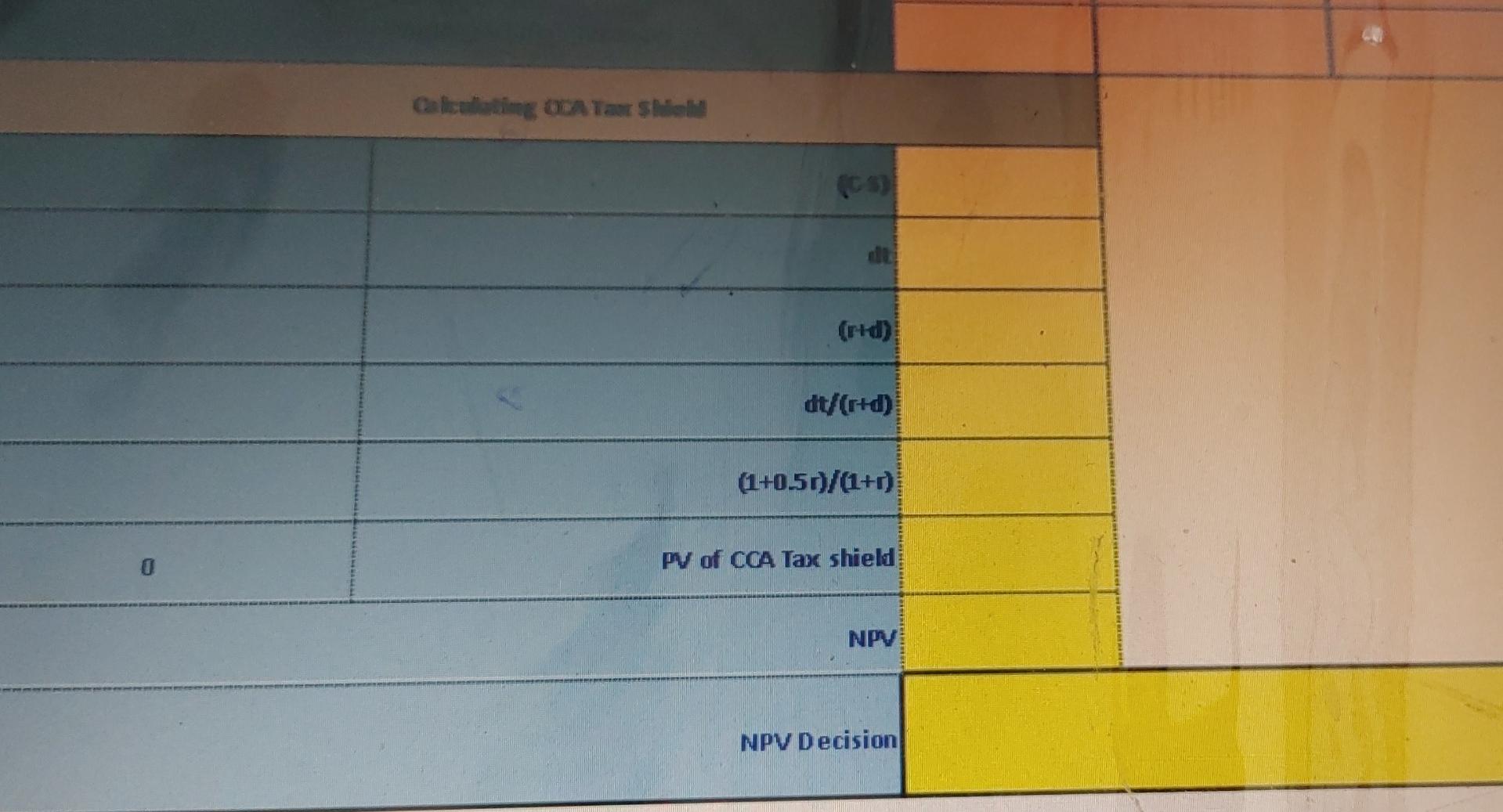

Defence Electronics Inc. is considering the purchase of a new machine for $325,000. The firm's old machines a book si 570,000 can be sold today for $40,000. The new machine will be subject to a CCA rate of 25 percent. It is expected to save an amalcash flow of $62,000 per year for 8 years through reduced fuel and maintenance expenses. The company will need to imest $10,000 in spare parts inventory (working capital) when they purchase the machine. At the end of the 8 years the company believes it can sell the machine for $20,000. Defence Electronics Inc. has a 12 percent cost of capital and a 40 percent tax rate. Required: Gather the relevant information into the key facts of this case and compute the Net Present Value for this capital hudgeting decision Enter all cash flows net of tax, where applicable. Round all cash flow numbers to zero decimal places. inter cash outflows as negative numbers. Questiom a NPV Galculations Year Items Emette Cash Flow After tear Cashim low 0 Initial Invesment 0 Trade-ins (Salvage of Old Machine) C Initial Working capital 1-8 Annual Cost savings 8 Salvage value of New Equipment 8 Working capital Recovery Calculating CCA Tax Shield Calculating OCA Tantsi (rid) dt/(r+d) (1+0.51)/(1+r) PV of CCA Tax shield NPV NPV Decision

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts