Question: urgrnt please!! in excel and show all work and math please 1. Davis acquires 100% of Ramos on January 1, 2009. Ramos will be operated

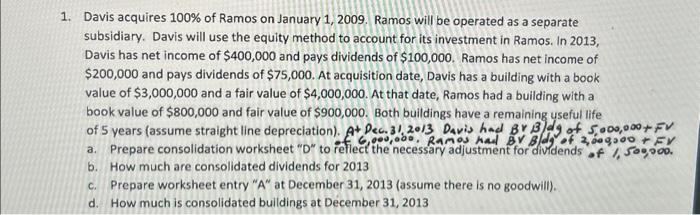

1. Davis acquires 100% of Ramos on January 1, 2009. Ramos will be operated as a separate subsidiary. Davis will use the equity method to account for its investment in Ramo5. In 2013, Davis has net income of $400,000 and pays dividends of $100,000. Ramos has net income of $200,000 and pays dividends of $75,000. At acquisition date, Davis has a building with a book value of $3,000,000 and a fair value of $4,000,000. At that date, Ramos had a building with a book value of $800,000 and fair value of $900,000. Both buildings have a remaining useful life a. Prepare consolidation worksheet "D" to reflect b. How much are consolidated dividends for 2013 c. Prepare worksheet entry "A" at December 31, 2013 (assume there is no goodwill). d. How much is consolidated buildings at December 31, 2013 1. Davis acquires 100% of Ramos on January 1, 2009. Ramos will be operated as a separate subsidiary. Davis will use the equity method to account for its investment in Ramo5. In 2013, Davis has net income of $400,000 and pays dividends of $100,000. Ramos has net income of $200,000 and pays dividends of $75,000. At acquisition date, Davis has a building with a book value of $3,000,000 and a fair value of $4,000,000. At that date, Ramos had a building with a book value of $800,000 and fair value of $900,000. Both buildings have a remaining useful life a. Prepare consolidation worksheet "D" to reflect b. How much are consolidated dividends for 2013 c. Prepare worksheet entry "A" at December 31, 2013 (assume there is no goodwill). d. How much is consolidated buildings at December 31, 2013

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts