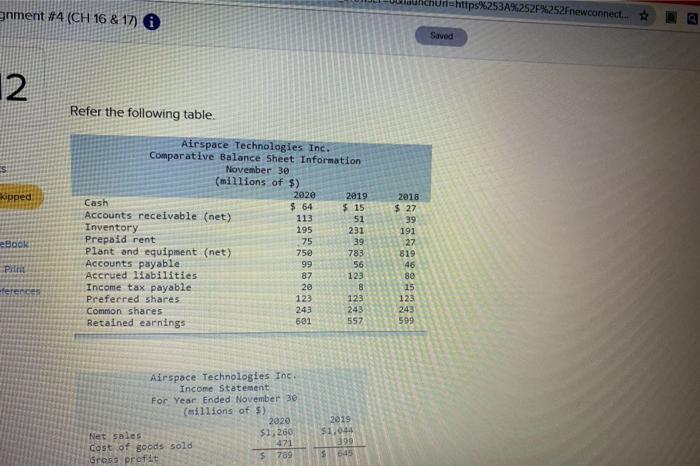

Question: Url=https%253A%252F%252Fnewconnect. anment #4 (CH 16 & 17) Sarved 12 Sipped Refer the following table. Airspace Technologies Inc. Comparative Balance Sheet Information November 30 (millions of

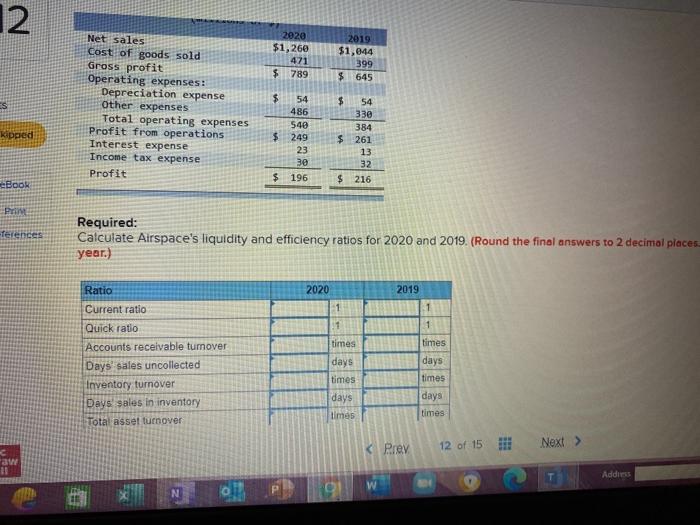

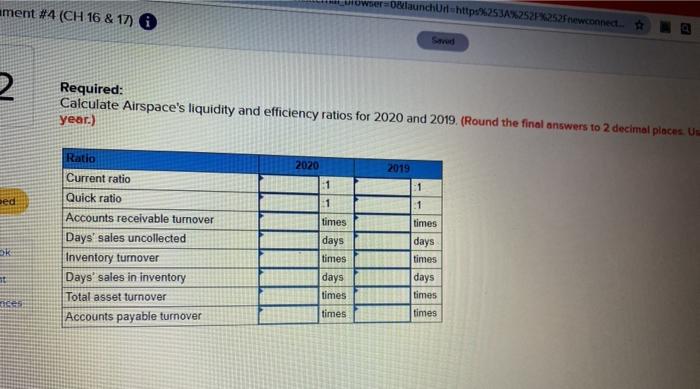

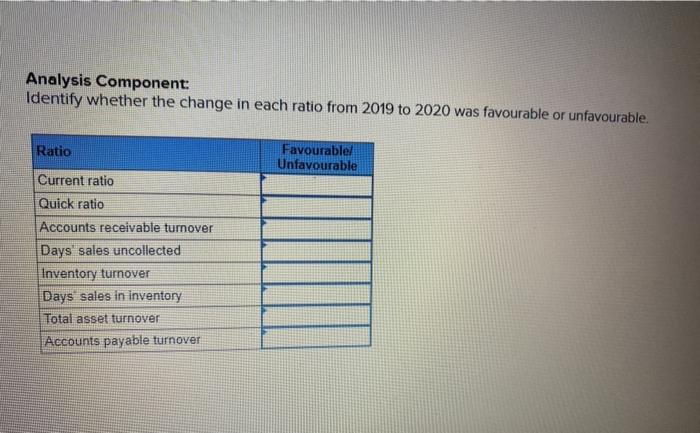

Url=https%253A%252F%252Fnewconnect. anment #4 (CH 16 & 17) Sarved 12 Sipped Refer the following table. Airspace Technologies Inc. Comparative Balance Sheet Information November 30 (millions of $) 2020 2019 Cash $ 64 $15 Accounts receivable (net) 113 51 Inventory 195 231 Prepaid rent 75 39 Plant and equipment (net) 750 783 Accounts payable 99 56 Accrued liabilities 87 123 Income tax payable 20 8 Preferred shares 123 Common shares 243 Retained earnings 601 557 eBook 2018 $ 27 39 191 27 819 46 80 15 123 243 599 PH ferences 123 243 Airspace Technologies Inc. Income Statement For Year Ended November 30 (illions of s) 2020 Net sules $1,260 Cost of goods sold 471 Gross profit 5 789 2019 $1.044 390 $ 545 12 2020 $1,260 471 $ 789 2019 $1,044 399 $ 645 $ Net sales cost of goods sold Gross profit Operating expenses: Depreciation expense Other expenses Total operating expenses Profit from operations Interest expense Income tax expense Profit 54 486 540 249 23 30 Kipped $ $ 54 330 384 $ 261 13 32 $ 216 $ 196 BOOM PM ferences Required: Calculate Airspace's liquidity and efficiency ratios for 2020 and 2019. (Round the final answers to 2 decimal places year.) Ratio 2020 2019 Current ratio 1 1 1 1 Quick ratio Accounts receivable turnover Days Sales uncollected Inventory turnover Days sales in inventory Total asset turnover times days times days times days times days times Times Prey 12 of 15 Next > aw 31 Address oll W wower DelaunchUnhttp%253A%252F%252Fnewcooned. ament #4 (CH 16 & 17) O Sons 2 Required: Calculate Airspace's liquidity and efficiency ratios for 2020 and 2019. (Round the final answers to 2 decimal places. Us year.) 2020 .1 ped 1 times Ratio Current ratio Quick ratio Accounts receivable turnover Days' sales uncollected Inventory turnover Days' sales in inventory Total asset turnover Accounts payable turnover days times days times times 2019 1 1 times days times days times times Analysis Component: Identify whether the change in each ratio from 2019 to 2020 was favourable or unfavourable. Ratio Favourable! Unfavourable Current ratio Quick ratio Accounts receivable tumover Days' sales uncollected Inventory turnover Days sales in inventory Total asset turnover Accounts payable turnover

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts