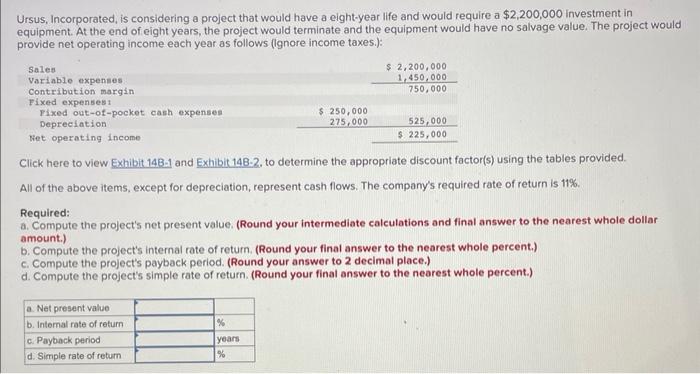

Question: Ursus, Incorporated, is considering a project that would have a eight-year life and would require a $2,200,000 investment in equipment. At the end of

Ursus, Incorporated, is considering a project that would have a eight-year life and would require a $2,200,000 investment in equipment. At the end of eight years, the project would terminate and the equipment would have no salvage value. The project would provide net operating income each year as follows (Ignore income taxes.): Sales Variable expenses Contribution margin Fixed expenses: $ 2,200,000 1,450,000 750,000 Fixed out-of-pocket cash expenses Depreciation Net operating income: $ 250,000 275,000 525,000 $225,000 Click here to view Exhibit 14B-1 and Exhibit 148-2, to determine the appropriate discount factor(s) using the tables provided. All of the above items, except for depreciation, represent cash flows. The company's required rate of return is 11%. Required: a. Compute the project's net present value. (Round your intermediate calculations and final answer to the nearest whole dollar amount.) b. Compute the project's internal rate of return. (Round your final answer to the nearest whole percent.) c. Compute the project's payback period. (Round your answer to 2 decimal place.) d. Compute the project's simple rate of return. (Round your final answer to the nearest whole percent.) a. Net present value b. Internal rate of return c. Payback period d. Simple rate of return % years %

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts