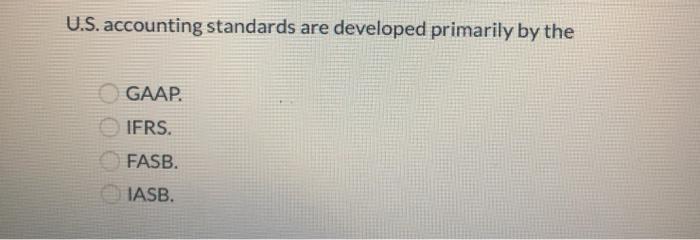

Question: U.S. accounting standards are developed primarily by the GAAP e IFRS. FASB. e IASB. If a company records a transaction with wrong amounts but properly

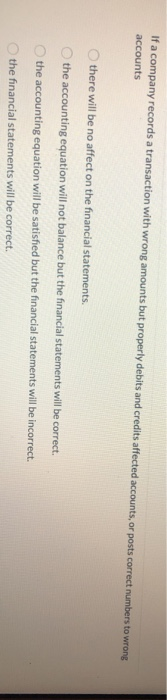

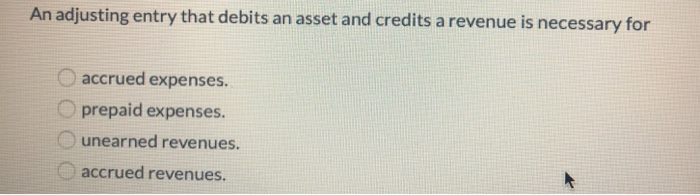

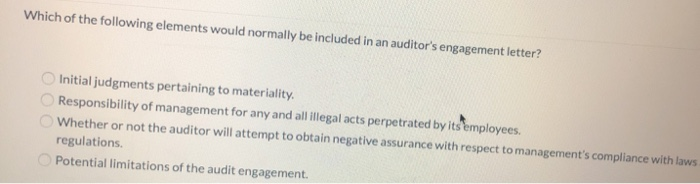

U.S. accounting standards are developed primarily by the GAAP e IFRS. FASB. e IASB. If a company records a transaction with wrong amounts but properly debits and credits affected accounts, or posts correct numbers to wrong accounts there will be no affect on the financial statements. the accounting equation will not balance but the financial statements will be correct. the accounting equation will be satisfied but the financial statements will be incorrect. the financial statements will be correct. An adjusting entry that debits an asset and credits a revenue is necessary for accrued expenses. prepaid expenses. unearned revenues. accrued revenues. Which of the following elements would normally be included in an auditor's engagement letter? Initial judgments pertaining to materiality. Responsibility of management for any and all illegal acts perpetrated by its employees. Whether or not the auditor will attempt to obtain negative assurance with respect to management's compliance with laws regulations. Potential limitations of the audit engagement

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts