Question: US based ABcyD company is evaluating a granite project for which it proposes to use a debt-equity ratio of 1.5:1. The pre-tax cost of debt

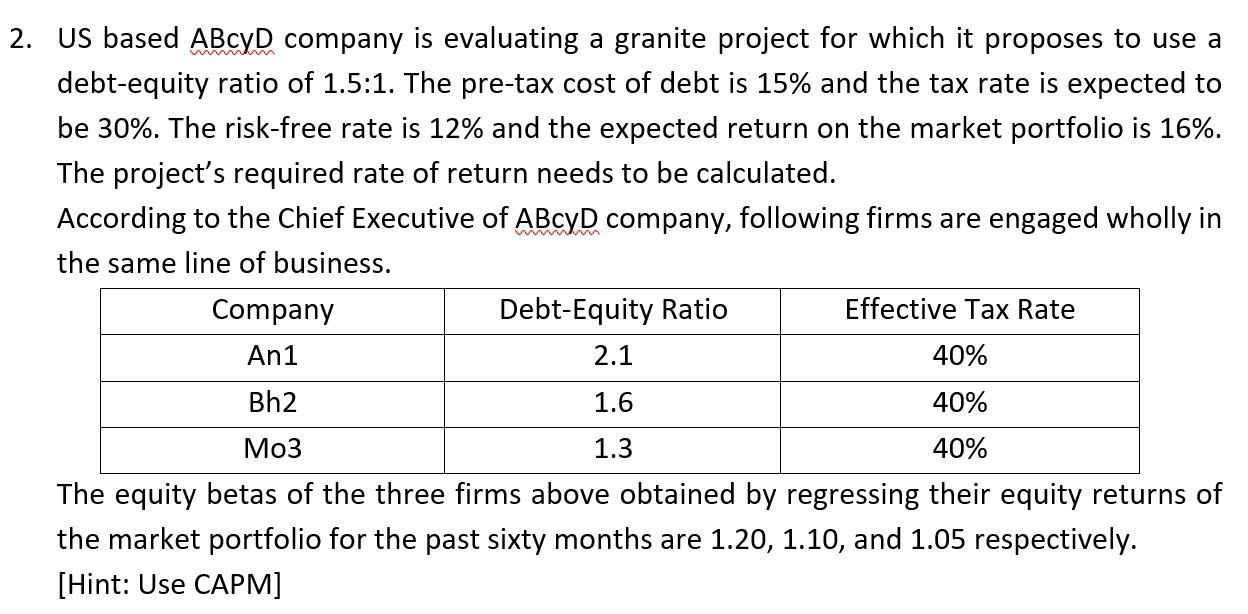

US based ABcyD company is evaluating a granite project for which it proposes to use a debt-equity ratio of 1.5:1. The pre-tax cost of debt is 15% and the tax rate is expected to be 30%. The risk-free rate is 12% and the expected return on the market portfolio is 16%. The project's required rate of return needs to be calculated. According to the Chief Executive of ABcyD company, following firms are engaged wholly in the same line of business. The equity betas of the three firms above obtained by regressing their equity returns of the market portfolio for the past sixty months are 1.20,1.10, and 1.05 respectively. [Hint: Use CAPM]

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts