Question: US based ML7N Engineering company is currently at its target debt-equity ratio of 4:5. It is evaluating a proposal to expand capacity which is

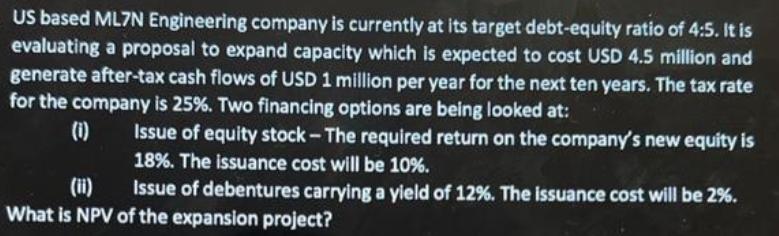

US based ML7N Engineering company is currently at its target debt-equity ratio of 4:5. It is evaluating a proposal to expand capacity which is expected to cost USD 4.5 million and generate after-tax cash flows of USD 1 million per year for the next ten years. The tax rate for the company is 25%. Two financing options are being looked at: (i) (ii) Issue of equity stock - The required return on the company's new equity is 18%. The issuance cost will be 10%. Issue of debentures carrying a yield of 12%. The issuance cost will be 2%. What is NPV of the expansion project?

Step by Step Solution

There are 3 Steps involved in it

To calculate the Net Present Value NPV of the expansion project we need to discount the aftertax cas... View full answer

Get step-by-step solutions from verified subject matter experts