Question: U.S. Dollar/Euro. The table, , indicates that a 1-year call option on euros at a strike rate of $1.2498/E will cost the buyer $0.0529/ ,

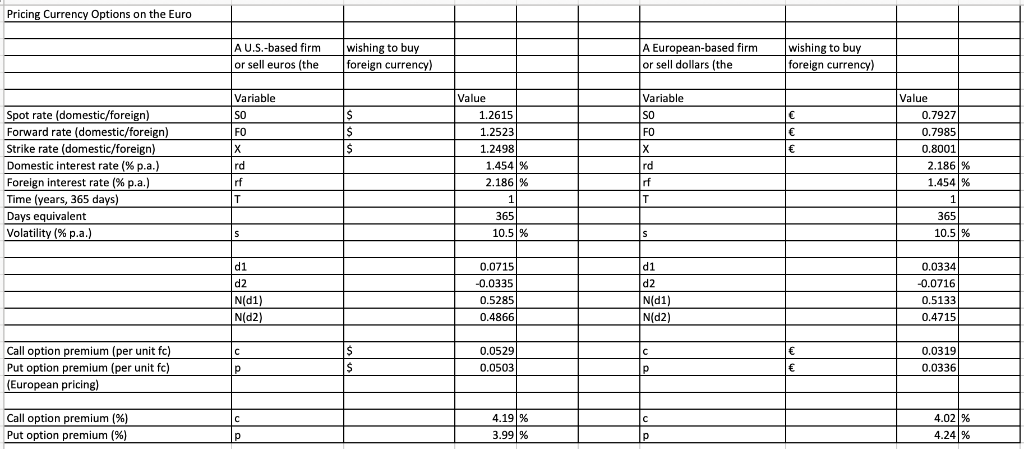

U.S. Dollar/Euro. The table, , indicates that a 1-year call option on euros at a strike rate of $1.2498/E will cost the buyer $0.0529/ , or 4.19%. But that assumed a volatility of 10 500% when the spot rate was $1.26 15e hat would the same cal option cost the o ati was reduced to 0500%, when the spot at alto $1.2475/? The same call option cost if the volatility was reduced to 10.500% when the spot rate fell to $1.2475e would be $ e. Round to four decimal places. Pricing Currency Options on the Euro A U.S.-based firm wishing to buy or sell euros (the foreign currency) A European-based firm or sell dollars (the wishing to foreign currency) Variable SO FO Value Variable Value Spot rate (domestic/foreign) Forward rate (domestic/foreign) Strike rate (domestic/foreign) Domestic interest rate (% pa) Foreign interest rate (% pa) Time (years, 365 days) Days equivalent Volatility 1% p 1.2615 1.2523 1.2498 0.7927 0.7985 0.8001 SO 2.1861% 1.454 % rd 1.454 | % 2.186 % rd 365 10.5 365 10.51% d1 d2 N(d1) N(d2 0.0715 -0.0335 0.5285 0.4866 d1 d2 N(d1 N(d2 0.0334 0.0716 0.5133 0.4715 Call option premium (per unit fc) Put option premium (per unit fc) (European pricing) 0.0529 0.0503 0.0319 0.0336 Call option premium (%) Put option premium (%) 4.19% 3.99% 4.02 % 4.24% U.S. Dollar/Euro. The table, , indicates that a 1-year call option on euros at a strike rate of $1.2498/E will cost the buyer $0.0529/ , or 4.19%. But that assumed a volatility of 10 500% when the spot rate was $1.26 15e hat would the same cal option cost the o ati was reduced to 0500%, when the spot at alto $1.2475/? The same call option cost if the volatility was reduced to 10.500% when the spot rate fell to $1.2475e would be $ e. Round to four decimal places. Pricing Currency Options on the Euro A U.S.-based firm wishing to buy or sell euros (the foreign currency) A European-based firm or sell dollars (the wishing to foreign currency) Variable SO FO Value Variable Value Spot rate (domestic/foreign) Forward rate (domestic/foreign) Strike rate (domestic/foreign) Domestic interest rate (% pa) Foreign interest rate (% pa) Time (years, 365 days) Days equivalent Volatility 1% p 1.2615 1.2523 1.2498 0.7927 0.7985 0.8001 SO 2.1861% 1.454 % rd 1.454 | % 2.186 % rd 365 10.5 365 10.51% d1 d2 N(d1) N(d2 0.0715 -0.0335 0.5285 0.4866 d1 d2 N(d1 N(d2 0.0334 0.0716 0.5133 0.4715 Call option premium (per unit fc) Put option premium (per unit fc) (European pricing) 0.0529 0.0503 0.0319 0.0336 Call option premium (%) Put option premium (%) 4.19% 3.99% 4.02 % 4.24%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts