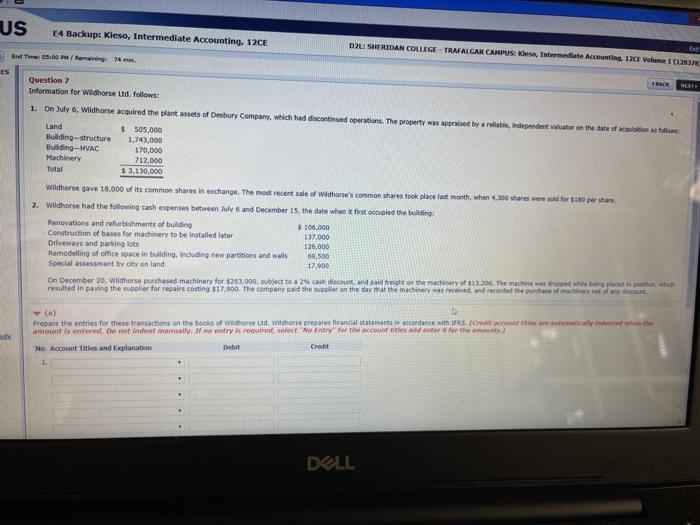

Question: US E4 Backup: Kieso, Intermediate Accounting. 12CE 3.00 / remaining em DL: SHERIDAN COLLEGE TRAFALGAR CAMPUS: diese, Intermediate Accounting 12CE Wome (126378 FAG Question 7

US E4 Backup: Kieso, Intermediate Accounting. 12CE 3.00 / remaining em DL: SHERIDAN COLLEGE TRAFALGAR CAMPUS: diese, Intermediate Accounting 12CE Wome (126378 FAG Question 7 Information for Wildhorse Utd. follows: 1. On July 6, Wildhorse acquired the plant assets of Desbury Company, which had discontinued operations. The property was posed by arte, independent on the date of it as follows Land $ 505,000 Building-structure 1,749,000 Building-HVAC 170,000 Machinery 712,000 Total $3,130.000 Wildhorse gave 18,000 of its common shares in exchange. The most recent sale of Widhorse's common shares took place last month, when 400 shares were sold for $180 per har 2. Wildhorse had the following cash expenses between July 6 and December 15, the date when it could the building Renovations and refurbishments of building 100.000 Construction of bases for machinery to be installed later 137.000 Driveways and parking lots 125,000 Remodelling of office space in building, including new partitions and walls 69,500 Special asset by city on land 17,000 On December 20, Wildhorse purchased machinery for $269,000, subject to a 2 cash discount and paid right on the machine of $1.200. The machine store resulted in paying the supplier for repairs costing $17.900. The company and the well on the day at the machinery was received and recorded the purch fact a) Prepare the entries for these transaction on the books of where ud, Wildhore great financial statement accordance with codi per essential indeed was the accoorities in the No. Account Titles and Explanation Debat Credit 1 DELL US E4 Backup: Kieso, Intermediate Accounting. 12CE 3.00 / remaining em DL: SHERIDAN COLLEGE TRAFALGAR CAMPUS: diese, Intermediate Accounting 12CE Wome (126378 FAG Question 7 Information for Wildhorse Utd. follows: 1. On July 6, Wildhorse acquired the plant assets of Desbury Company, which had discontinued operations. The property was posed by arte, independent on the date of it as follows Land $ 505,000 Building-structure 1,749,000 Building-HVAC 170,000 Machinery 712,000 Total $3,130.000 Wildhorse gave 18,000 of its common shares in exchange. The most recent sale of Widhorse's common shares took place last month, when 400 shares were sold for $180 per har 2. Wildhorse had the following cash expenses between July 6 and December 15, the date when it could the building Renovations and refurbishments of building 100.000 Construction of bases for machinery to be installed later 137.000 Driveways and parking lots 125,000 Remodelling of office space in building, including new partitions and walls 69,500 Special asset by city on land 17,000 On December 20, Wildhorse purchased machinery for $269,000, subject to a 2 cash discount and paid right on the machine of $1.200. The machine store resulted in paying the supplier for repairs costing $17.900. The company and the well on the day at the machinery was received and recorded the purch fact a) Prepare the entries for these transaction on the books of where ud, Wildhore great financial statement accordance with codi per essential indeed was the accoorities in the No. Account Titles and Explanation Debat Credit 1 DELL

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts