Question: US monetary policy can be measured by changes in the Federal funds rate, which are announced by the Federal Open Market Committee (FOMC) meetings. Given

US monetary policy can be measured by changes in the Federal funds rate, which are announced by the Federal Open Market Committee (FOMC) meetings. Given the importance of monetary policy to the whole economy, investors pay special attention to the FOMC announcements. We have collected data on FOMC announcements from 1989 to 2007 and the aggregate stock market reactions to it.

Here is a list of variables:

- Return: S&P 500 index return on the announcement date (in percentage)

- Total change: change of Federal fund rate (in bps)

- Expected: investors expected change of Federal fund rate, which is estimated based on the futures contracts written on the Federal fund rate (in bps)

- Surprise: the difference between Total change and Expected, which measures the change that is out of expectation of investors (in bps)

- Scheduled: equals to 1 if the FOMC is scheduled, and 0 if not.

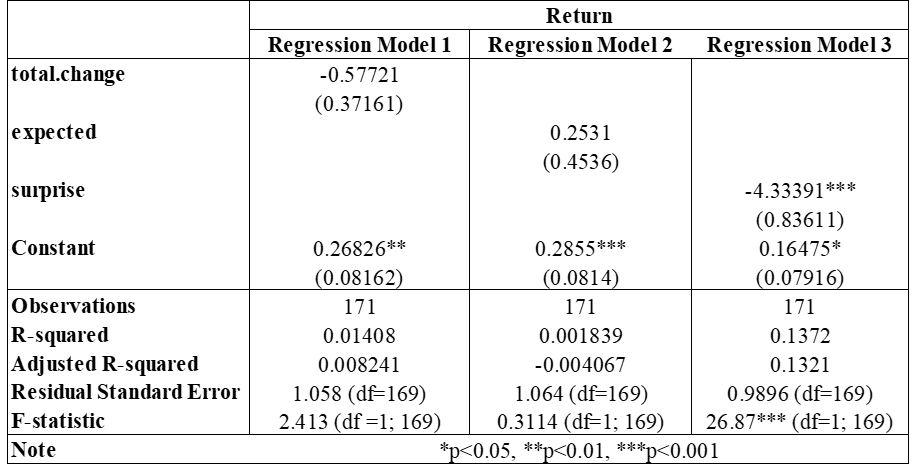

With this dataset, we have run three separate regressions:

In the first regression, Y is Return, X is Total change;

In the second regression, Y is Return, X is Expected;

In the third regression, Y is Return, X is Surprise.

The results are presented as below

Comparing the three regression results, which X variable explains Y the best? (0.5 mark). Why that is the case? [Note: you may link it with market efficiency] (1 mark)

Comparing the three regression results, which X variable explains Y the best? (0.5 mark). Why that is the case? [Note: you may link it with market efficiency] (1 mark)

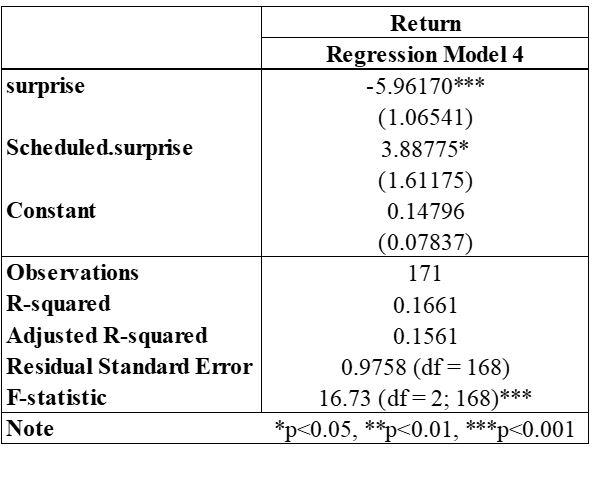

We also create a variable which equals to Scheduled*Surprise, and then run a regression in which Y is Return, the first X variable is Surprise, and the second X variable is Scheduled*Surprise. The results are presented as below:

Based on the results, at the 5% significance level, is the effect of Surprise on Returndependent on whether the FOMC meeting is scheduled or not? (0.5 mark) If so, please explain the impact of Scheduled in details [answer in less than 50 words]. (1 mark)

Return Regression Model 1 Regression Model 2 Regression Model 3 total.change -0.57721 (0.37161) expected 0.2531 (0.4536) surprise -4.33391 Constant 0.26826** 0.2855*** (0.83611) 0.16475* (0.07916) 171 (0.08162) (0.0814) 171 171 0.01408 0.001839 0.1372 Observations R-squared Adjusted R-squared Residual Standard Error F-statistic Note 0.008241 -0.004067 0.1321 1.058 (df=169) 1.064 (df=169) 0.9896 (df=169) 2.413 (df =1; 169) 0.3114 (df=1; 169) 26.87*** df=1; 169) *p

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts