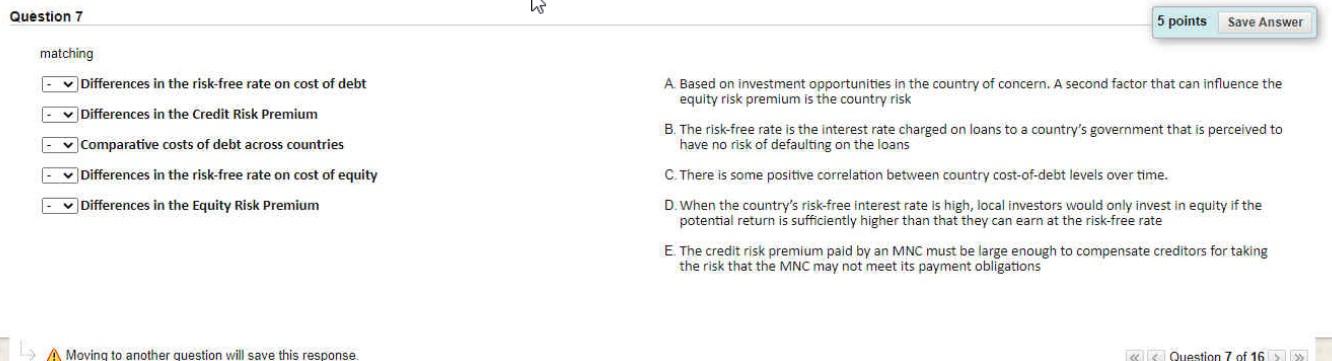

Question: us Question 7 5 points Save Answer matching - Differences in the risk-free rate on cost of debt - Differences in the Credit Risk Premium

us Question 7 5 points Save Answer matching - Differences in the risk-free rate on cost of debt - Differences in the Credit Risk Premium v Comparative costs of debt across countries - Differences in the risk-free rate on cost of equity Differences in the Equity Risk Premium A. Based on investment opportunities in the country of concern. A second factor that can influence the equity risk premium is the country risk B. The risk-free rate is the interest rate charged on loans to a country's government that is perceived to have no risk of defaulting on the loans C. There is some positive correlation between country cost-of-debt levels over time. D. When the country's risk-free interest rate is high, local investors would only invest in equity if the potential return is sufficiently higher than that they can earn at the risk-free rate E. The credit risk premium paid by an MNC must be large enough to compensate creditors for taking the risk that the MNC may not meet its payment obligations A Moving to another question will save this response >>

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts