Question: US tax need help please toSave Design Layout References | Bad Debt Follow Saved to my Mac Mailings Review View Table Design Layout Immersive Reader

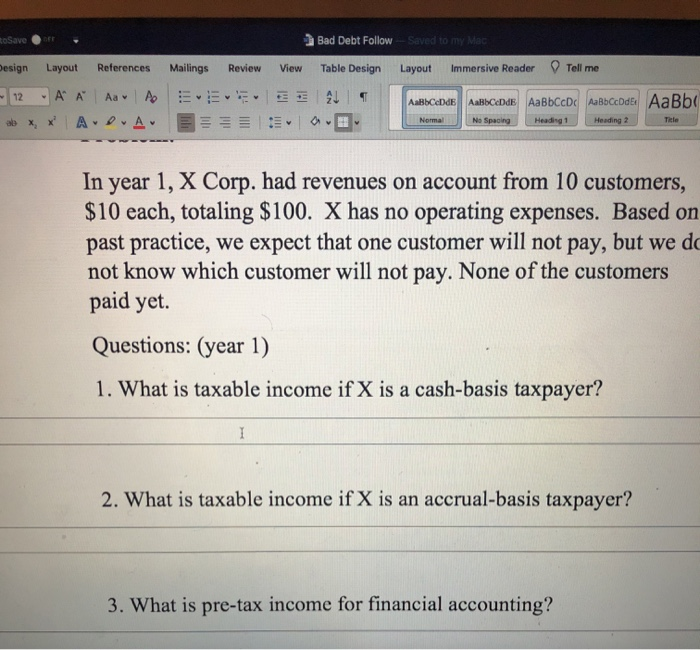

toSave Design Layout References | Bad Debt Follow Saved to my Mac Mailings Review View Table Design Layout Immersive Reader Tell me EEE 21 T AaBbceDdE AaBBCODE AaBbccdc AaBb CcDdEt AaBb No Spacing Heading 1 Heading 2 12 ' ' Aa A ADA v Normal Tele In year 1, X Corp. had revenues on account from 10 customers, $10 each, totaling $100. X has no operating expenses. Based on past practice, we expect that one customer will not pay, but we do not know which customer will not pay. None of the customers paid yet. Questions: (year 1) 1. What is taxable income if X is a cash-basis taxpayer? 1 2. What is taxable income if X is an accrual-basis taxpayer? 3. What is pre-tax income for financial accounting

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts