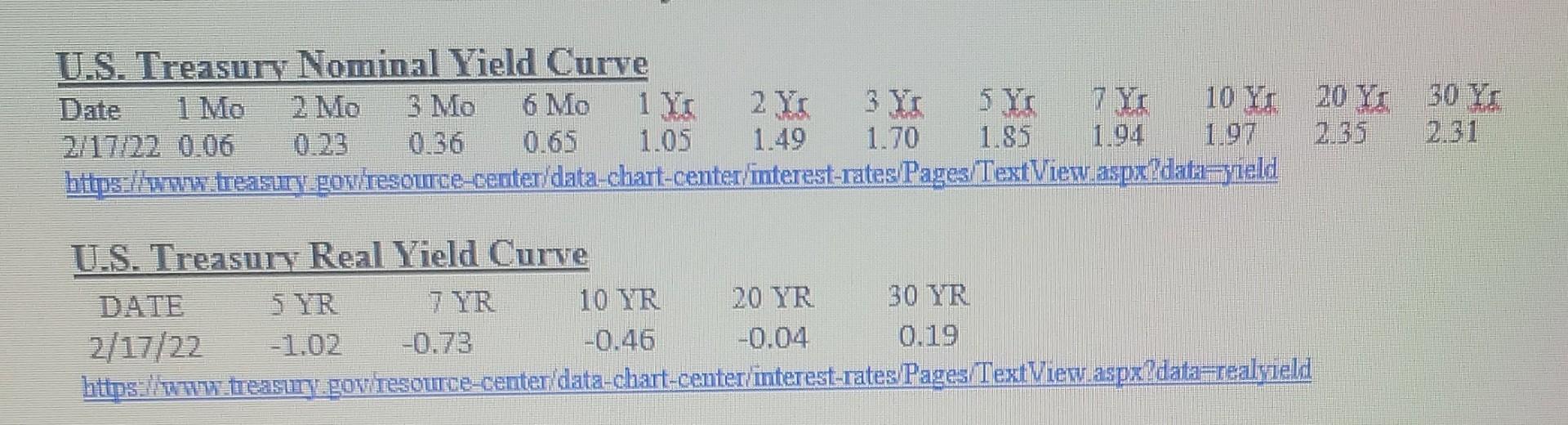

Question: U.S. Treasury Nominal Yield Curve 1 Mo 2 Me 3 Mo 6 MO 1 Yt 2 YT 3 Ys 7 YT 10 Yr 20 Yr

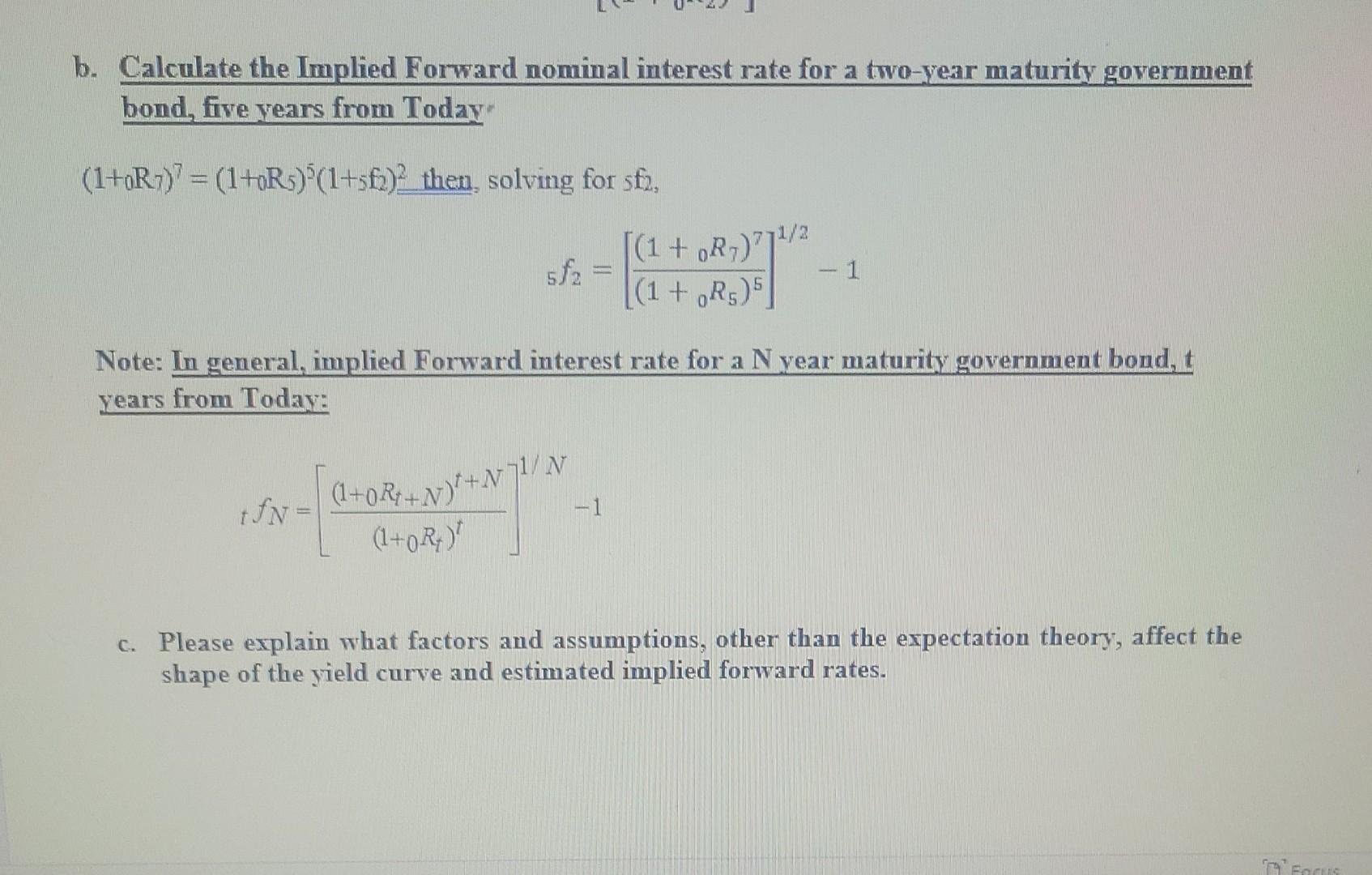

U.S. Treasury Nominal Yield Curve 1 Mo 2 Me 3 Mo 6 MO 1 Yt 2 YT 3 Ys 7 YT 10 Yr 20 Yr 30 Y. 2/17/22 0.06 0.65 1.05 1.49 1.70 1.85 1.97 2.31 https://www.treasury.gOVESOUTce-center/data-chart-center/interest-rates/Pages/TextView.aspx?datz-yield U.S. Treasury Real Yield Curve DATE SYR 7 YR 10 YR 20 YR 30 YR 2/17/22 -1.02 -0.46 -0.04 0.19 https:www.treasury.gov.tesource-center'data-chart-center interest rates/Pages/TextView.aspx?data=realyield b. Calculate the Implied Forward nominal interest rate for a two-year maturity government bond, five years from Today (1+R2) = (1+oRs) (1+sfa)? then, solving for sf, 5f2 | (1 + OR)1/2 - 1 (1 + R) Note: In general, implied Forward interest rate for a N year maturity government bond, t years from Today: (1+0Rx+x)'+w71/1 fN= + -1 (1+OR) C. Please explain what factors and assumptions, other than the expectation theory, affect the shape of the yield curve and estimated implied forward rates. To Focus U.S. Treasury Nominal Yield Curve 1 Mo 2 Me 3 Mo 6 MO 1 Yt 2 YT 3 Ys 7 YT 10 Yr 20 Yr 30 Y. 2/17/22 0.06 0.65 1.05 1.49 1.70 1.85 1.97 2.31 https://www.treasury.gOVESOUTce-center/data-chart-center/interest-rates/Pages/TextView.aspx?datz-yield U.S. Treasury Real Yield Curve DATE SYR 7 YR 10 YR 20 YR 30 YR 2/17/22 -1.02 -0.46 -0.04 0.19 https:www.treasury.gov.tesource-center'data-chart-center interest rates/Pages/TextView.aspx?data=realyield b. Calculate the Implied Forward nominal interest rate for a two-year maturity government bond, five years from Today (1+R2) = (1+oRs) (1+sfa)? then, solving for sf, 5f2 | (1 + OR)1/2 - 1 (1 + R) Note: In general, implied Forward interest rate for a N year maturity government bond, t years from Today: (1+0Rx+x)'+w71/1 fN= + -1 (1+OR) C. Please explain what factors and assumptions, other than the expectation theory, affect the shape of the yield curve and estimated implied forward rates. To Focus

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts