Question: Use 2021 tax forms ONLY Forms required: 1040, schedule 1, and Schedule B A manual capital gain tax calculation worksheet Assume taxpayer received the correct

Use 2021 tax forms ONLY

Forms required: 1040, schedule 1, and Schedule B

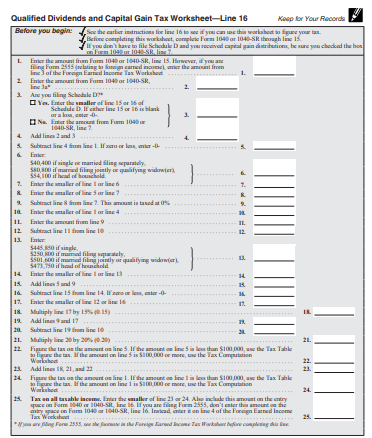

A manual capital gain tax calculation worksheet

Assume taxpayer received the correct amount of economic stimulus payments

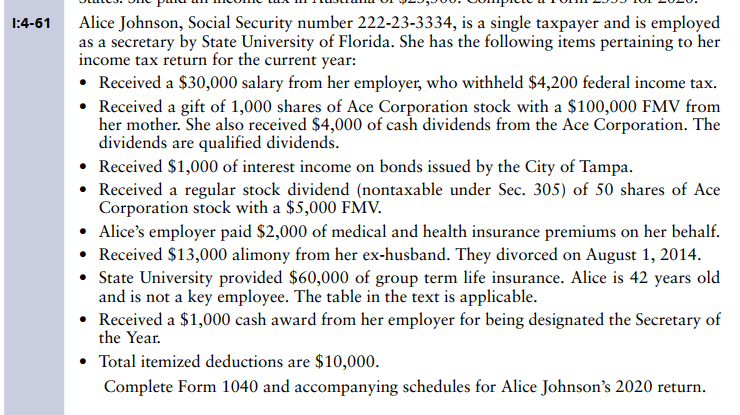

1:4-61 Alice Johnson, Social Security number 222-23-3334, is a single taxpayer and is employed as a secretary by State University of Florida. She has the following items pertaining to her income tax return for the current year: Received a $30,000 salary from her employer, who withheld $4,200 federal income tax. Received a gift of 1,000 shares of Ace Corporation stock with a $100,000 FMV from her mother. She also received $4,000 of cash dividends from the Ace Corporation. The dividends are qualified dividends. Received $1,000 of interest income on bonds issued by the City of Tampa. Received a regular stock dividend (nontaxable under Sec. 305) of 50 shares of Ace Corporation stock with a $5,000 FMV. Alice's employer paid $2,000 of medical and health insurance premiums on her behalf. Received $13,000 alimony from her ex-husband. They divorced on August 1, 2014. State University provided $60,000 of group term life insurance. Alice is 42 years old and is not a key employee. The table in the text is applicable. Received a $1,000 cash award from her employer for being designated the Secretary of the Year. Total itemized deductions are $10,000. Complete Form 1040 and accompanying schedules for Alice Johnson's 2020 return. Qualified Dividends and Capital Gain Tax Worksheet-Line 16 Keep for Your Records Before you begin to the care instructions fine line 16 to see if you want me the worksheets you as Before completing this worksheet, complete Form 109 or 1040-SR through line 15 you dont have in file Schedule and you received capital gain distribuce be sure you chedoad the bo Form 104 104 Slime 1 Enter the ancient from Form 1040 ar 1040-SR, lime 15. However, if you are filing Form 2555 ting bags carned income the meantime line of the Foreign Earned Income Tax Worksheet 2 Enthe amount om 1040 1040-SR 2. Are you filing Schedule Y. Fint the smaller of line 15 or of Schedule D. If the line 15 or 1bis blank araw, Na Enter the amount froen om 104 1040-SR, ling? 4 Add lines and Subtract line 4 from line. If we low S40,400 if single married filing separately S80. So iframed bing jantly alifying widowie 354.100 if head of henhold 2 Enter the smaller af line or line 6 & in the smaller of line 5 or line? 1 Subtract line from line. This amount is tudatos Find the mulier of line or line 4 11. Enthe amount fronline 11 12 Subtract line from line 10 } 9. 10 12 H 15. 11 544550 i single $250 oil med fingely SSOIGOO ifmum filing jantly or qualifying widow S473.780 if headed buched 14 Enthe aller fline on line 13 15. Add lines and 16 Subtract lines from line 14. lfmol- 17. Ein the smaller af line 12 or line 16 12 Multiply line 17 by 15(0.15) 19 Add lines and 17 21 Subtract line 19 from line 10 21 21. Multiply line 2 by 20% (0.20) Figure the tax as the amount online. If the amount online is les than 100,000, the Tax Table teligere the tax the amount online is $100.000 more, the Tax Computation Warlahest 23 Add lines 1, 21 and 22 24 Fire the tax on the amount online. If the amount online in than $100.000, the Tax Table to figure the ta theme is 100.000, the Tax Computation Warlohet 24 Tas en all taxable income. Enter the wall of line 23 24. Ale include the amount on the arty are Form 1040 1040-SIL line 16. If you are filing Form255, dren't enter the amount as the any space for 1040 ar 1040-SR, line 16. Inwicadcnter on line 4 of the Foreign Earned Income Tax Worksheet Ang For Tar iratthark 21. 22 23. 24. 1:4-61 Alice Johnson, Social Security number 222-23-3334, is a single taxpayer and is employed as a secretary by State University of Florida. She has the following items pertaining to her income tax return for the current year: Received a $30,000 salary from her employer, who withheld $4,200 federal income tax. Received a gift of 1,000 shares of Ace Corporation stock with a $100,000 FMV from her mother. She also received $4,000 of cash dividends from the Ace Corporation. The dividends are qualified dividends. Received $1,000 of interest income on bonds issued by the City of Tampa. Received a regular stock dividend (nontaxable under Sec. 305) of 50 shares of Ace Corporation stock with a $5,000 FMV. Alice's employer paid $2,000 of medical and health insurance premiums on her behalf. Received $13,000 alimony from her ex-husband. They divorced on August 1, 2014. State University provided $60,000 of group term life insurance. Alice is 42 years old and is not a key employee. The table in the text is applicable. Received a $1,000 cash award from her employer for being designated the Secretary of the Year. Total itemized deductions are $10,000. Complete Form 1040 and accompanying schedules for Alice Johnson's 2020 return. Qualified Dividends and Capital Gain Tax Worksheet-Line 16 Keep for Your Records Before you begin to the care instructions fine line 16 to see if you want me the worksheets you as Before completing this worksheet, complete Form 109 or 1040-SR through line 15 you dont have in file Schedule and you received capital gain distribuce be sure you chedoad the bo Form 104 104 Slime 1 Enter the ancient from Form 1040 ar 1040-SR, lime 15. However, if you are filing Form 2555 ting bags carned income the meantime line of the Foreign Earned Income Tax Worksheet 2 Enthe amount om 1040 1040-SR 2. Are you filing Schedule Y. Fint the smaller of line 15 or of Schedule D. If the line 15 or 1bis blank araw, Na Enter the amount froen om 104 1040-SR, ling? 4 Add lines and Subtract line 4 from line. If we low S40,400 if single married filing separately S80. So iframed bing jantly alifying widowie 354.100 if head of henhold 2 Enter the smaller af line or line 6 & in the smaller of line 5 or line? 1 Subtract line from line. This amount is tudatos Find the mulier of line or line 4 11. Enthe amount fronline 11 12 Subtract line from line 10 } 9. 10 12 H 15. 11 544550 i single $250 oil med fingely SSOIGOO ifmum filing jantly or qualifying widow S473.780 if headed buched 14 Enthe aller fline on line 13 15. Add lines and 16 Subtract lines from line 14. lfmol- 17. Ein the smaller af line 12 or line 16 12 Multiply line 17 by 15(0.15) 19 Add lines and 17 21 Subtract line 19 from line 10 21 21. Multiply line 2 by 20% (0.20) Figure the tax as the amount online. If the amount online is les than 100,000, the Tax Table teligere the tax the amount online is $100.000 more, the Tax Computation Warlahest 23 Add lines 1, 21 and 22 24 Fire the tax on the amount online. If the amount online in than $100.000, the Tax Table to figure the ta theme is 100.000, the Tax Computation Warlohet 24 Tas en all taxable income. Enter the wall of line 23 24. Ale include the amount on the arty are Form 1040 1040-SIL line 16. If you are filing Form255, dren't enter the amount as the any space for 1040 ar 1040-SR, line 16. Inwicadcnter on line 4 of the Foreign Earned Income Tax Worksheet Ang For Tar iratthark 21. 22 23. 24

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts