Question: USE 4 DECIMAL PLACES (rounded)for intermediate calculations and round your final answer to two decimal places. For amounts involving dollars and cents, use two decimal

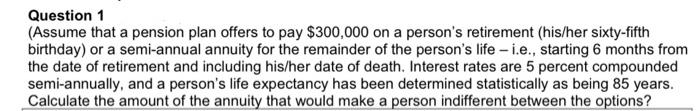

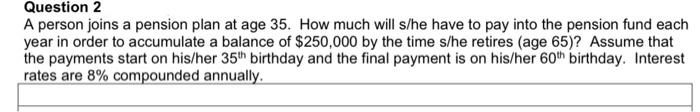

Question 1 (Assume that a pension plan offers to pay $300,000 on a person's retirement (his/her sixty-fifth birthday) or a semi-annual annuity for the remainder of the person's life - i.e., starting 6 months from the date of retirement and including his/her date of death. Interest rates are 5 percent compounded semi-annually, and a person's life expectancy has been determined statistically as being 85 years. Calculate the amount of the annuity that would make a person indifferent between the options? A person joins a pension plan at age 35 . How much will s/he have to pay into the pension fund each year in order to accumulate a balance of $250,000 by the time s/he retires (age 65)? Assume that the payments start on his/her 35th birthday and the final payment is on his/her 60th birthday. Interest rates are 8% compounded annually

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts