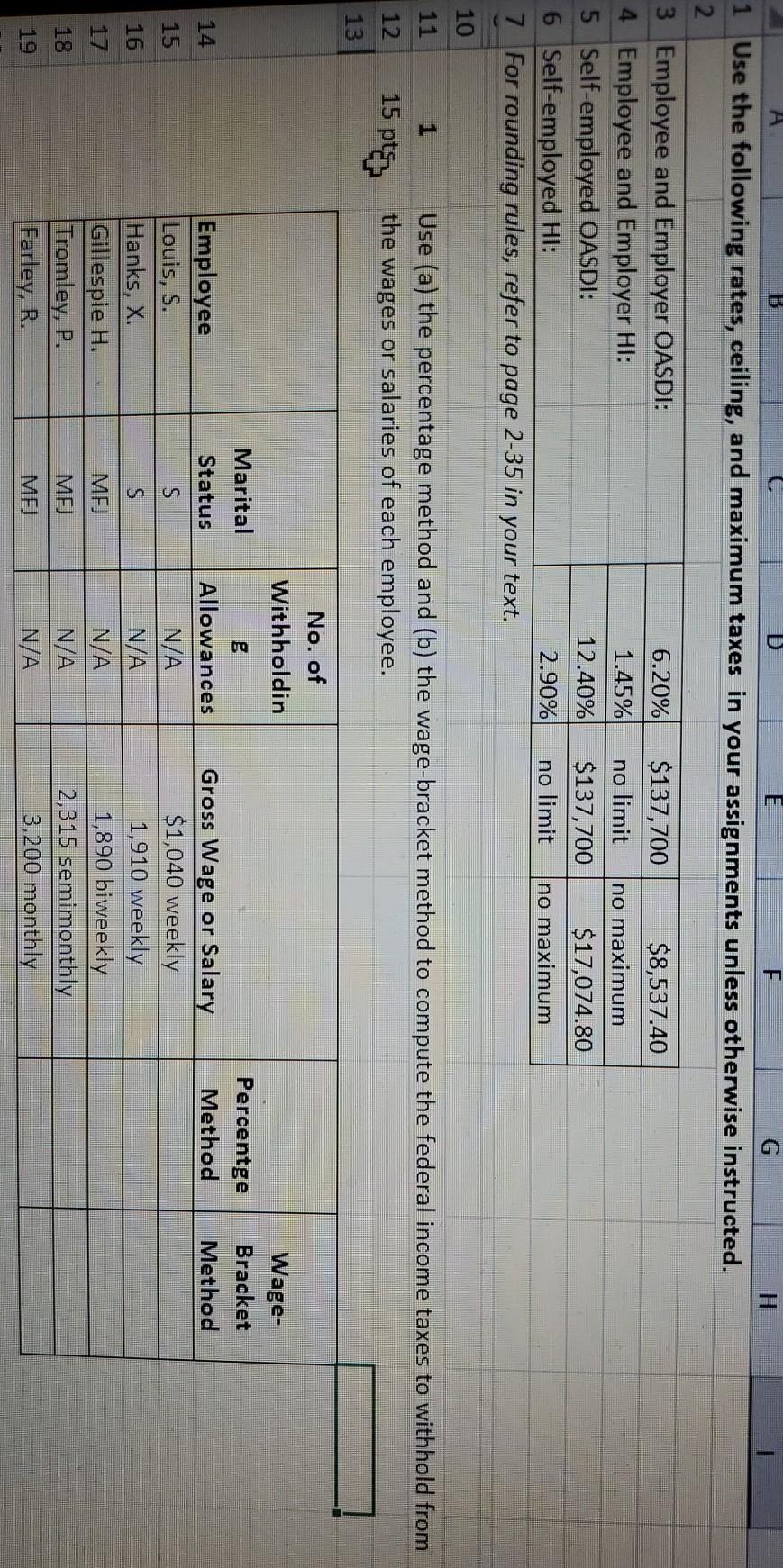

Question: Use (a) the percentage method and (b) the wage bracket method to compute the federal income taxes to withhold from the wages or salaries of

Use (a) the percentage method and (b) the wage bracket method to compute the federal income taxes to withhold from the wages or salaries of each employee.

F 1 Use the following rates, ceiling, and maximum taxes in your assignments unless otherwise instructed. 2. 3 Employee and Employer OASDI: 6.20% $137,700 $8,537.40 4 Employee and Employer HI: 1.45% no limit no maximum 5 Self-employed OASDI: 12.40% $137,700 $17,074.80 6 Self-employed HI: 2.90% no limit no maximum 7 For rounding rules, refer to page 2-35 in your text. 10 11 Use (a) the percentage method and (b) the wage-bracket method to compute the federal income taxes to withhold from the wages or salaries of each employee. 12 15 ptt 13 No. of Withholdin Marital Percentge Method Wage- Bracket Method 14 Status 15 S 16 S Employee Louis, S. Hanks, X. Gillespie H. Tromley, P. Farley, R. Allowances N/A N/A N/A N/A N/A Gross Wage or Salary $1,040 weekly 1,910 weekly 1,890 biweekly 2,315 semimonthly 3,200 monthly MEJ ME) 18 19 MEJ F 1 Use the following rates, ceiling, and maximum taxes in your assignments unless otherwise instructed. 2. 3 Employee and Employer OASDI: 6.20% $137,700 $8,537.40 4 Employee and Employer HI: 1.45% no limit no maximum 5 Self-employed OASDI: 12.40% $137,700 $17,074.80 6 Self-employed HI: 2.90% no limit no maximum 7 For rounding rules, refer to page 2-35 in your text. 10 11 Use (a) the percentage method and (b) the wage-bracket method to compute the federal income taxes to withhold from the wages or salaries of each employee. 12 15 ptt 13 No. of Withholdin Marital Percentge Method Wage- Bracket Method 14 Status 15 S 16 S Employee Louis, S. Hanks, X. Gillespie H. Tromley, P. Farley, R. Allowances N/A N/A N/A N/A N/A Gross Wage or Salary $1,040 weekly 1,910 weekly 1,890 biweekly 2,315 semimonthly 3,200 monthly MEJ ME) 18 19 MEJ

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts