Question: Use activity-based costing! Mango Inc. has long suspected that there is something wrong with their costing system. The sales were increasing, but the profit remained

Use activity-based costing!

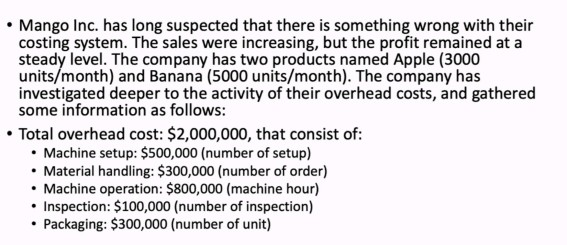

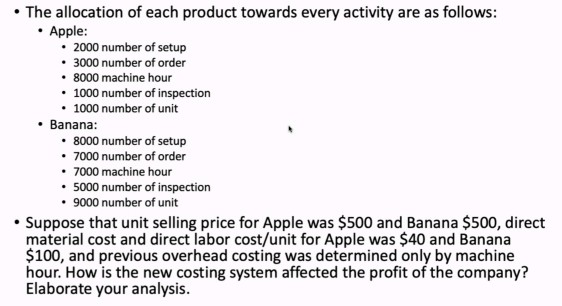

Mango Inc. has long suspected that there is something wrong with their costing system. The sales were increasing, but the profit remained at a steady level. The company has two products named Apple (3000 units/month) and Banana (5000 units/month). The company has investigated deeper to the activity of their overhead costs, and gathered some information as follows: Total overhead cost: $2,000,000, that consist of: Machine setup: $500,000 (number of setup) . Material handling: $300,000 (number of order) Machine operation: $800,000 (machine hour) Inspection: $100,000 (number of inspection) Packaging: $300,000 (number of unit) The allocation of each product towards every activity are as follows: Apple: 2000 number of setup 3000 number of order 8000 machine hour 1000 number of inspection 1000 number of unit . Banana: 8000 number of setup 7000 number of order 7000 machine hour 5000 number of inspection 9000 number of unit Suppose that unit selling price for Apple was $500 and Banana $500, direct material cost and direct labor cost/unit for Apple was $40 and Banana $100, and previous overhead costing was determined only by machine hour. How is the new costing system affected the profit of the company? Elaborate your analysis

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts