Question: Use all the information provided to answer question 1 - 12 Figure 1 MicroDrive's Financial Statements in most recent two years Figure 2 Inputs for

Use all the information provided to answer question 1 - 12

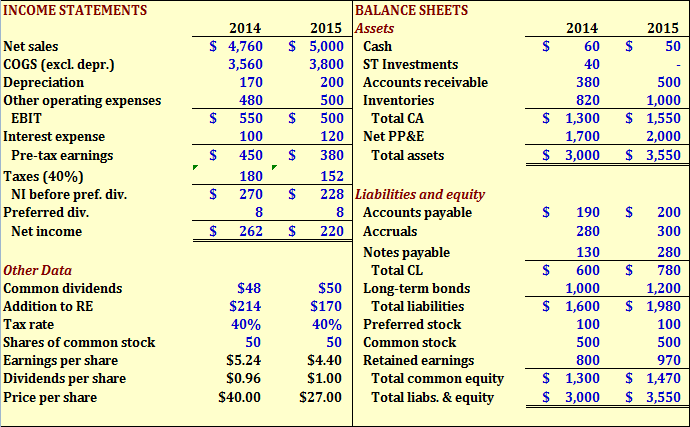

Figure 1 MicroDrive's Financial Statements in most recent two years

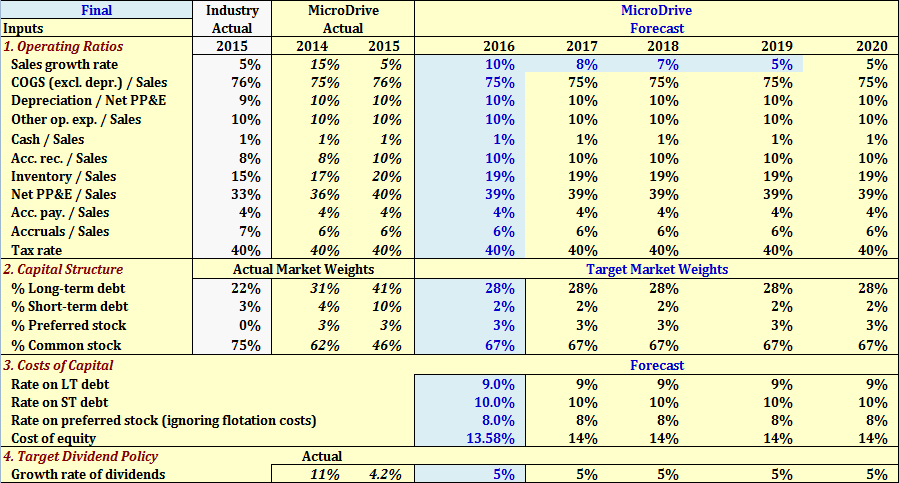

Figure 2 Inputs for the Selected Scenarios

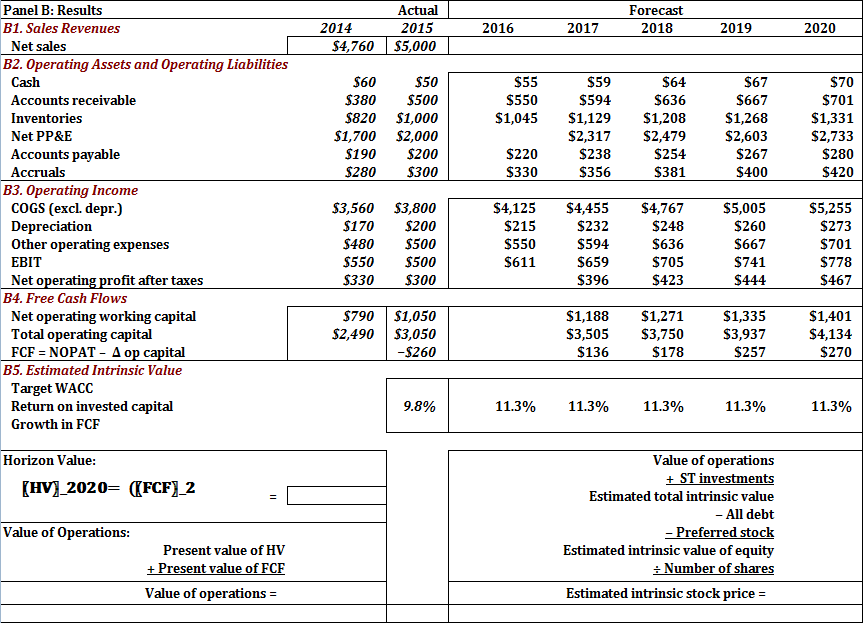

Figure 3 Projections and Valuation

Figure 2 outlines the assumptions and forecasts. The model suggests that MicroDrive's sales will increase by 10%, 8%, 7%, 5%, and 5% in the next 5 years. And the sales will continue to grow at 5% after 2020 perpetually. All the ratios represented figure 2 remain the same as those in 2015 except for COGS/Sales, Inventory/Sales, and Net PP&E/Sales ratios. Figure 2 indicates the company will successfully improve the efficiency of its operation by lowering COGS, Inventory, and Net PP&E relative to sales. Free cash flows experience non-constant growth rates from 2016 to 2020. Eventually, the growth rate of free cash flow will stay at 5% after 2020. With all the information provided, fill in the blanks in Figure 3. (Refer to the notes for formulas.)

1. Sales in 2016, 2017, 2018, 2019, and 2020

2. Net PP&E in 2016

3. Net operating profits after taxes in 2016

4. Net operating working capital in 2016

5. Total operating capital in 2016

6. Free cash flow in 2016

7. What is the target weighted average cost of capital (WACC)?

8. What is the horizon value 2020 (HV2020)?

9. What is the present value of HV2020?

10. What is the present value of free cash flows from 2016 to 2020?

11. What is the value of operations?

12. What is the estimated intrinsic stock price?

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts