Question: USE ANNUAL WORTH Analysis Two mutually exclusive design alternatives are being considered. The estimated cash flows for each alternative are given in the following table

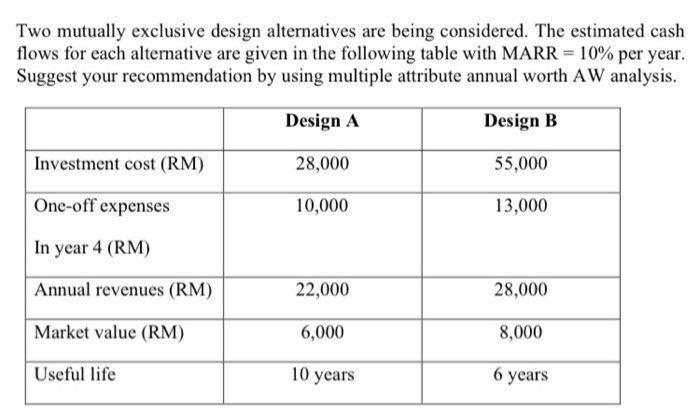

Two mutually exclusive design alternatives are being considered. The estimated cash flows for each alternative are given in the following table with MARR = 10% per year. Suggest your recommendation by using multiple attribute annual worth AW analysis. Design A Design B Investment cost (RM) 28,000 55,000 One-off expenses 10,000 13,000 In year 4 (RM) Annual revenues (RM) 22,000 28,000 Market value (RM) 6,000 8,000 Useful life 10 years 6 years

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts