Question: Use Answer Report and Sensitivity Report to answer the following question. The Scenario The company is considering three nut mixes for inclusion in the new

Use Answer Report and Sensitivity Report to answer the following question.

Use Answer Report and Sensitivity Report to answer the following question.

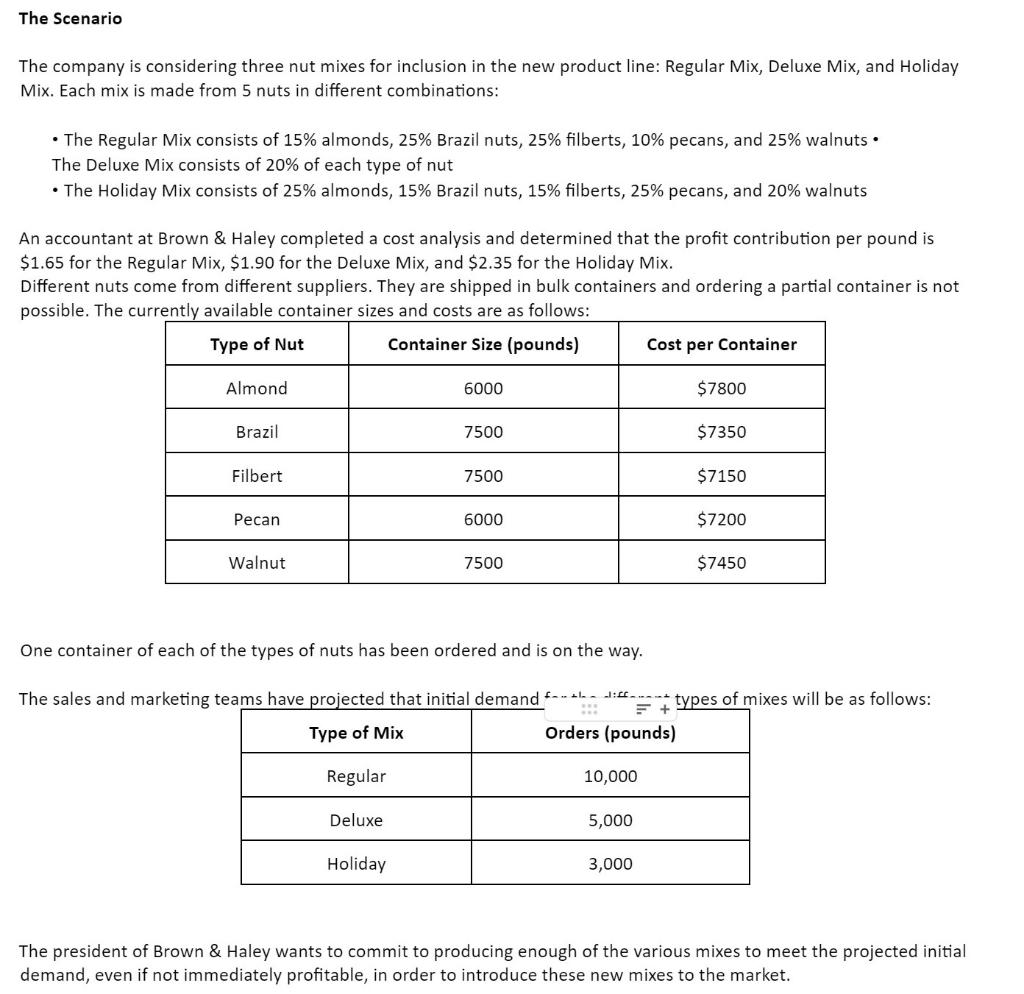

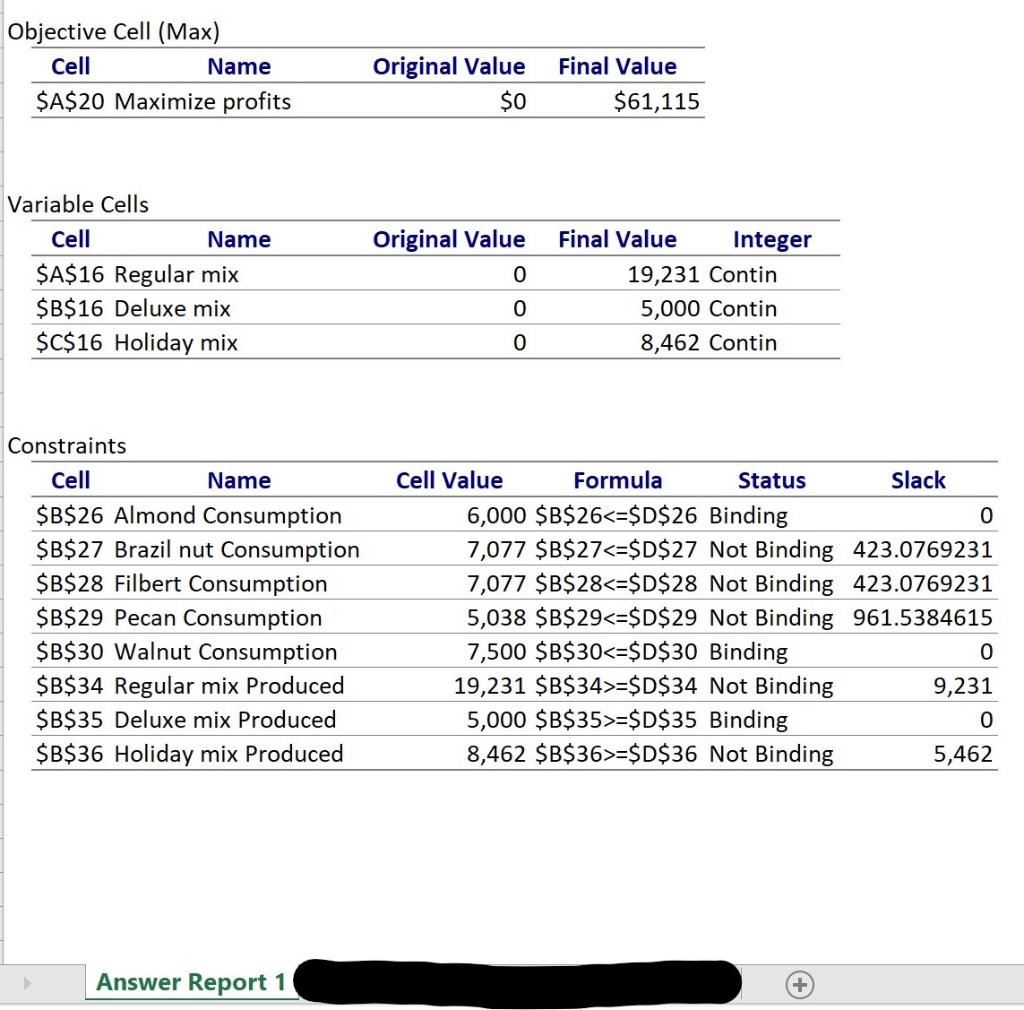

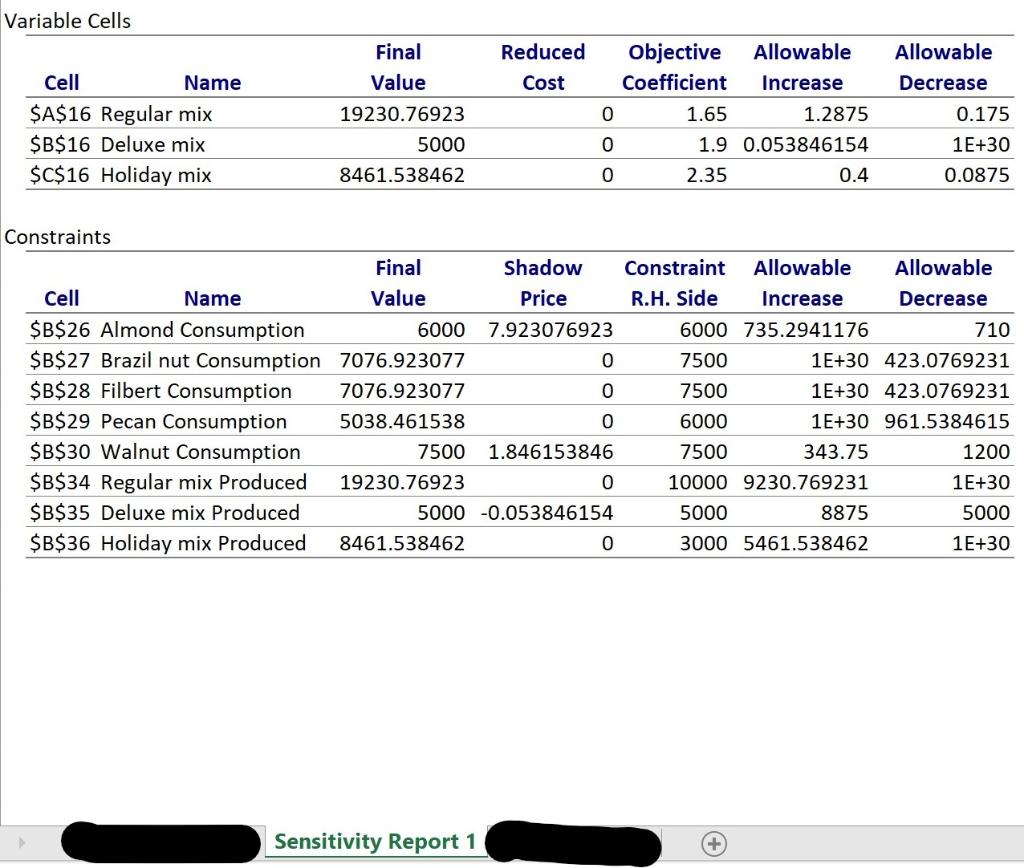

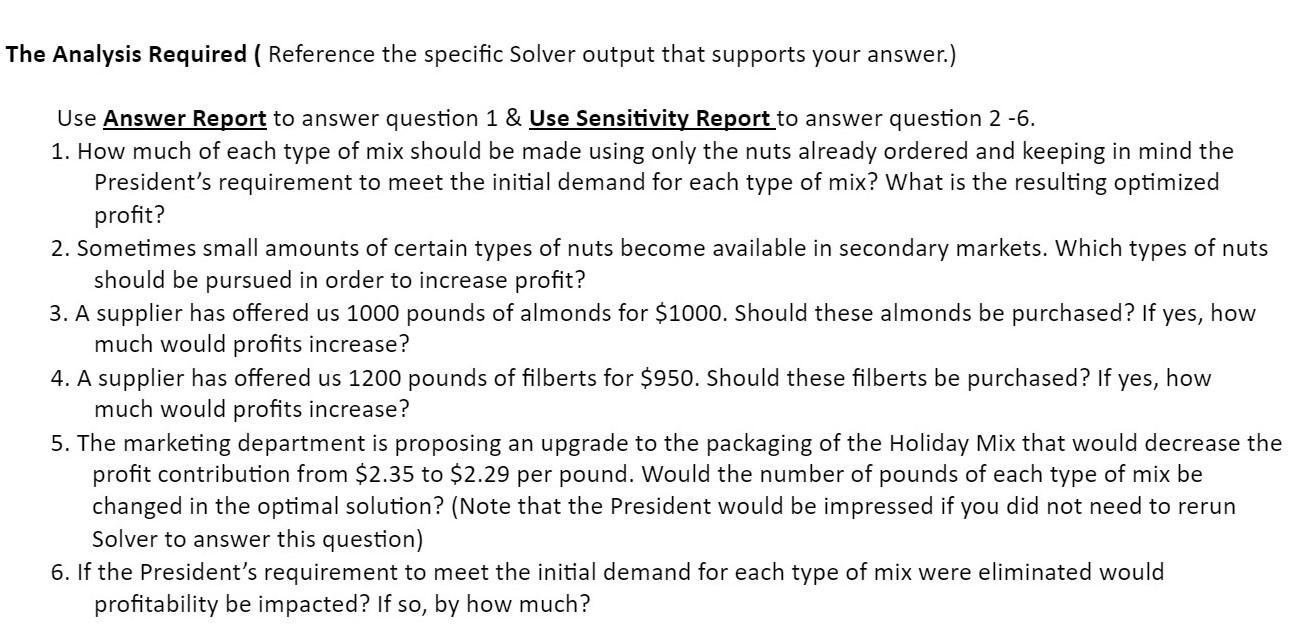

The Scenario The company is considering three nut mixes for inclusion in the new product line: Regular Mix, Deluxe Mix, and Holiday Mix. Each mix is made from 5 nuts in different combinations: The Regular Mix consists of 15% almonds, 25% Brazil nuts, 25% filberts, 10% pecans, and 25% walnuts. The Deluxe Mix consists of 20% of each type of nut The Holiday Mix consists of 25% almonds, 15% Brazil nuts, 15% filberts, 25% pecans, and 20% walnuts An accountant at Brown & Haley completed a cost analysis and determined that the profit contribution per pound is $1.65 for the Regular Mix, $1.90 for the Deluxe Mix, and $2.35 for the Holiday Mix. Different nuts come from different suppliers. They are shipped in bulk containers and ordering a partial container is not possible. The currently available container sizes and costs are as follows: Type of Nut Container Size (pounds) Cost per Container Almond 6000 $7800 Brazil 7500 $7350 Filbert 7500 $7150 Pecan 6000 $7200 Walnut 7500 $7450 One container of each of the types of nuts has been ordered and is on the way. The sales and marketing teams have projected that initial demand fondla =+ types of mixes will be as follows: Type of Mix Orders (pounds) Regular 10,000 Deluxe 5,000 Holiday 3,000 The president of Brown & Haley wants to commit to producing enough of the various mixes to meet the projected initial demand, even if not immediately profitable, in order to introduce these new mixes to the market. Objective Cell (Max) Cell Name $A$20 Maximize profits Original Value $0 Final Value $61,115 Variable Cells Cell Name $A$16 Regular mix $B$16 Deluxe mix $C$16 Holiday mix Original Value 0 Final Value Integer 19,231 Contin 5,000 Contin 8,462 Contin 0 0 Constraints Cell Name $B$26 Almond Consumption $B$27 Brazil nut Consumption $B$28 Filbert Consumption $B$29 Pecan Consumption $B$30 Walnut Consumption $B$34 Regular mix Produced $B$35 Deluxe mix Produced $B$36 Holiday mix Produced Cell Value Formula Status Slack 6,000 $B$26=$D$34 Not Binding 9,231 5,000 $B$35>=$D$35 Binding 0 8,462 $B$36>=$D$36 Not Binding 5,462 Answer Report 1 Variable Cells Final Reduced Allowable Cost Decrease Cell Name $A$16 Regular mix $B$16 Deluxe mix $C$16 Holiday mix Value 19230.76923 5000 8461.538462 Objective Allowable Coefficient Increase 0 1.65 1.2875 0 1.9 0.053846154 0 2.35 0.4 0.175 1E+30 0.0875 Constraints Final Shadow Constraint Allowable Allowable Cell Name Value Price R.H. Side Increase Decrease $B$26 Almond Consumption 6000 7.923076923 6000 735.2941176 710 $B$27 Brazil nut Consumption 7076.923077 0 7500 1E+30 423.0769231 $B$28 Filbert Consumption 7076.923077 0 7500 1E+30 423.0769231 $B$29 Pecan Consumption 5038.461538 0 6000 1E+30 961.5384615 $B$30 Walnut Consumption 7500 1.846153846 7500 343.75 1200 $B$34 Regular mix Produced 19230.76923 0 10000 9230.769231 1E+30 $B$35 Deluxe mix Produced 5000 -0.053846154 5000 8875 5000 $B$36 Holiday mix Produced 8461.538462 0 3000 5461.538462 1E+30 Sensitivity Report 1 The Analysis Required ( Reference the specific Solver output that supports your answer.) Use Answer Report to answer question 1 & Use Sensitivity Report to answer question 2-6. 1. How much of each type of mix should be made using only the nuts already ordered and keeping in mind the President's requirement to meet the initial demand for each type of mix? What is the resulting optimized profit? 2. Sometimes small amounts of certain types of nuts become available in secondary markets. Which types of nuts should be pursued in order to increase profit? 3. A supplier has offered us 1000 pounds of almonds for $1000. Should these almonds be purchased? If yes, how much would profits increase? 4. A supplier has offered us 1200 pounds of filberts for $950. Should these filberts be purchased? If yes, how much would profits increase? 5. The marketing department is proposing an upgrade to the packaging of the Holiday Mix that would decrease the profit contribution from $2.35 to $2.29 per pound. Would the number of pounds of each type of mix be changed in the optimal solution? (Note that the President would be impressed if you did not need to rerun Solver to answer this question) 6. If the President's requirement to meet the initial demand for each type of mix were eliminated would profitability be impacted? If so, by how much

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts