Question: Use Appendix A - Candidate Projects to answer Evaluation Criteria Answer the Evaluation Criteria and answer each Disposition in Appendix A - Candidate Projects Exercise

Use Appendix A - Candidate Projects to answer Evaluation Criteria

Answer the Evaluation Criteria and answer each Disposition in Appendix A - Candidate Projects

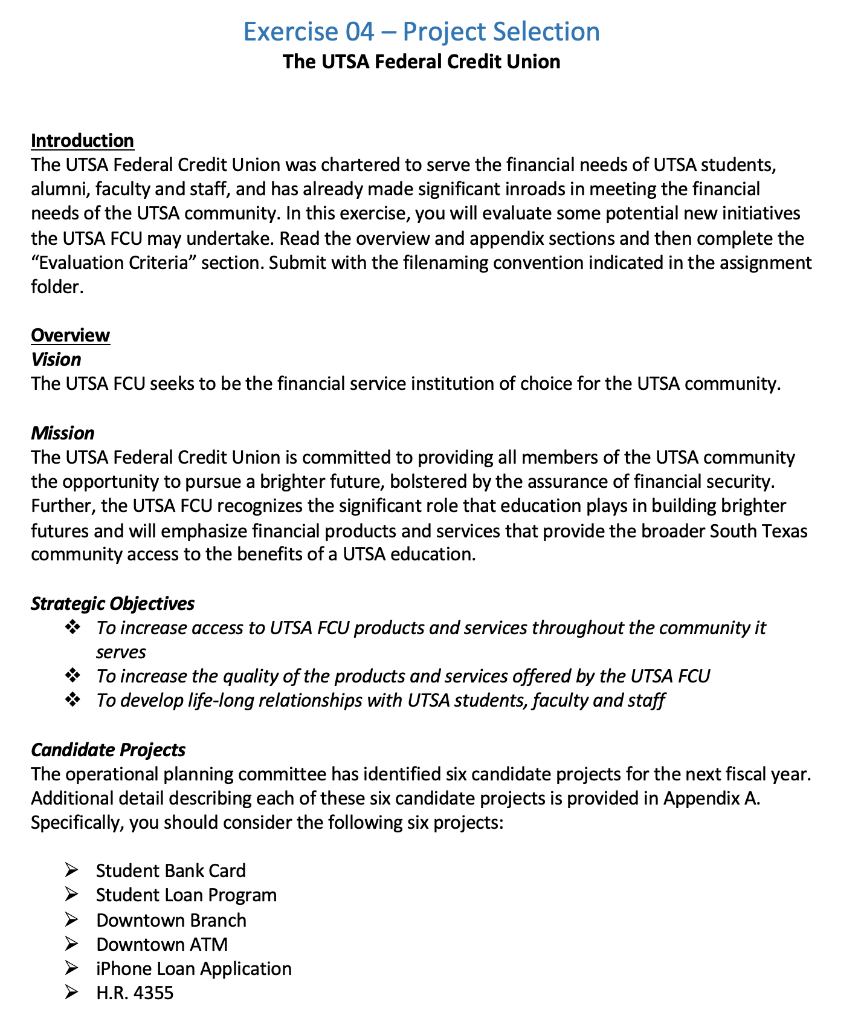

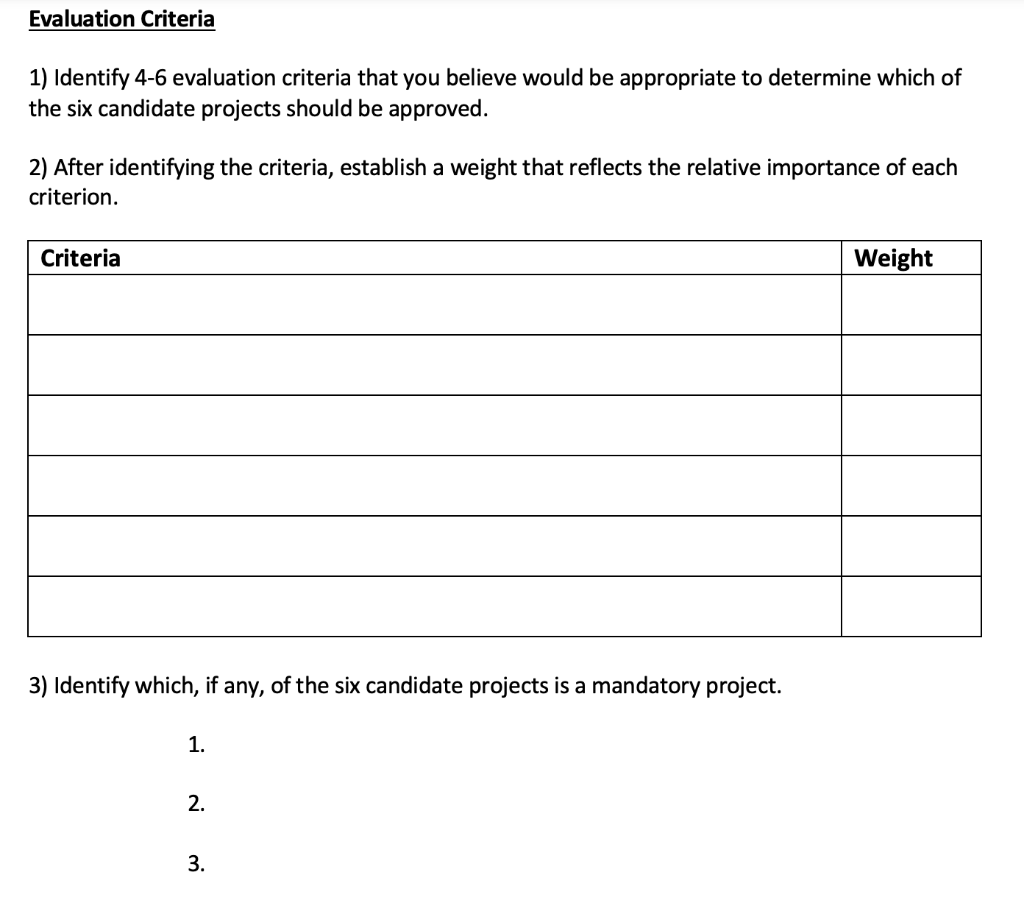

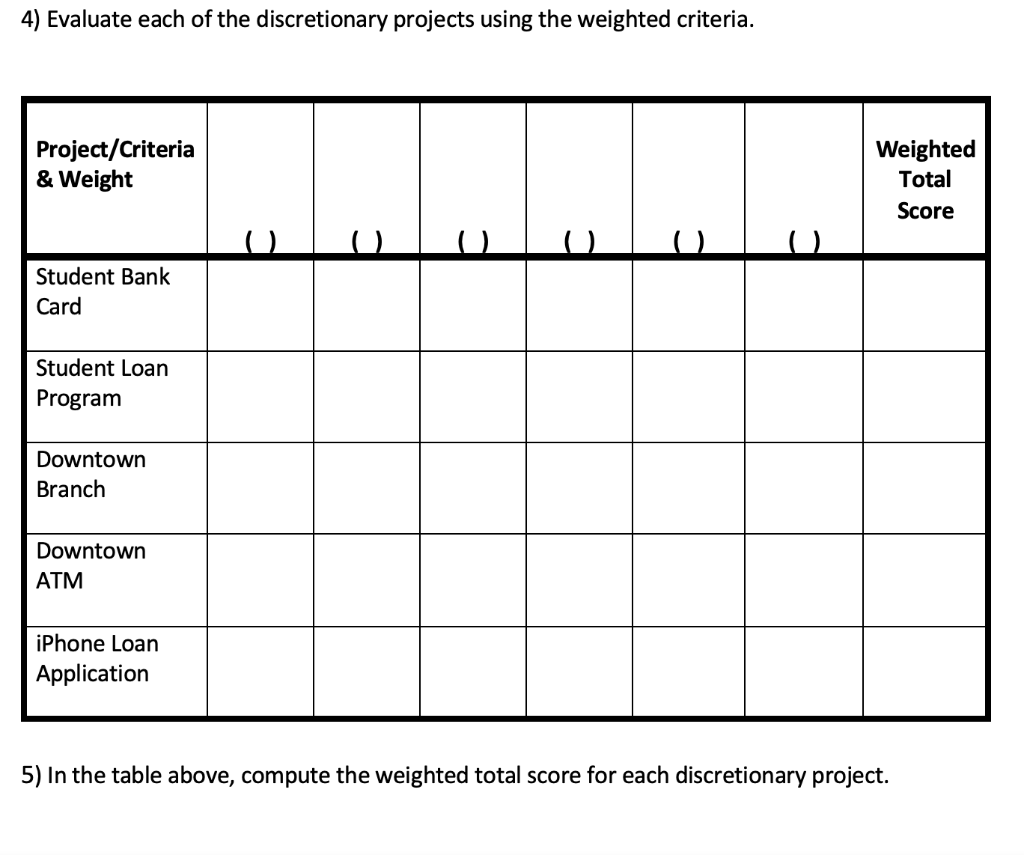

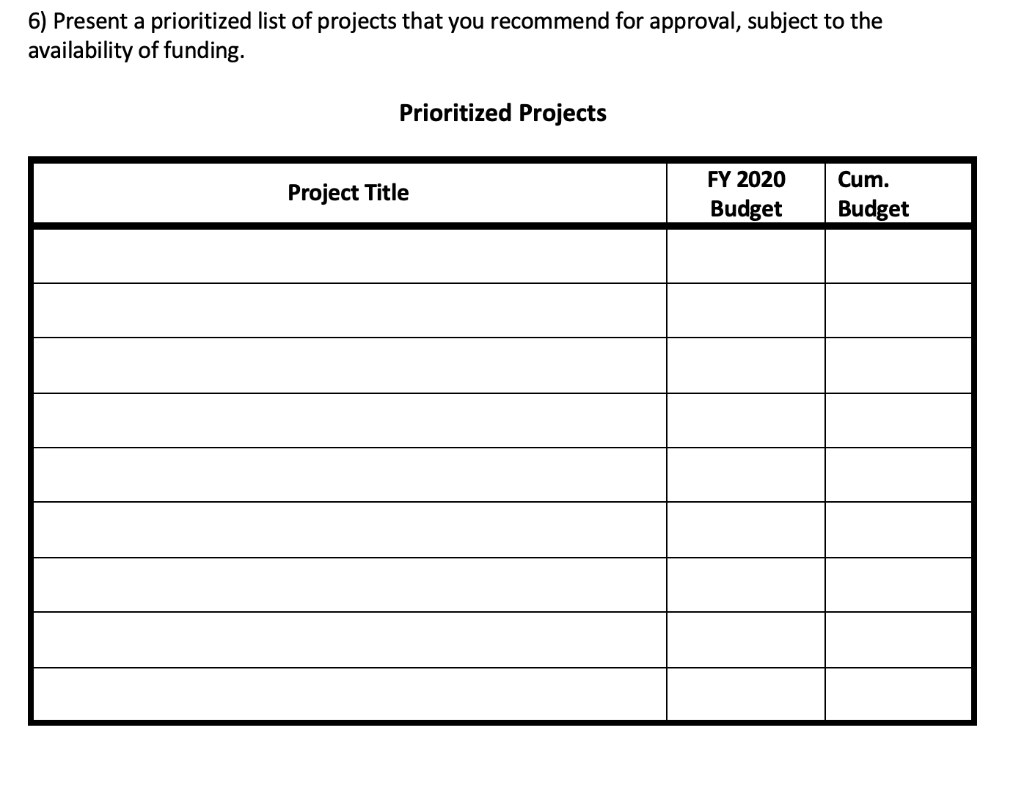

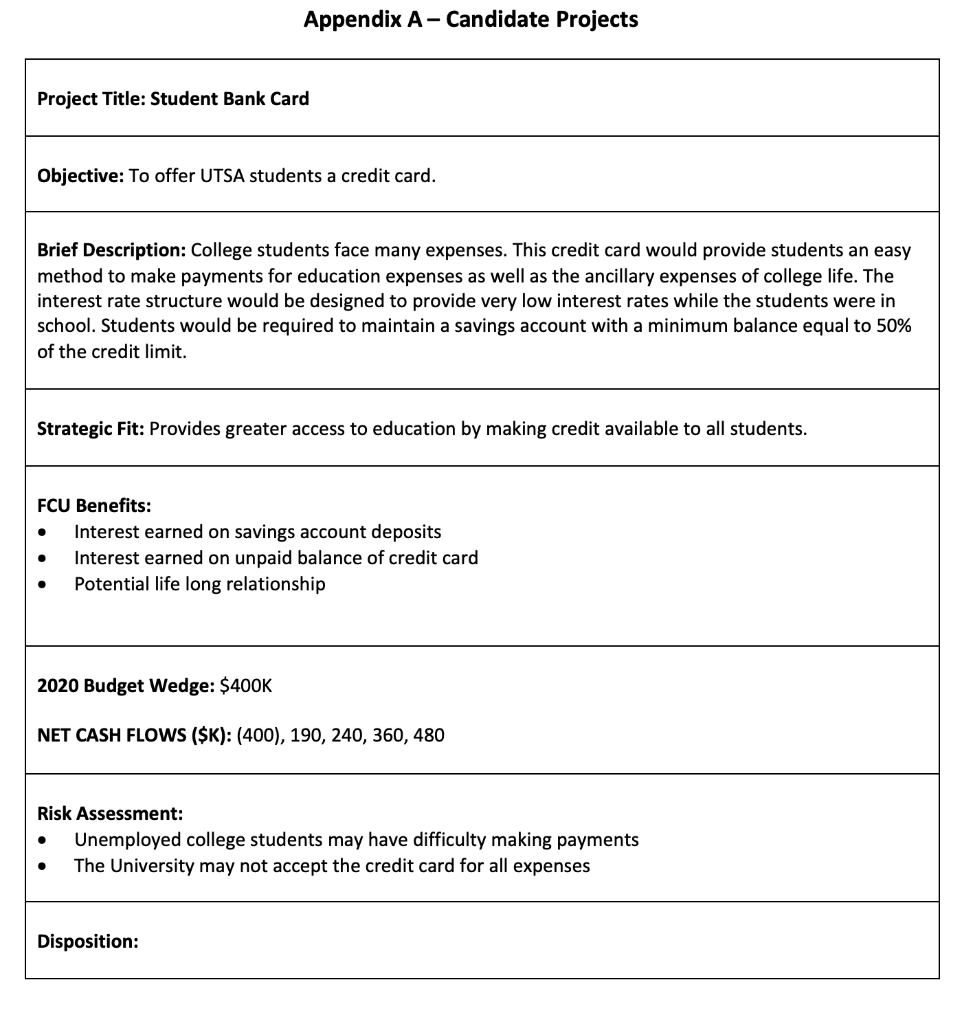

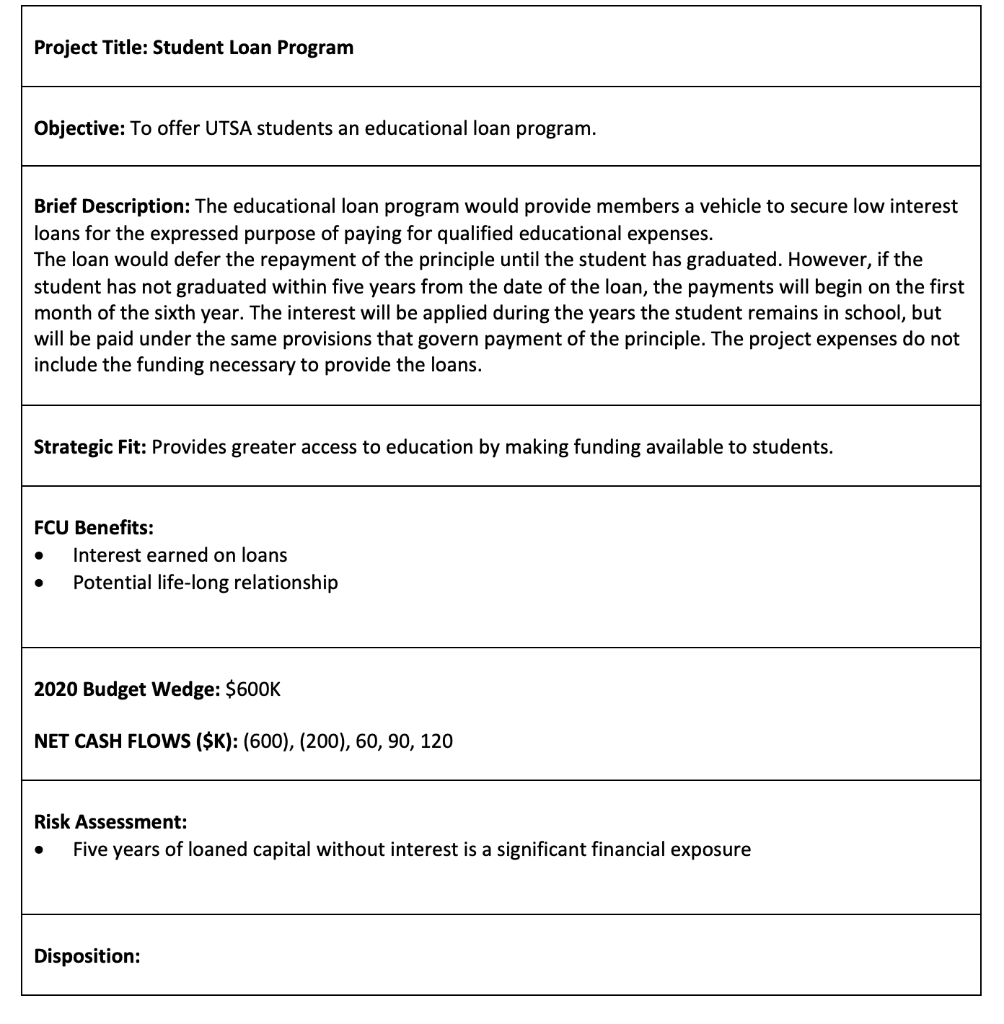

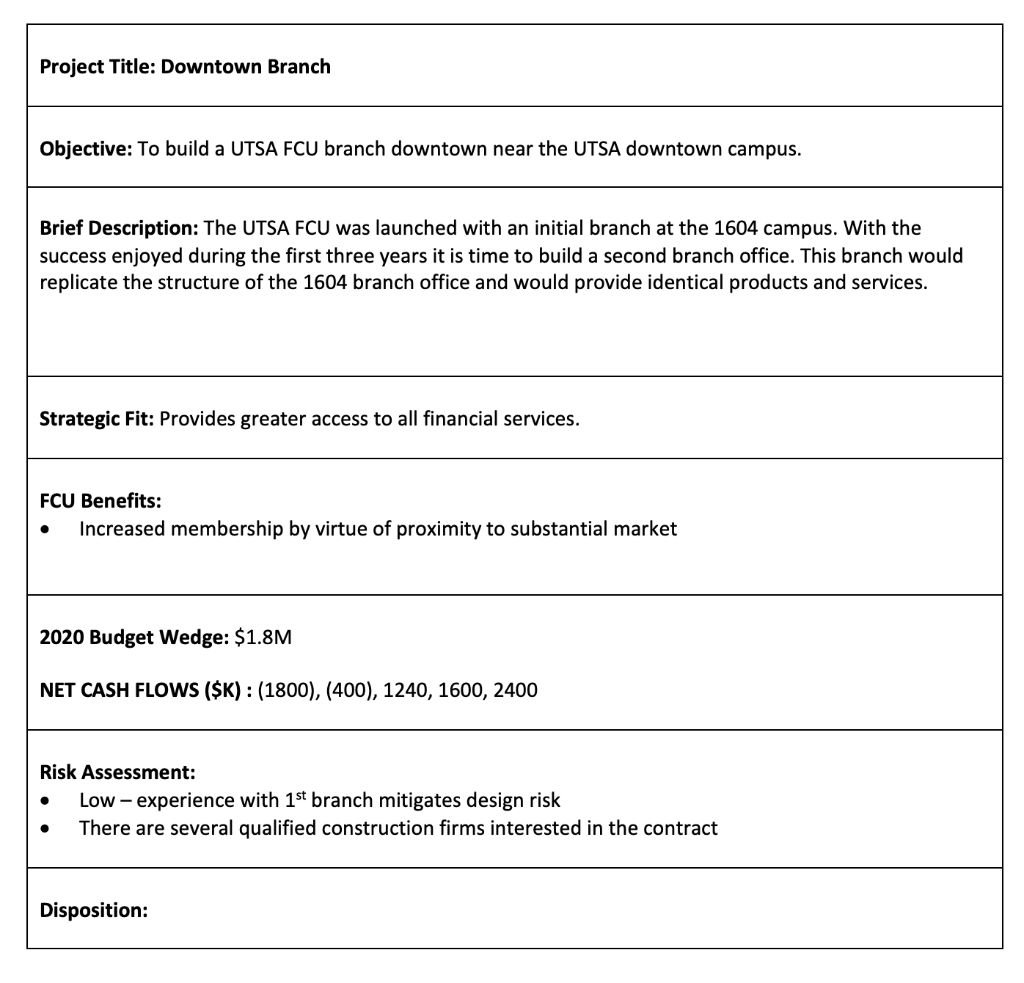

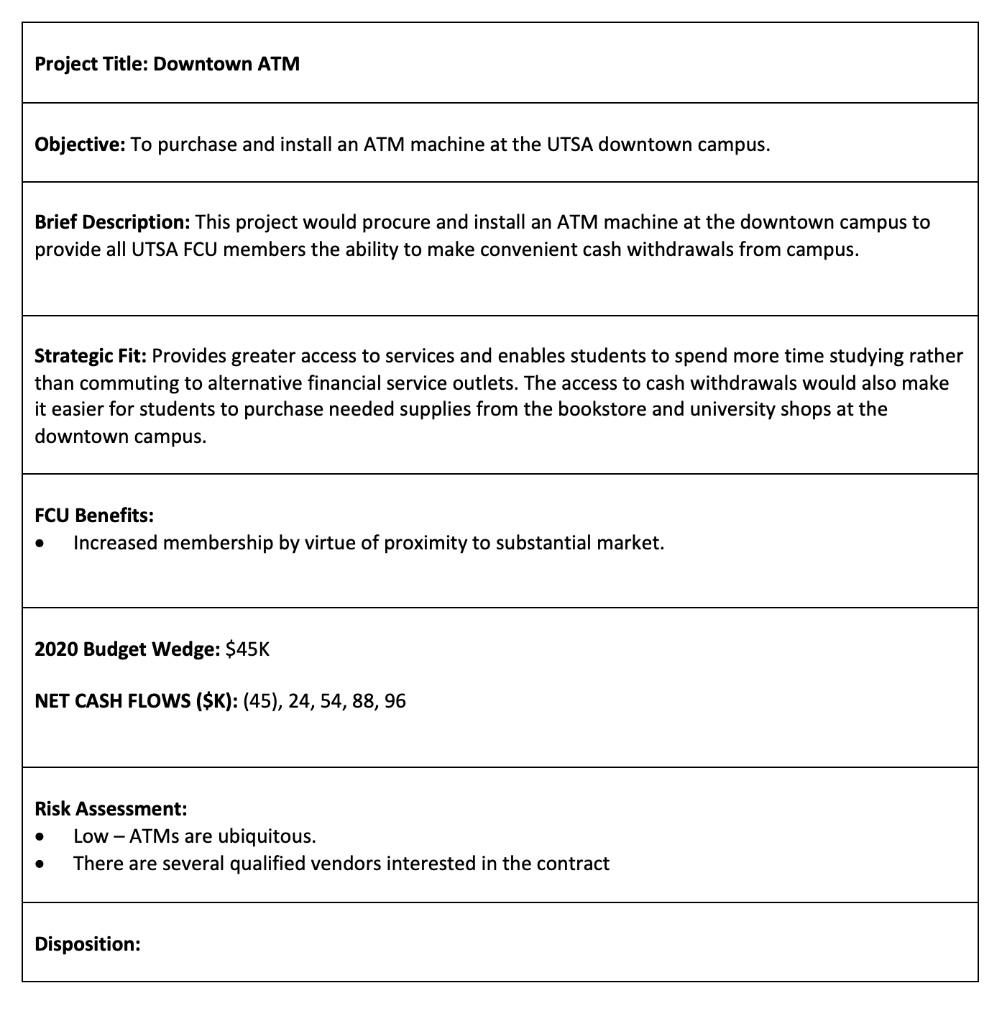

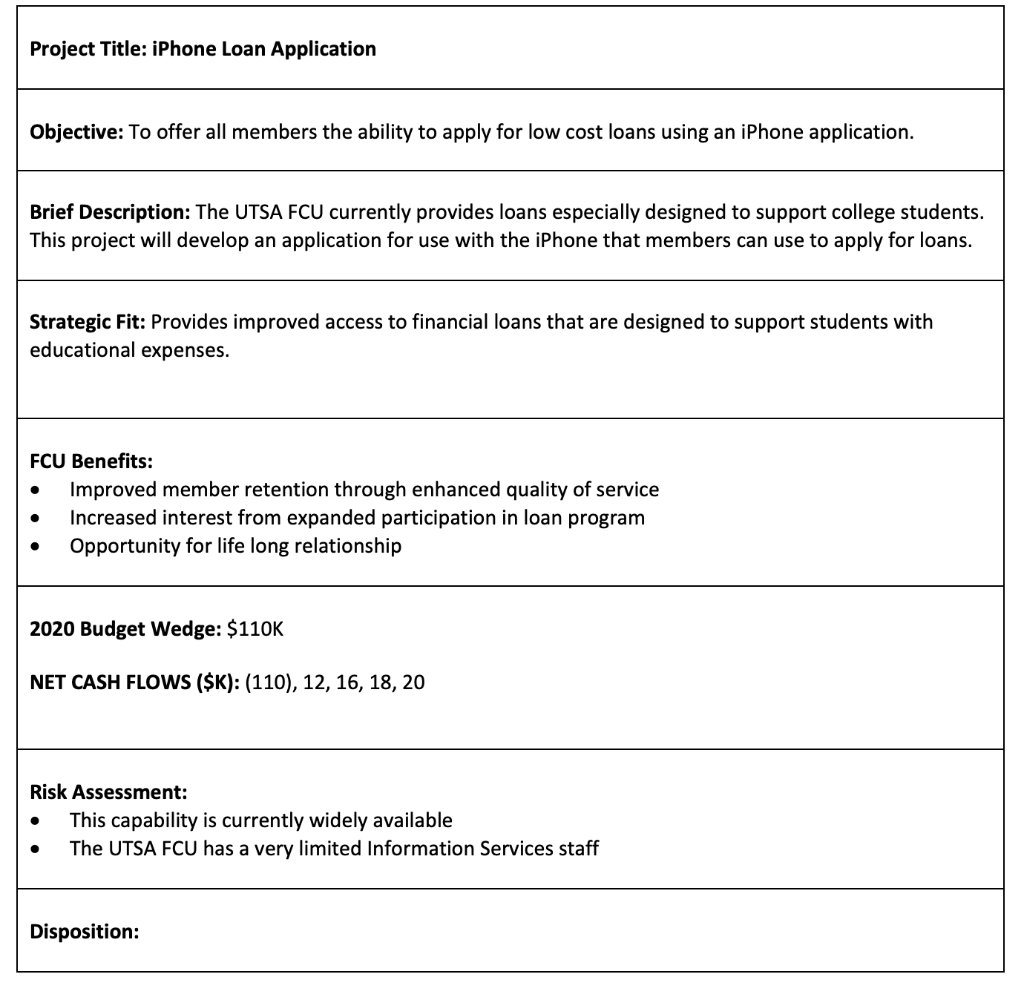

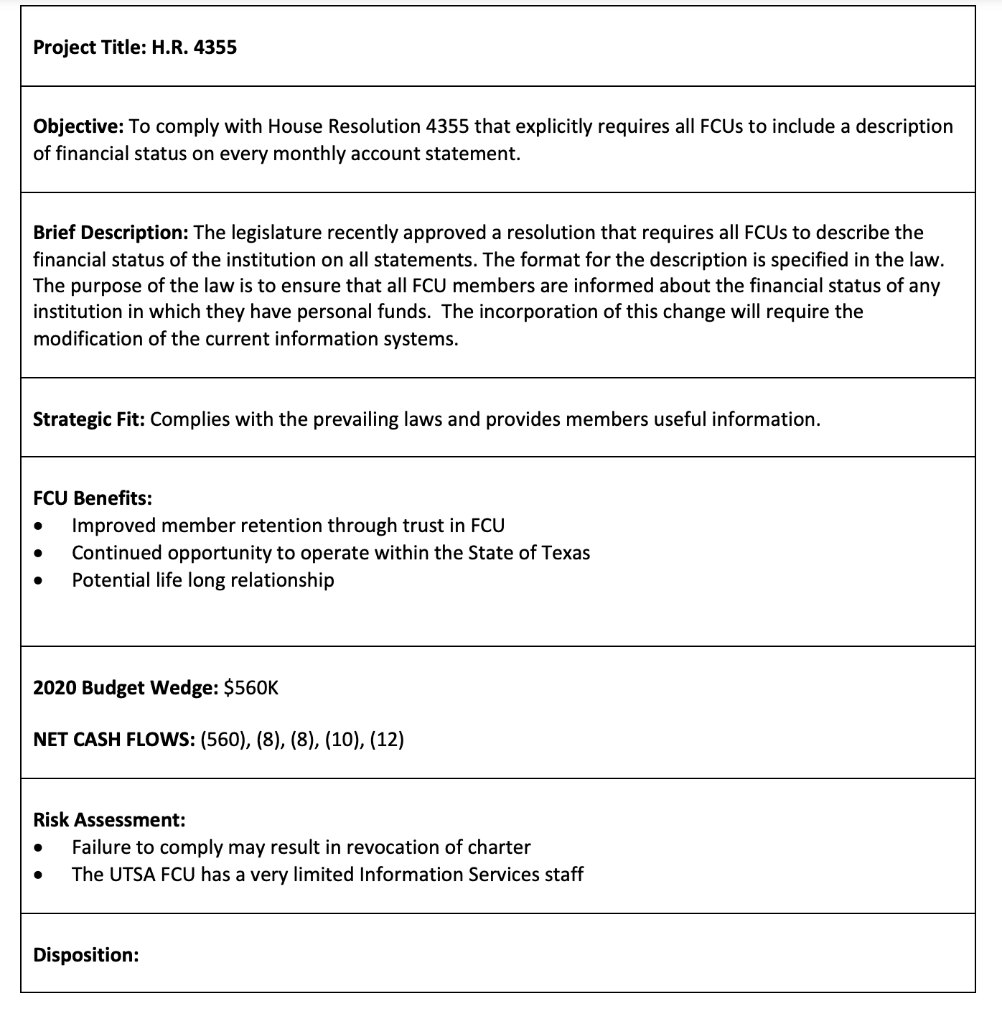

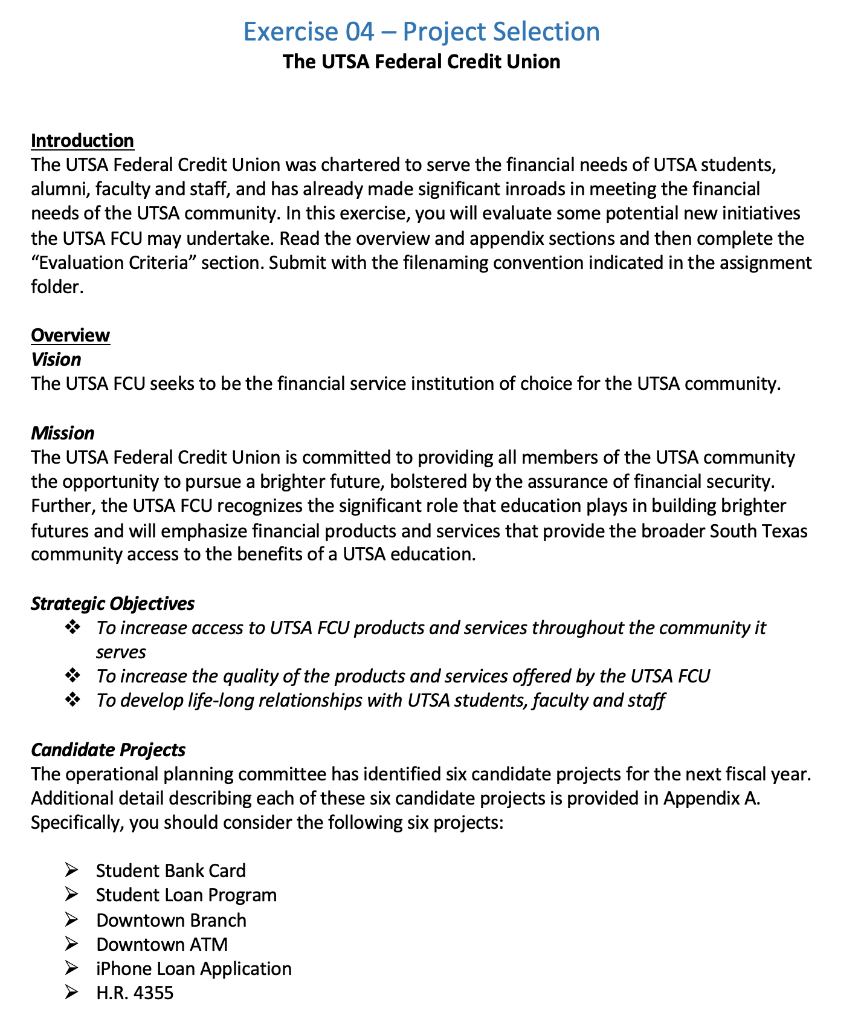

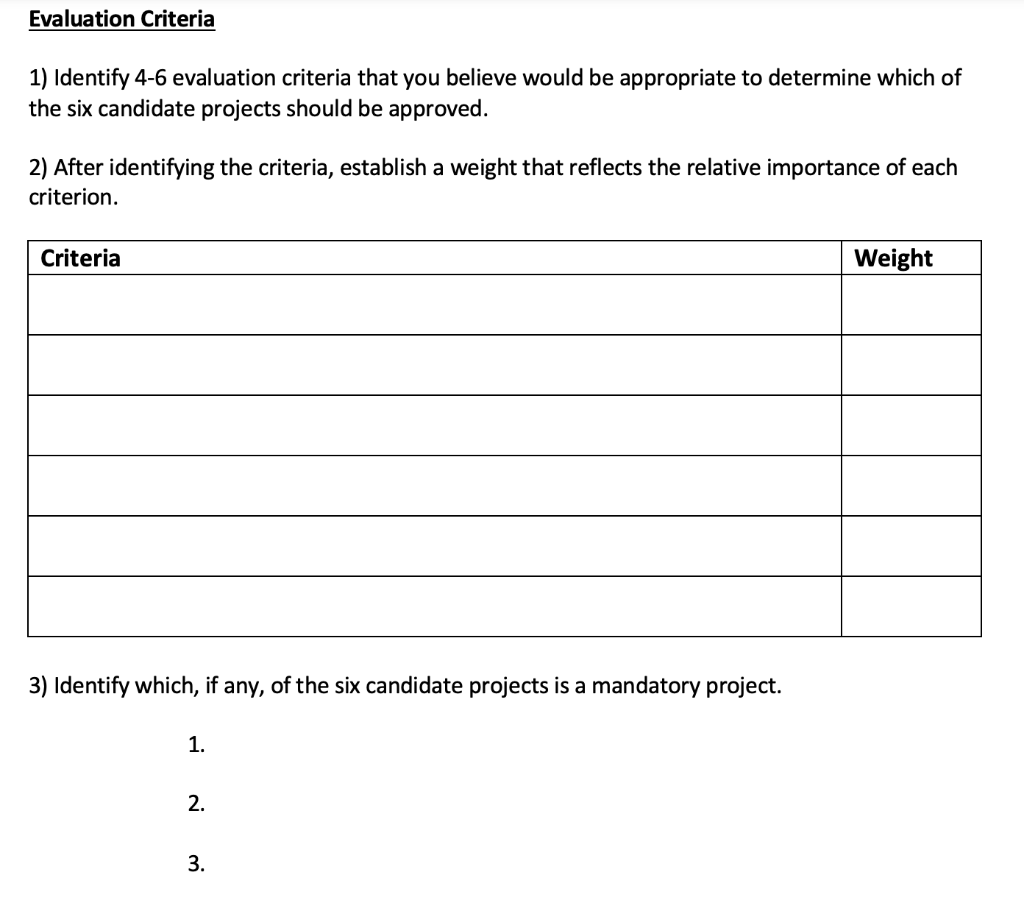

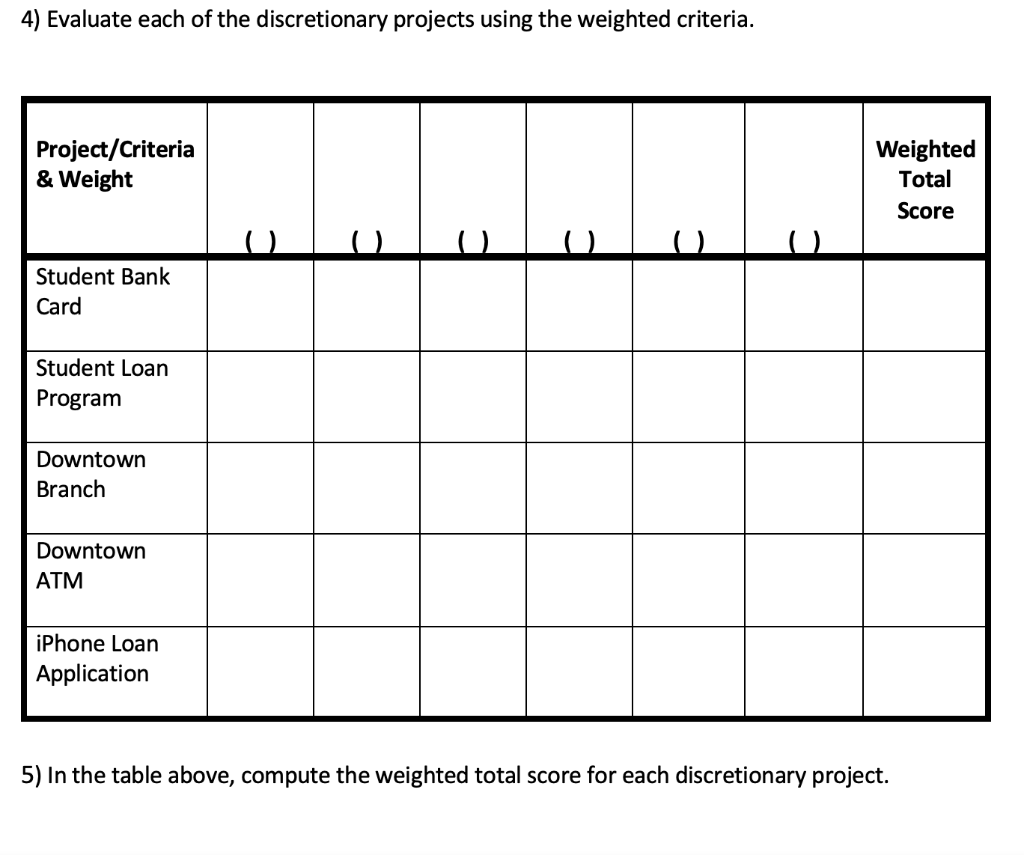

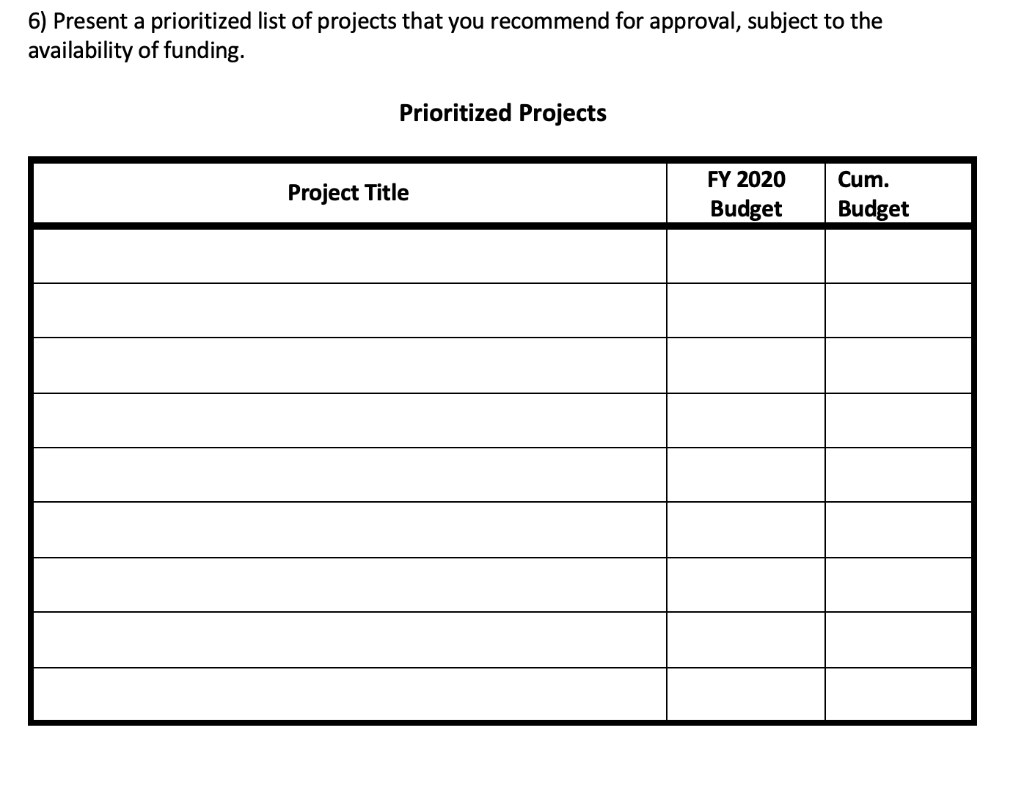

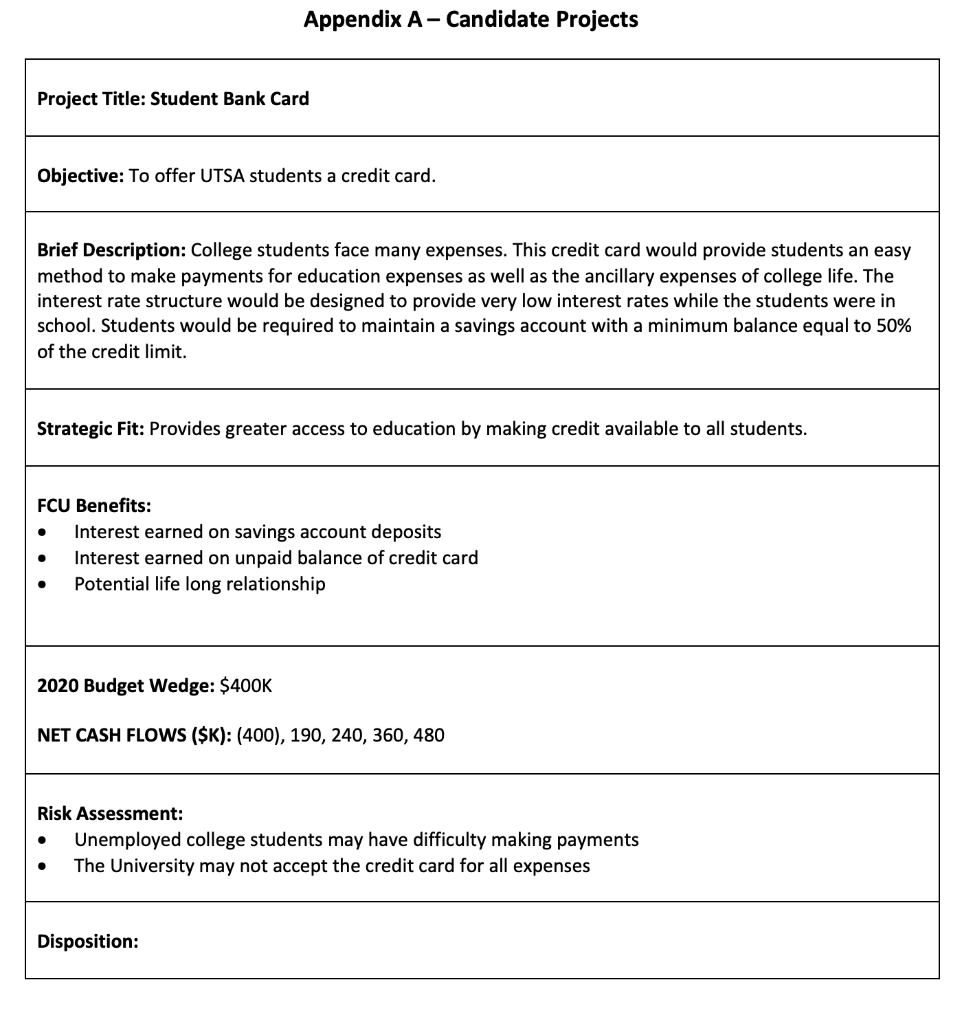

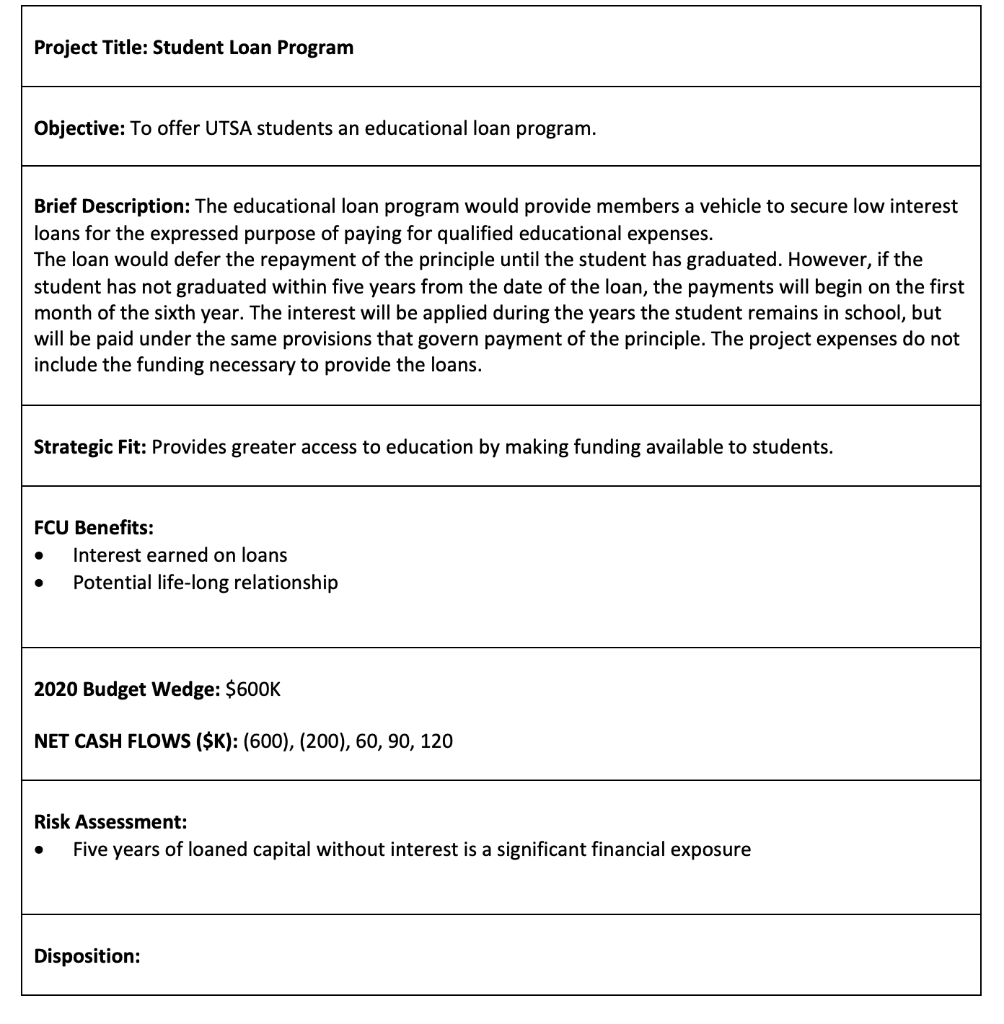

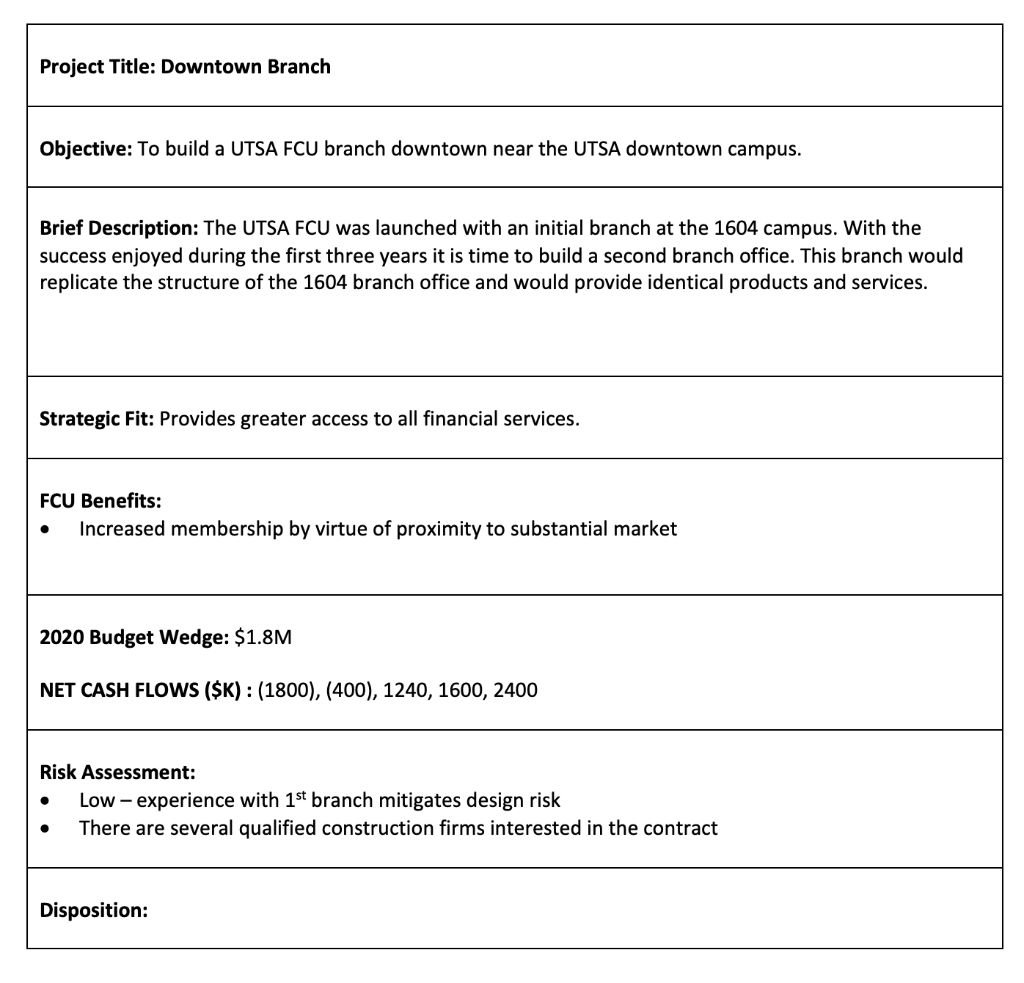

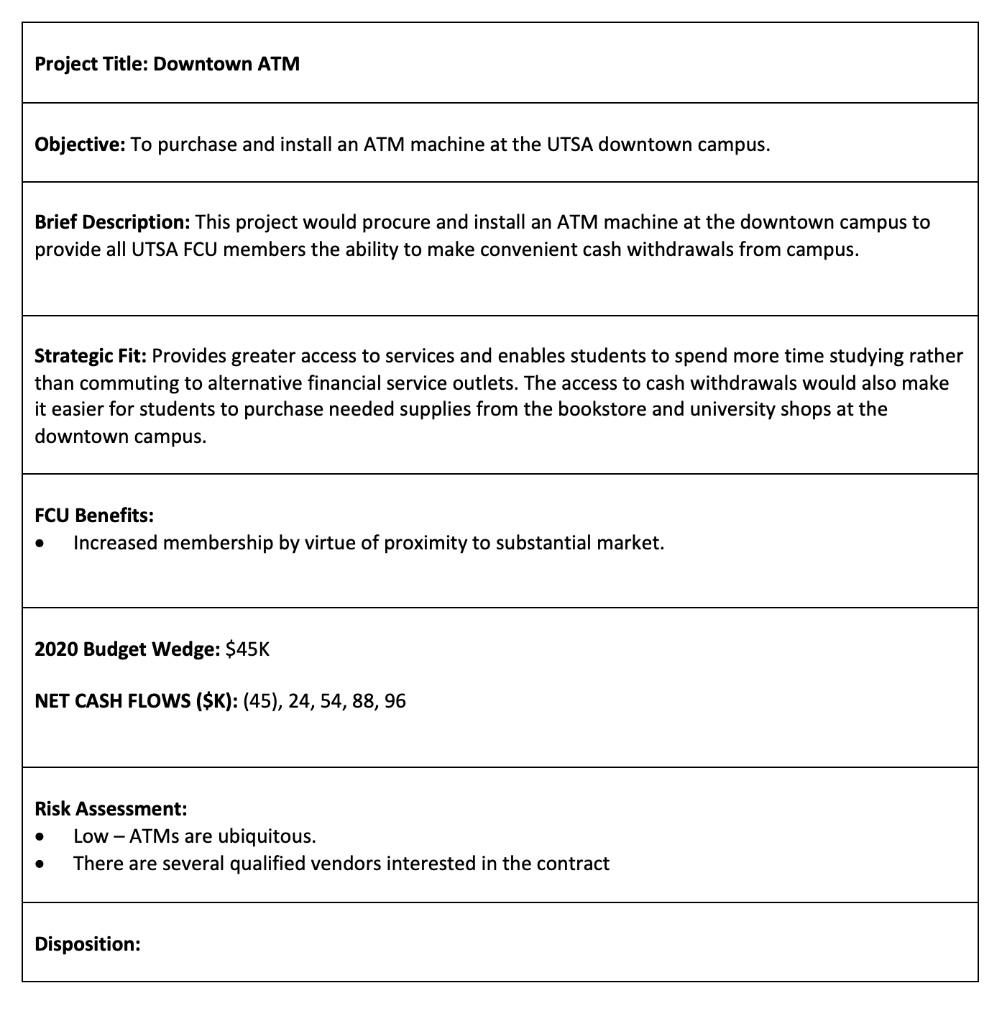

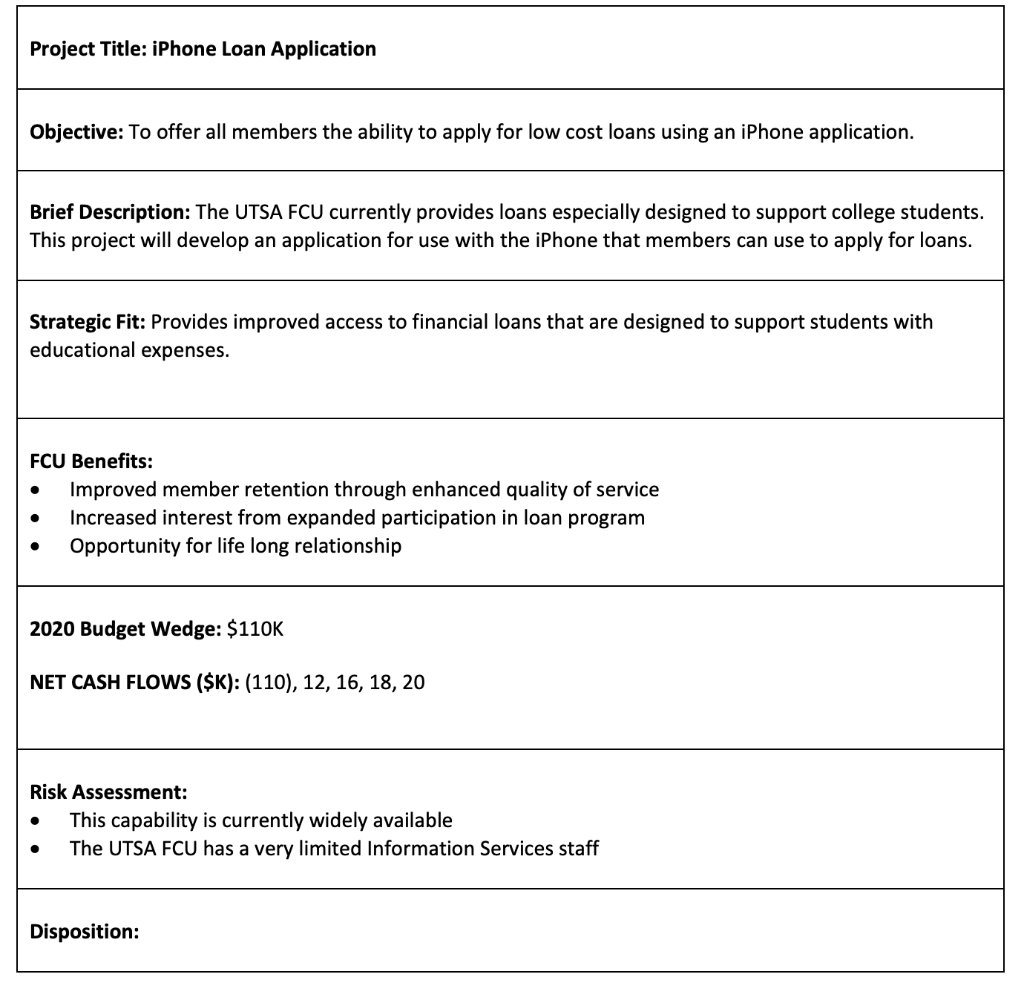

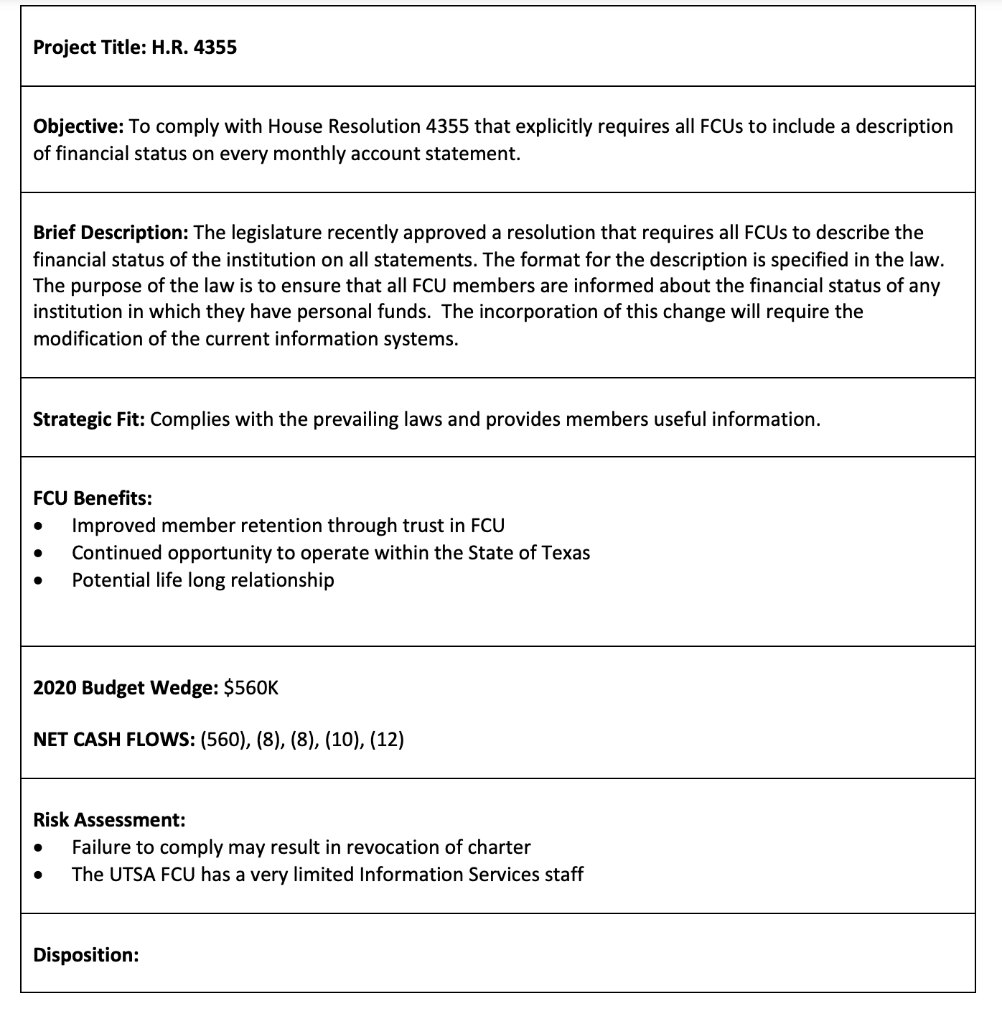

Exercise 04 Project Selection The UTSA Federal Credit Union Introduction The UTSA Federal Credit Union was chartered to serve the financial needs of UTSA students, alumni, faculty and staff, and has already made significant inroads in meeting the financial needs of the UTSA community. In this exercise, you will evaluate some potential new initiatives the UTSA FCU may undertake. Read the overview and appendix sections and then complete the Evaluation Criteria section. Submit with the filenaming convention indicated in the assignment folder. Overview Vision The UTSA FCU seeks to be the financial service institution of choice for the UTSA community. Mission The UTSA Federal Credit Union is committed to providing all members of the UTSA community the opportunity to pursue a brighter future, bolstered by the assurance of financial security. Further, the UTSA FCU recognizes the significant role that education plays in building brighter futures and will emphasize financial products and services that provide the broader South Texas community access to the benefits of a UTSA education. Strategic Objectives To increase access to UTSA FCU products and services throughout the community it serves * To increase the quality of the products and services offered by the UTSA FCU * To develop life-long relationships with UTSA students, faculty and staff Candidate Projects The operational planning committee has identified six candidate projects for the next fiscal year. Additional detail describing each of these six candidate projects is provided in Appendix A. Specifically, you should consider the following six projects: > Student Bank Card > Student Loan Program > Downtown Branch Downtown ATM > iPhone Loan Application > H.R. 4355 Evaluation Criteria 1) Identify 4-6 evaluation criteria that you believe would be appropriate to determine which of the six candidate projects should be approved. 2) After identifying the criteria, establish a weight that reflects the relative importance of each criterion. Criteria Weight 3) Identify which, if any, of the six candidate projects is a mandatory project. 1. 2. 3. 4) Evaluate each of the discretionary projects using the weighted criteria. Project/Criteria & Weight Weighted Total Score a a) Student Bank Card Student Loan Program Downtown Branch Downtown ATM iPhone Loan Application 5) In the table above, compute the weighted total score for each discretionary project. 6) Present a prioritized list of projects that you recommend for approval, subject to the availability of funding. Prioritized Projects Project Title FY 2020 Budget Cum. Budget Appendix A-Candidate Projects Project Title: Student Bank Card Objective: To offer UTSA students a credit card. Brief Description: College students face many expenses. This credit card would provide students an easy method to make payments for education expenses as well as the ancillary expenses of college life. The interest rate structure would be designed to provide very low interest rates while the students were in school. Students would be required to maintain a savings account with a minimum balance equal to 50% of the credit limit. Strategic Fit: Provides greater access to education by making credit available to all students. O FCU Benefits: Interest earned on savings account deposits Interest earned on unpaid balance of credit card Potential life long relationship . . 2020 Budget Wedge: $400K NET CASH FLOWS ($K): (400), 190, 240, 360, 480 0 Risk Assessment: Unemployed college students may have difficulty making payments The University may not accept the credit card for all expenses Disposition: Project Title: Student Loan Program Objective: To offer UTSA students an educational loan program. Brief Description: The educational loan program would provide members a vehicle to secure low interest loans for the expressed purpose of paying for qualified educational expenses. The loan would defer the repayment of the principle until the student has graduated. However, if the student has not graduated within five years from the date of the loan, the payments will begin on the first month of the sixth year. The interest will be applied during the years the student remains in school, but will be paid under the same provisions that govern payment of the principle. The project expenses do not include the funding necessary to provide the loans. Strategic Fit: Provides greater access to education by making funding available to students. . FCU Benefits: Interest earned on loans Potential life-long relationship . 2020 Budget Wedge: $600K NET CASH FLOWS ($K): (600), (200), 60, 90, 120 Risk Assessment: Five years of loaned capital without interest is a significant financial exposure Disposition: Project Title: Downtown Branch Objective: To build a UTSA FCU branch downtown near the UTSA downtown campus. Brief Description: The UTSA FCU was launched with an initial branch at the 1604 campus. With the success enjoyed during the first three years it is time to build a second branch office. This branch would replicate the structure of the 1604 branch office and would provide identical products and services. Strategic Fit: Provides greater access to all financial services. FCU Benefits: Increased membership by virtue of proximity to substantial market . 2020 Budget Wedge: $1.8M NET CASH FLOWS (SK) : (1800), (400), 1240, 1600, 2400 Risk Assessment: Low - experience with 1st branch mitigates design risk There are several qualified construction firms interested in the contract O Disposition: Project Title: Downtown ATM Objective: To purchase and install an ATM machine at the UTSA downtown campus. Brief Description: This project would procure and install an ATM machine at the downtown campus to provide all UTSA FCU members the ability to make convenient cash withdrawals from campus. Strategic Fit: Provides greater access to services and enables students to spend more time studying rather than commuting to alternative financial service outlets. The access to cash withdrawals would also make it easier for students to purchase needed supplies from the bookstore and university shops at the downtown campus. FCU Benefits: Increased membership by virtue of proximity to substantial market. . 2020 Budget Wedge: $45K NET CASH FLOWS ($K): (45), 24, 54, 88, 96 Risk Assessment: Low - ATMs are ubiquitous. There are several qualified vendors interested in the contract O Disposition: Project Title: iPhone Loan Application Objective: To offer all members the ability to apply for low cost loans using an iPhone application. Brief Description: The UTSA FCU currently provides loans especially designed to support college students. This project will develop an application for use with the iPhone that members can use to apply for loans. Strategic Fit: Provides improved access to financial loans that are designed to support students with educational expenses. . FCU Benefits: Improved member retention through enhanced quality of service Increased interest from expanded participation in loan program Opportunity for life long relationship . 2020 Budget Wedge: $110K NET CASH FLOWS (SK): (110), 12, 16, 18, 20 Risk Assessment: This capability is currently widely available The UTSA FCU has a very limited Information Services staff Disposition: Project Title: H.R. 4355 Objective: To comply with House Resolution 4355 that explicitly requires all FCUs to include a description of financial status on every monthly account statement. Brief Description: The legislature recently approved a resolution that requires all FCUs to describe the financial status of the institution on all statements. The format for the description is specified in the law. The purpose of the law is to ensure that all FCU members are informed about the financial status of any institution in which they have personal funds. The incorporation of this change will require the modification of the current information systems. Strategic Fit: Complies with the prevailing laws and provides members useful information. FCU Benefits: Improved member retention through trust in FCU Continued opportunity to operate within the State of Texas Potential life long relationship 2020 Budget Wedge: $560K NET CASH FLOWS: (560), (8), (8), (10), (12) Risk Assessment: Failure to comply may result in revocation of charter The UTSA FCU has a very limited Information Services staff . Disposition