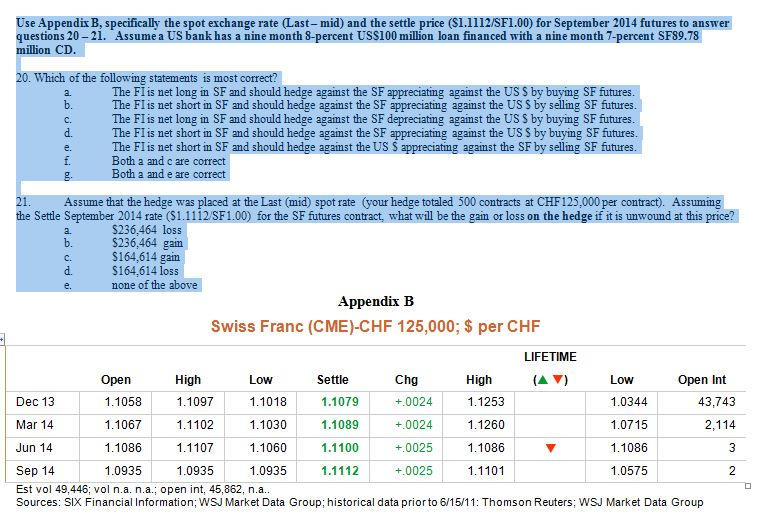

Question: Use Appendix B, specifically the spot exchange rate (Last- mid) and the settle price (S1.1112/SF1.00) for September 2014 futures to answer questions 20-21. Assume a

Use Appendix B, specifically the spot exchange rate (Last- mid) and the settle price (S1.1112/SF1.00) for September 2014 futures to answer questions 20-21. Assume a US bank has a nine month 8-percent US$100 million loan financed with a nine month 7-percent SF89.78 million CD. Which of the following statements is most correct? The Flis net long in SF and should hedge agaimst the SF The Fl is net short in SF and should hedge agaimst the SF appreciating against the US S by sellimg SF futures. The Fl is net long in SF and should hedge agamst the SF depreciating against the US $ by buying SF futures. The FI is net short in SF and should hedge agaimst the SF appreciating agaimst the US S by buying SF futures The FI is net short in SF and should hedge against the US S appreciating against the SF by sellimg SF Both a and c are correct Both a and e are correct g agaimst the US S by buying SF a. b. C. d. Assume that the hedge was placed at the Last (mid) spot rate (your hedge totaled 500 contracts at CHF125,000 per contract). Assuming the Settle September 2014 rate (S1.1112 SF1.00) for the SF futures contract, what will be the gain or loss on the hedge if it is unwound at this price? 2. b. ?. d. S236,464 loss $236,464 gan $164,614 gan $164,614 loss none of the above Appendix B Swiss Franc (CME)-CHF 125,000; $ per CHF LIFETIME Open 1.1058 1.1067 1.1086 1.0935 High 1.1097 1.1102 1.1107 1.0935 Low 1.1018 1.1030 1.1060 1.0935 Chg +.0024 +.0024 +.0025 +.0025 High 1.1253 1.1260 1.1086 1.1101 Settle Low 1.0344 1.0715 1.1086 1.0575 Open Int 1.1079 1.1089 1.1100 1.1112 Dec 13 43,743 Mar 14 Jun 14 Sep 14 Est vol 49,446, vol n.a. n.a.; open int, 45,862, n.a Sources: SIX Financial Information; WSJ Market Data Group; historical data prior to 6/15/11: Thomson Reuters; WSJ Market Data Group Use Appendix B, specifically the spot exchange rate (Last- mid) and the settle price (S1.1112/SF1.00) for September 2014 futures to answer questions 20-21. Assume a US bank has a nine month 8-percent US$100 million loan financed with a nine month 7-percent SF89.78 million CD. Which of the following statements is most correct? The Flis net long in SF and should hedge agaimst the SF The Fl is net short in SF and should hedge agaimst the SF appreciating against the US S by sellimg SF futures. The Fl is net long in SF and should hedge agamst the SF depreciating against the US $ by buying SF futures. The FI is net short in SF and should hedge agaimst the SF appreciating agaimst the US S by buying SF futures The FI is net short in SF and should hedge against the US S appreciating against the SF by sellimg SF Both a and c are correct Both a and e are correct g agaimst the US S by buying SF a. b. C. d. Assume that the hedge was placed at the Last (mid) spot rate (your hedge totaled 500 contracts at CHF125,000 per contract). Assuming the Settle September 2014 rate (S1.1112 SF1.00) for the SF futures contract, what will be the gain or loss on the hedge if it is unwound at this price? 2. b. ?. d. S236,464 loss $236,464 gan $164,614 gan $164,614 loss none of the above Appendix B Swiss Franc (CME)-CHF 125,000; $ per CHF LIFETIME Open 1.1058 1.1067 1.1086 1.0935 High 1.1097 1.1102 1.1107 1.0935 Low 1.1018 1.1030 1.1060 1.0935 Chg +.0024 +.0024 +.0025 +.0025 High 1.1253 1.1260 1.1086 1.1101 Settle Low 1.0344 1.0715 1.1086 1.0575 Open Int 1.1079 1.1089 1.1100 1.1112 Dec 13 43,743 Mar 14 Jun 14 Sep 14 Est vol 49,446, vol n.a. n.a.; open int, 45,862, n.a Sources: SIX Financial Information; WSJ Market Data Group; historical data prior to 6/15/11: Thomson Reuters; WSJ Market Data Group

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts