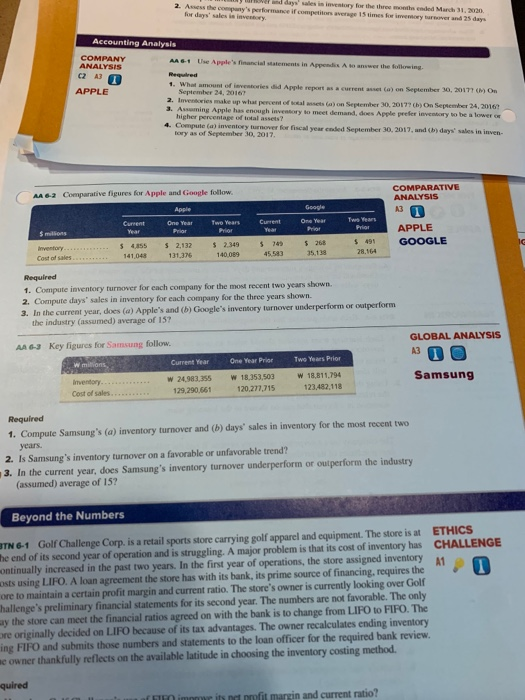

Question: Use Apples financial statements in Appendix A to answer the following? 2. Are the company's performance of competitors were 15 times for red 25 days

2. Are the company's performance of competitors were 15 times for red 25 days four days' sales is inventory Accounting Analysis COMPANY A# Use Apple's financial statements in Appendix Anwwer the following ANALYSIS Required CZA 1. What amount of inventories did Apple report as a current stay on September 30, 20177 (M On APPLE September 24, 20167 2. mies make up what percent of a set on September 30, 2017? (b) on September 24, 2016 3. Auming Apple has enough inventory to meet demand, dees Apple prefer inventory to be a lower higher percentage of total assets? 4. Compute(a) inventory turnover for fiscal year ended September 30, 2017, and his days' sales in inven- Bory as of September 30, 2017 AA 6-2 Comparative figures for Apple and Google follow. COMPARATIVE ANALYSIS 13 Google Current Year Apple One Year Prior Two Years Prior Current Year 5 71 One Year Pro Smlos Two Years Price $ 491 28,164 APPLE GOOGLE Inventory..... 5 4.155 Cost of sales 141048 $ 2,132 131.376 $ 2.349 140,089 $268 35,138 Required 1. Compute inventory turnover for each company for the most recent two years shown. 2. Compute days' sales in inventory for each company for the three years shown. 3. In the current year, does(a) Apple's and (b) Google's inventory turnover underperform or cutperform the industry (assumed) average of 157 AA 6-3 Key figures for Samsung follow. One Year Prior Two Years Prior GLOBAL ANALYSIS Samsung Current Year W 24.983.355 129,290,561 W millions Inventory... Cost of sales. W 18.353,503 120.277,715 W 18,811,794 123,482.118 Required 1. Compute Samsung's (a) inventory turnover and (b) days' sales in inventory for the most recent two years. 2. Is Samsung's inventory turnover on a favorable or unfavorable trend? 3. In the current year, does Samsung's inventory turnover underperform or outperform the industry (assumed) average of 157 Beyond the Numbers BTN 6-1 Golf Challenge Corp. is a retail sports store carrying golf apparel and equipment. The store is at ETHICS the end of its second year of operation and is struggling. A major problem is that its cost of inventory has CHALLENGE continually increased in the past two years. In the first year of operations, the store assigned inventory A1 osts using LIFO. A loan agreement the store has with its bank, its prime source of financing, requires the ore to maintain a certain profit margin and current ratio. The store's owner is currently looking over Golf Challenge's preliminary financial statements for its second year. The numbers are not favorable. The only way the store can meet the financial ratios agreed on with the bank is to change from LIFO to FIFO. The ore originally decided on LIFO because of its tax advantages. The owner recalculates ending inventory ing FIFO and submits those numbers and statements to the loan officer for the required bank review. me owner thankfully reflects on the available latitude in choosing the inventory costing method. quired im neprofit margin and current ratio

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts