Question: Use Apple's financial statements in Appendix A to answer the following. Required: 1. Is Apple's statement of cash flows prepared under the direct method or

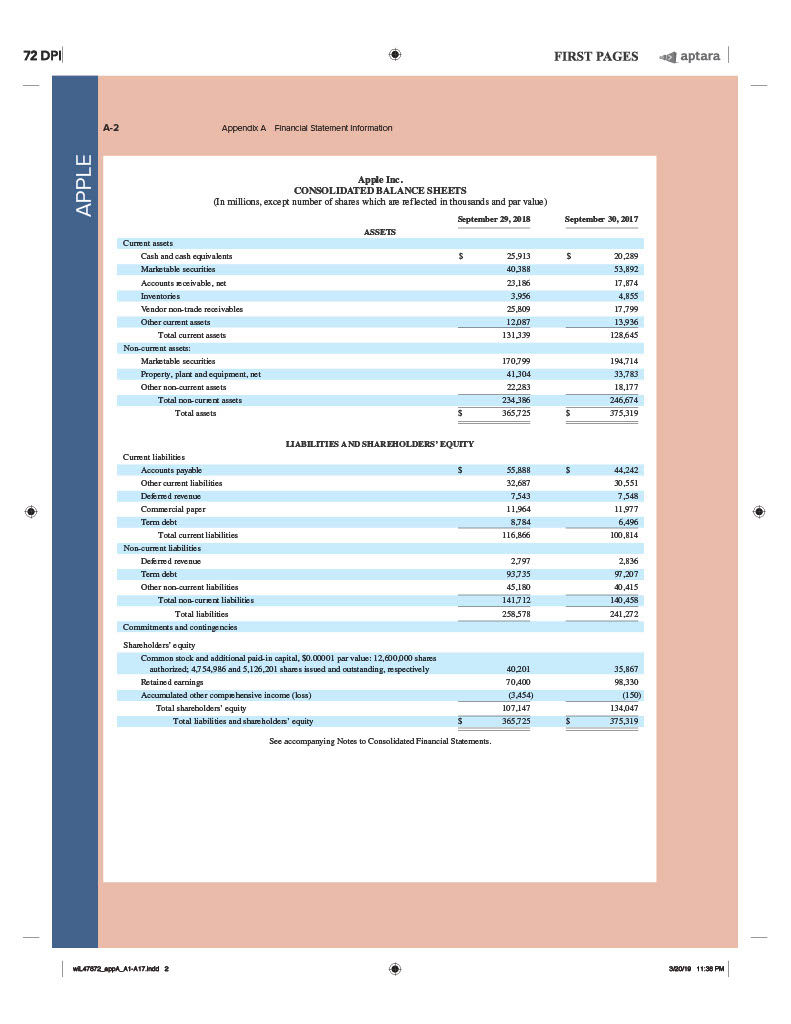

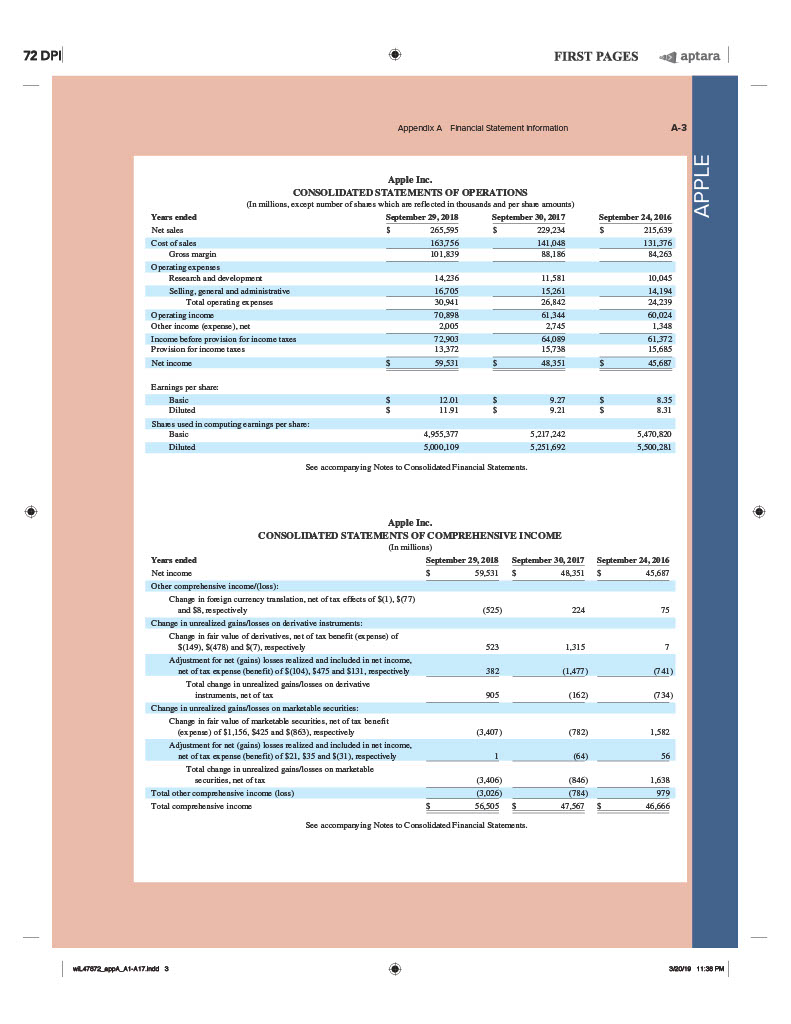

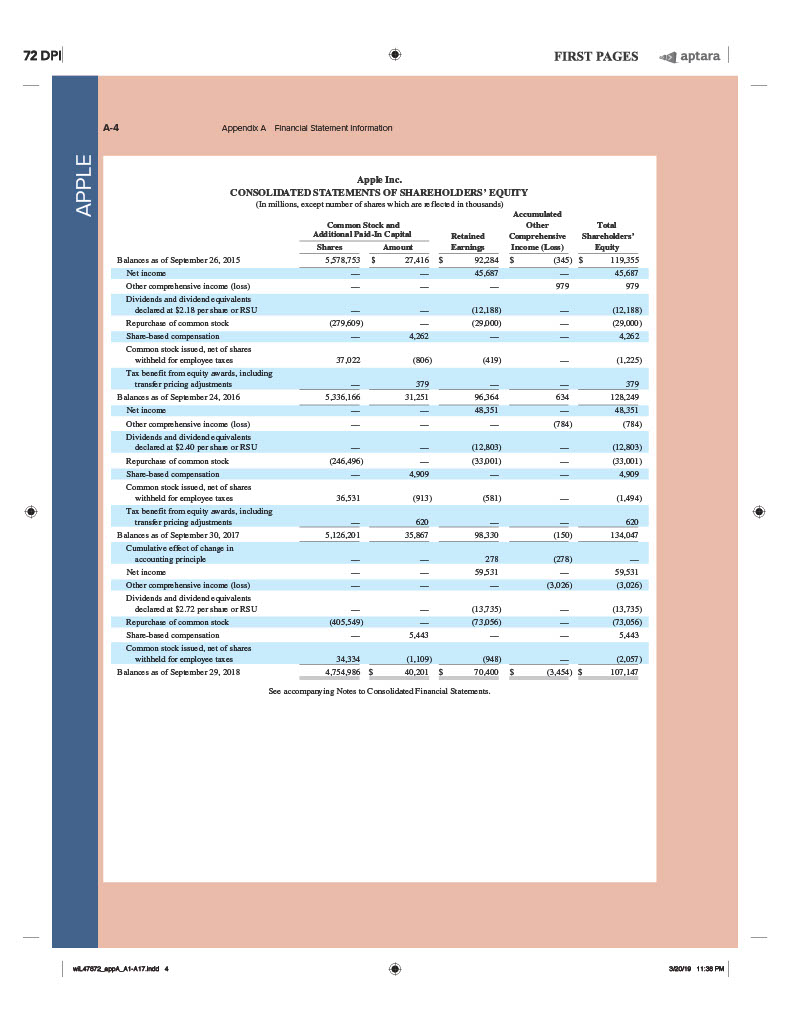

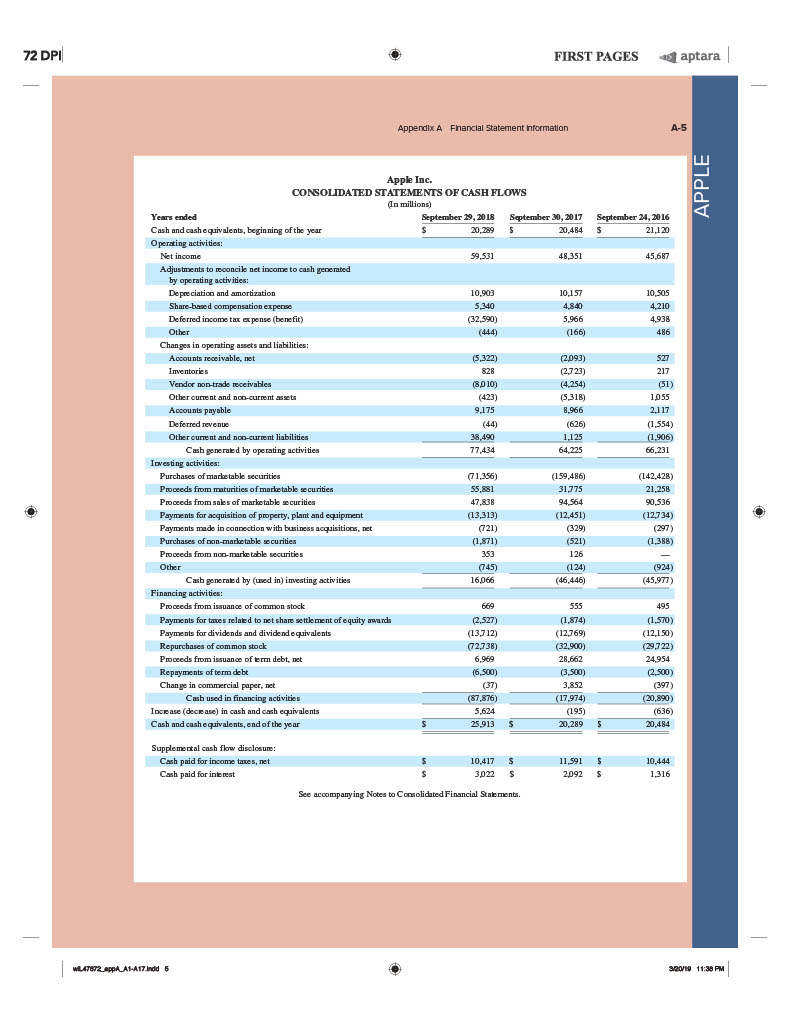

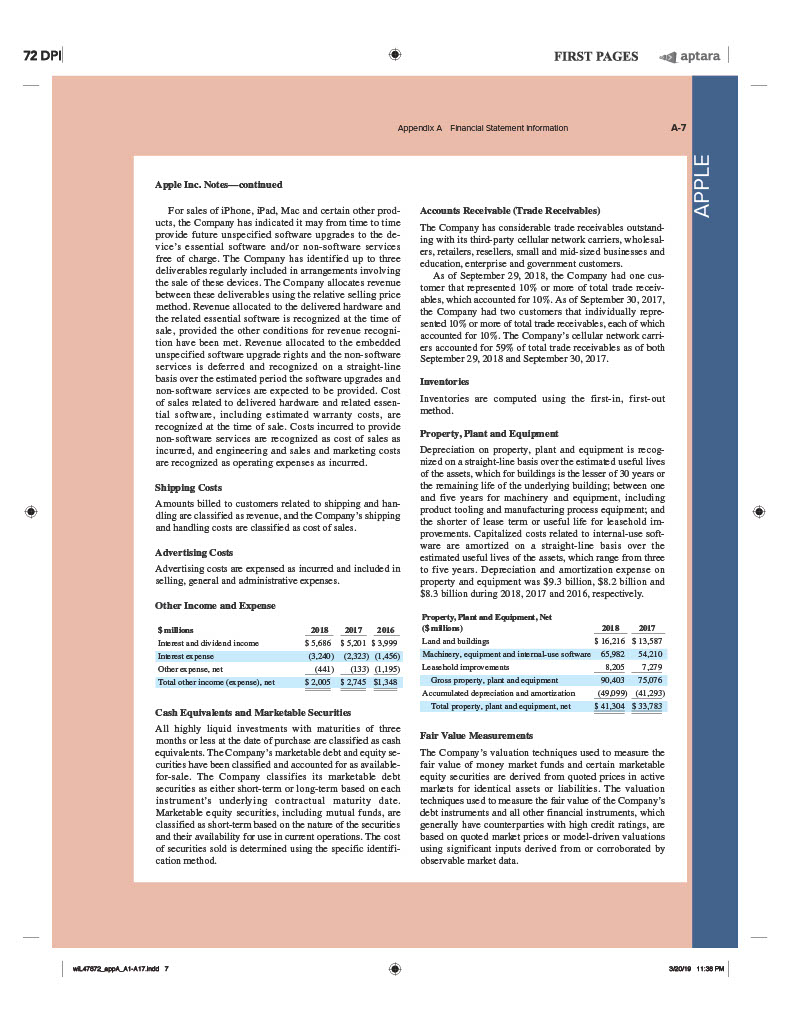

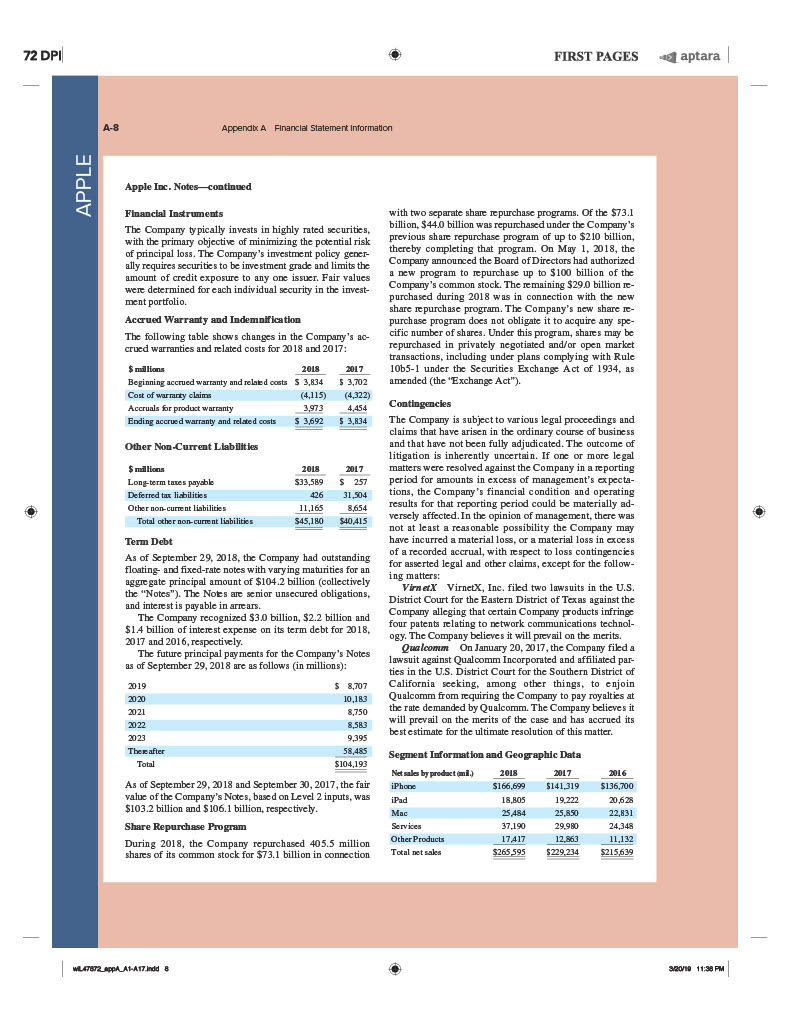

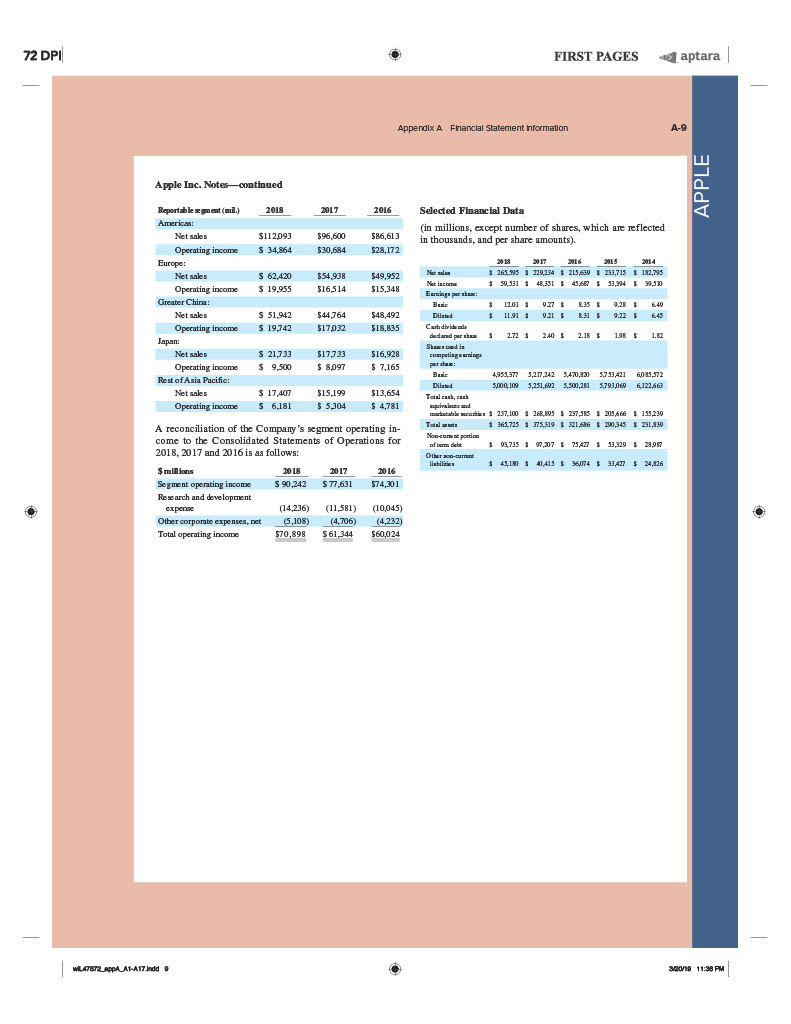

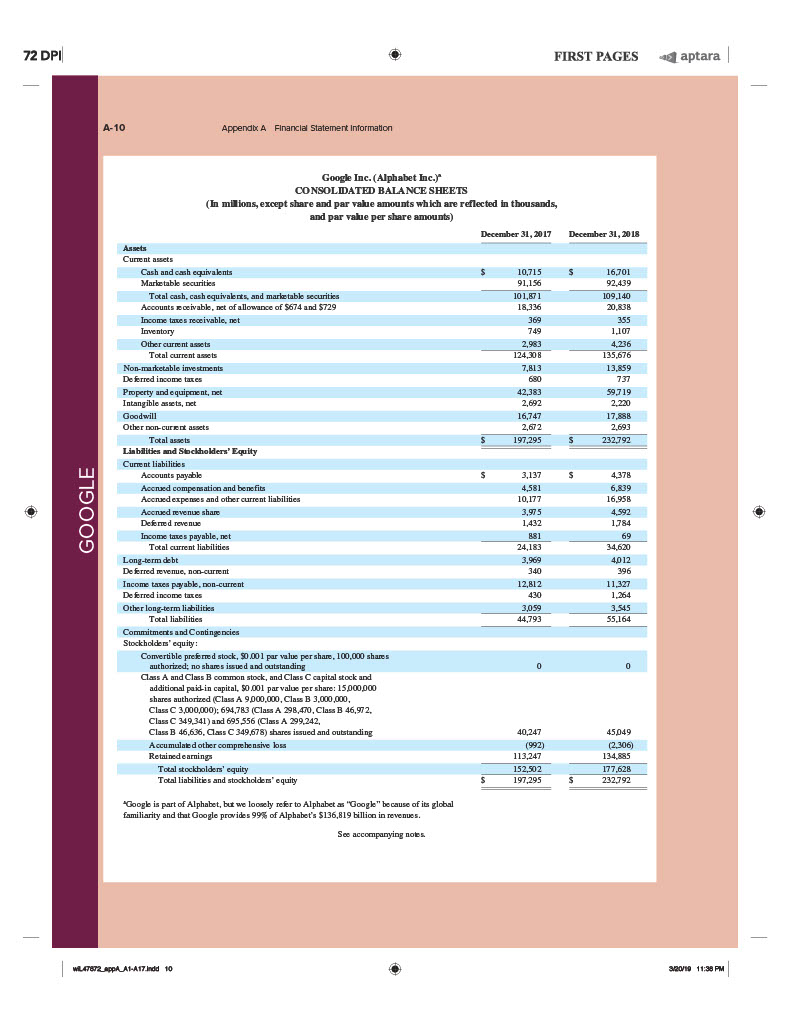

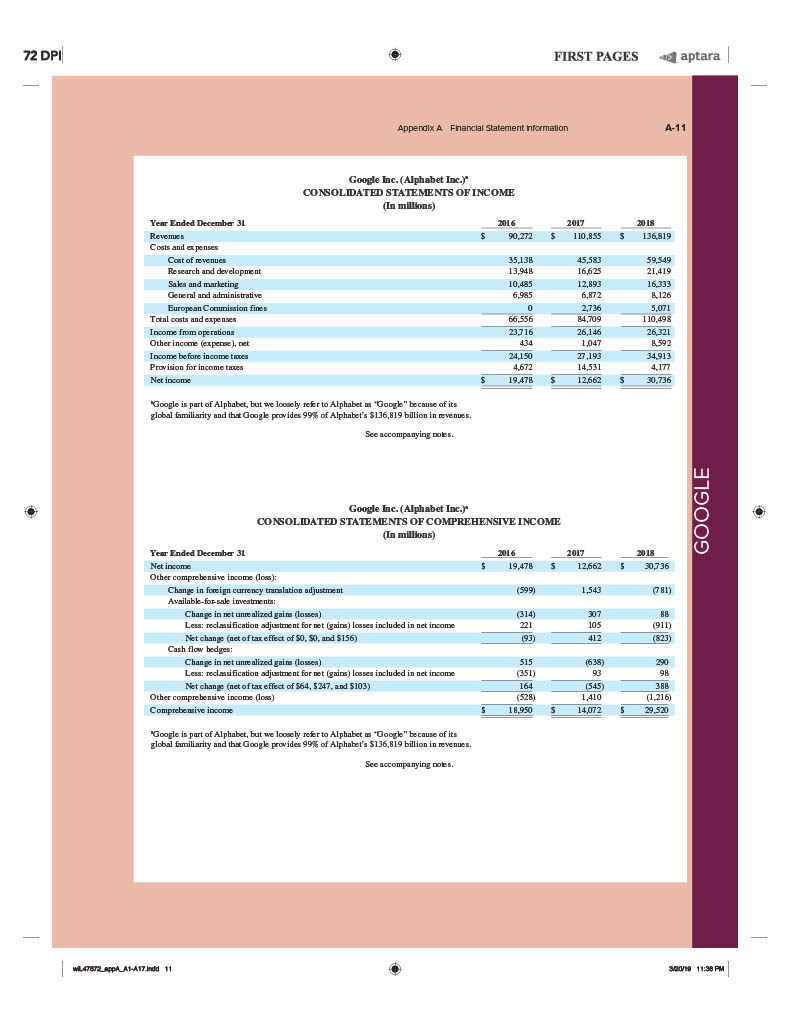

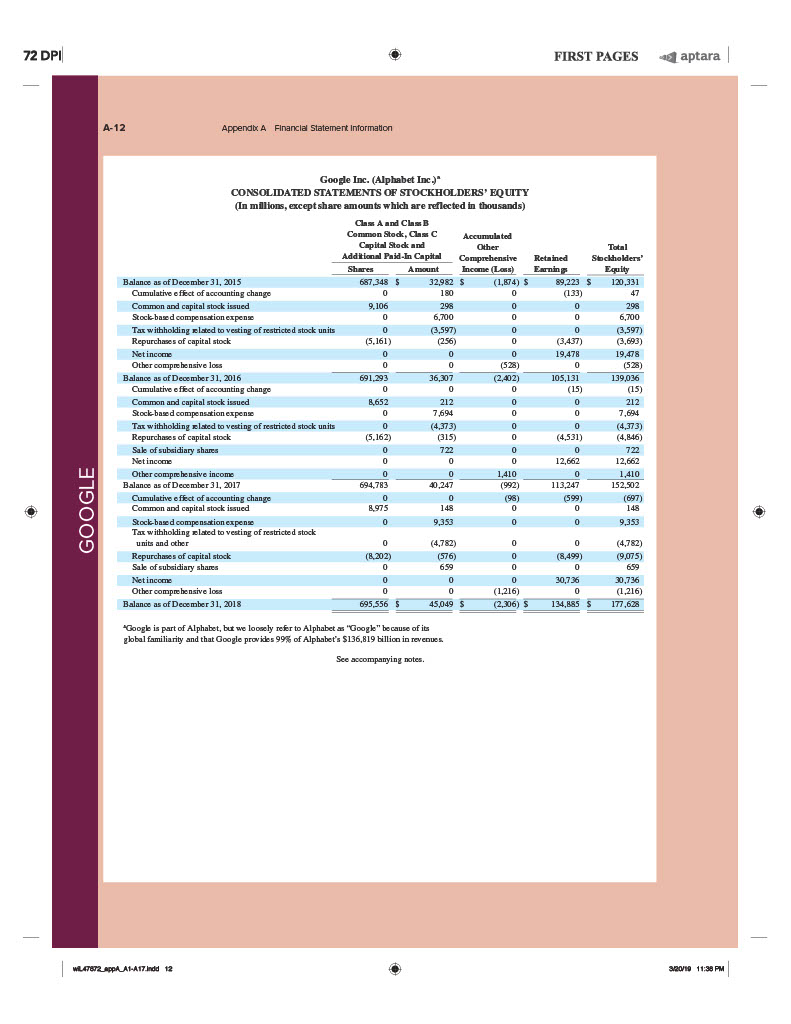

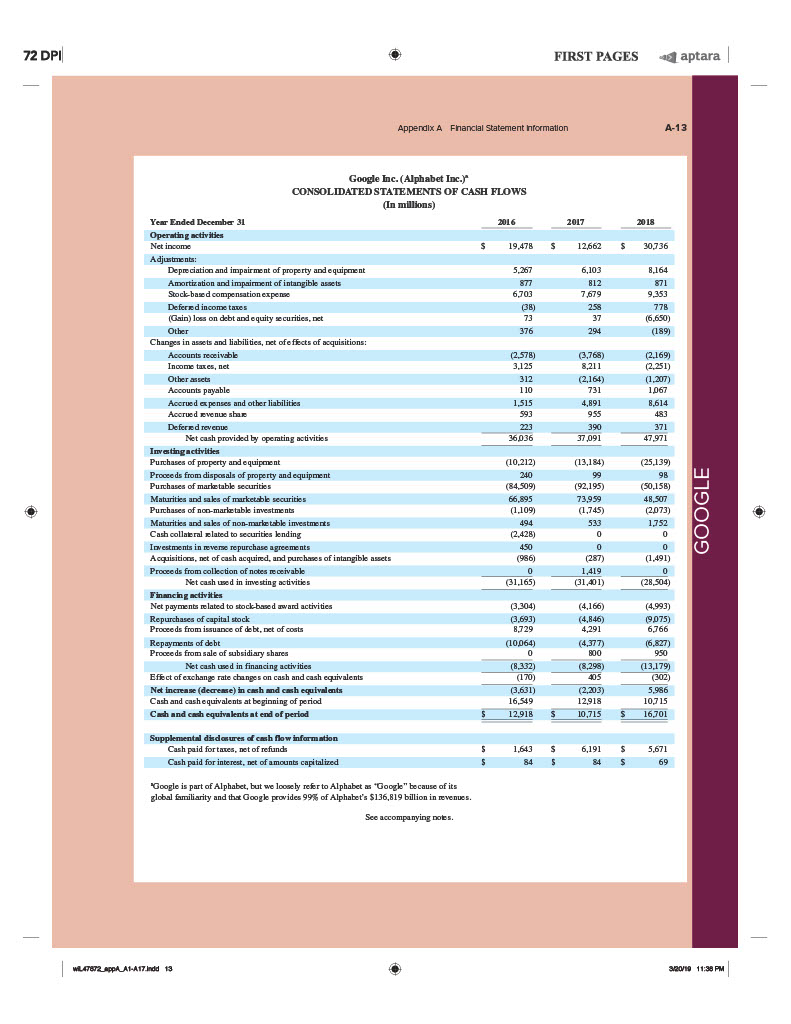

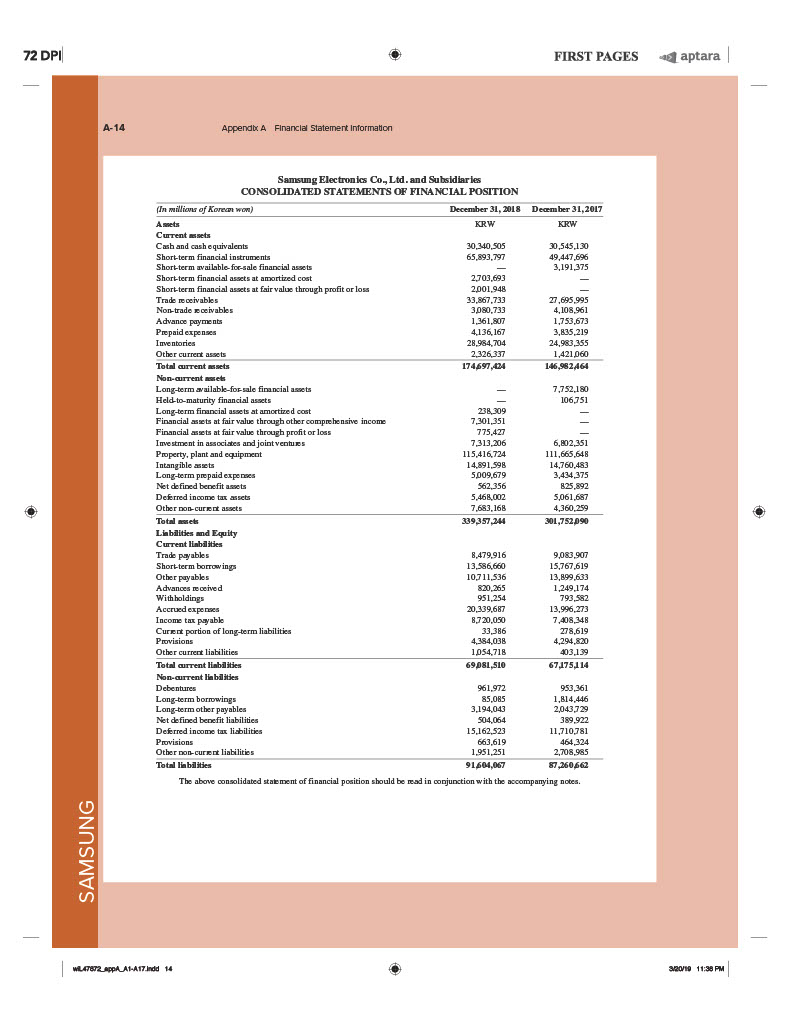

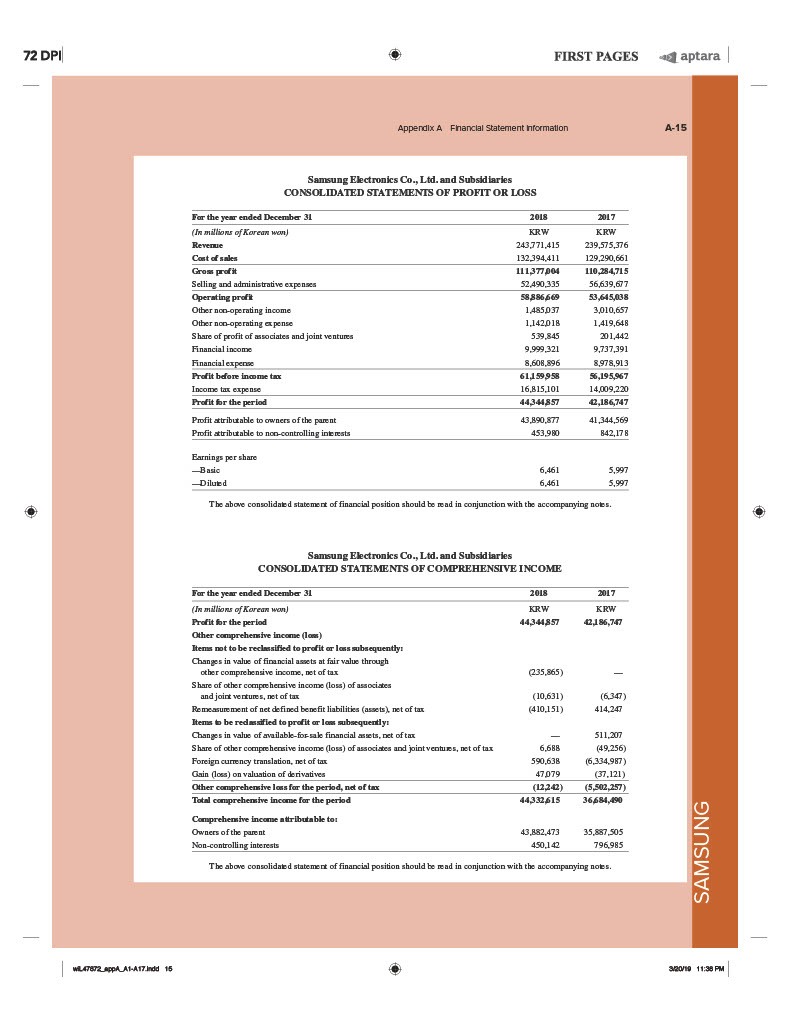

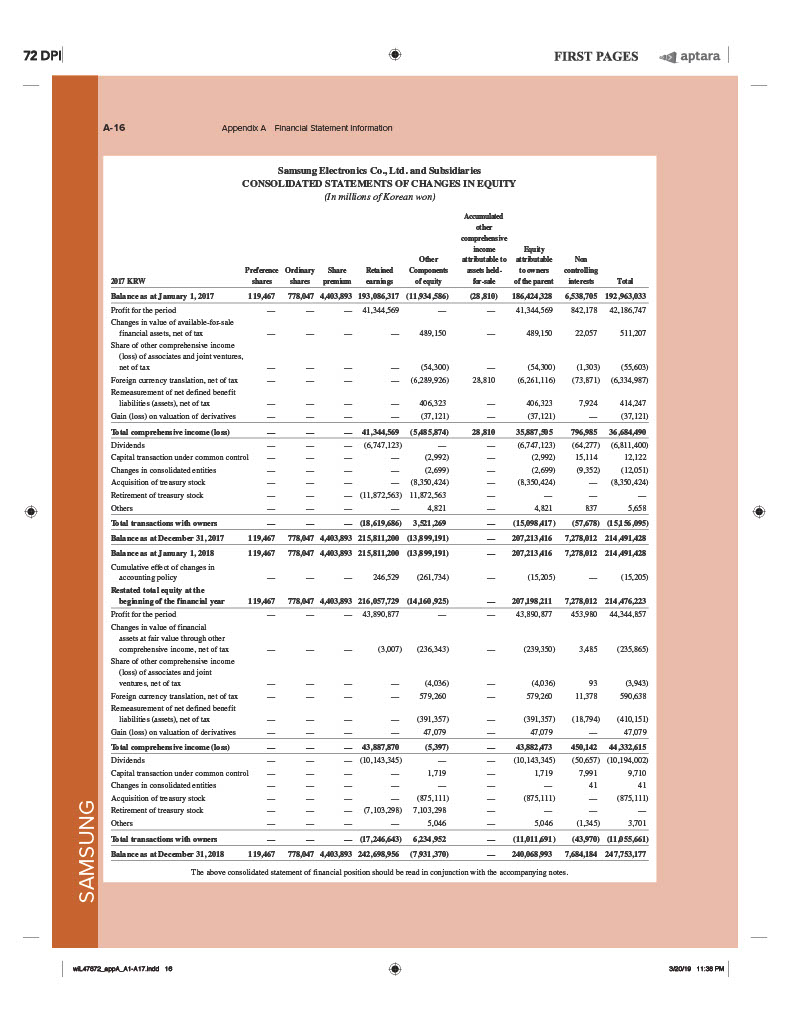

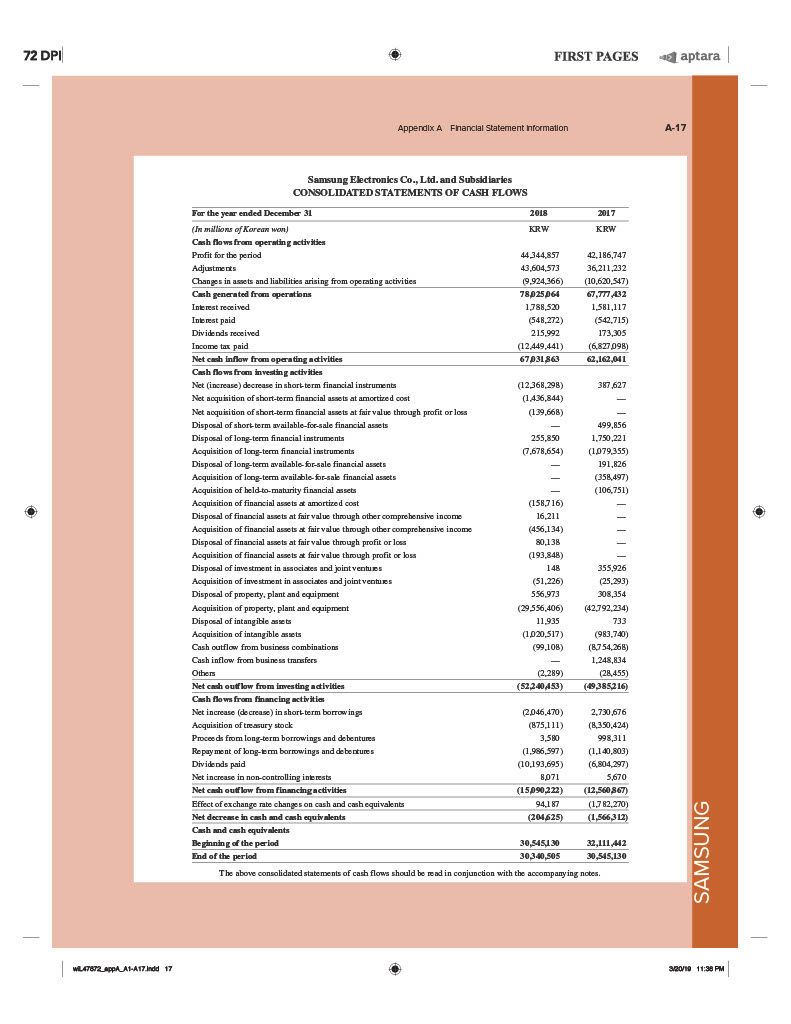

Use Apple's financial statements in Appendix A to answer the following. Required: 1. Is Apple's statement of cash flows prepared under the direct method or the indirect method? 2. For each fiscal year 2018,2017 , and 2016 , identify the amount of cash provided by operating activities and cash paid for dividends. 3. In 2018, did Apple have sufficient cash flows from operations to pay dividends? 4. Did Apple spend more or less cash to repurchase common stock in 2018 versus 2017? Complete this question by entering your answers in the tabs below. Is Apple's statement of cash flows prepared under the direct method or the indirect method? Appendk A Financlal Statement information Apple Inc. CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflected in thousands and par value) LABII.ITIES AND SHAREHOLDERS' EQUITY See accompanying Notes to Consolidated Financial Ststements. Appendx A Fhanclal Statement information See accompanying Notes to Consolidsted Financial Statements. Appendix A Financlal Statement information Apple lnc. Notes-continued For sales of iPhone, IPad, Mac and certain other products, the Company has indicated it may from time to time provide future unspecified software upgrades to the device's essential software and/or non-software services free of charge. The Company has identified up to three deliverables regularly included in arrangements involving the sale of these devices. The Company allocates revenue between these deliverables using the relative selling price method. Revenue allocated to the delivered hardware and the related essential sof tware is recognized at the time of sale, provided the other conditions for revenue recognition have been met. Revenue allocated to the embedded unspecified software upgrade rights and the non-software services is deferred and recognized on a straight-line basis over the estimated period the software upgrades and non-software services are expected to be provided. Cost of sales related to delivered hardware and related essential software, including estimated warranty costs, are recognized at the time of sale. Costs incurred to provide non-software services are recognized as cost of sales as incurred, and engineering and sales and marketing costs are recognized as operating expenses as incurred. Shipping Costs Amounts billed to customers related to shipping and handling are classified as revenue, and the Company's shipping and handling costs are classified as cost of sales. Advertising Costs Advertising costs are expensed as incurred and included in selling, general and administrative expenses. Other Income and Expense Cash Equivalents and Marketable Securities All highly liquid investments with maturities of three months or less at the date of purchase are classified as cash equivalents. The Company's marketable debt and equity securities have been classified and accounted for as availablefor-sale. The Company classifies its marketable debt securities as either short-term or long-term based on each instrument's underlying contractual maturity date. Marketable equity securities, including mutual funds, are classified as short-termbased on the nature of the securities and their availability for use in current operations. The cost of securities sold is determined using the specific identification method. Accounts Receivable (Trade Recetvables) The Company has considerable trade receivables outstanding with its third-party cellular network carriers, wholesalers, retailers, resellers, small and mid-sized businesses and education, enterprise and government customers. As of September 29, 2018, the Company had one customer that represented 10% or more of total trade receivables, which accounted for 10%. As of September 30, 2017, the Company had two customers that individually represented 10% or more of total trade receivables, each of which accounted for 10%. The Company's cellular network carriers accounted for 59% of total trade receivables as of both September 29, 2018 and September 30, 2017. Inventories Inventories are computed using the first-in, first-out method. Property, Pant and Equipment Depreciation on property, plant and equipment is recognized on a straight-line basis over the estimated useful lives of the assets, which for buildings is the lesser of 30 years or the remaining life of the underlying building; between one and five years for machinery and equipment, including product tooling and manufacturing process equipment; and the shorter of lease term or useful life for leasehold improvements. Capitalized costs related to internal-use software are amortized on a straight-line basis over the estimated usefullives of the assets, which range from three to five years. Depreciation and amortization expense on property and equipment was $9.3 billion, $8.2 billion and $8.3 billion during 2018,2017 and 2016 , respectively. Fair Value Measurements The Company's valuation techniques used to measure the fair value of money market funds and certain marketable equity securities are derived from quoted prices in active markets for identical assets or liabilities. The valuation techniques used to measure the fair value of the Company's debt instruments and all other financial instruments, which generally have counterparties with high credit ratings, are based on quoted marlet prices or model-driven valuations using significant inputs derived from or corroborated by observable market data. Apple Inc. Notes-continued Financial Instruments The Company ty pically invests in highly rated securities, with the primary objective of minimizing the potential risk of principal loss. The Company's investment policy generally requires securities to be investment grade and limits the amount of credit exposure to any one issuer. Fair values were determined for each individual security in the investment portfolio. Accrued Warranty and Indemnification The following table shows changes in the Company's accrued warranties and related costs for 2018 and 2017 : Other Non-Current Liabilities Term Debt As of September 29, 2018, the Company had outstanding floating and fixed-rate notes with varying maturities for an aggregate principal amount of $104.2 billion (collectively the "Notes"). The Notes are senior unsecured obligations, and interest is payable in arrears. The Company recognized $3.0 billion, $2.2 billion and $1.4 billion of interest expense on its term debt for 2018 , 2017 and 2016 , respectively. The future principal payments for the Company's Notes as of September 29, 2018 are as follows (in millions): with two separate share repurchase programs. Of the $73.1 billion, $44.0 billion was repurhased under the Company's previous share repurchase program of up to $210 billion, thereby completing that program. On May 1, 2018, the Company announced the Board of Directors had authorized a new program to repurchase up to $100 billion of the Company's common stock. The remaining $29.0 billion repurchased during 2018 was in connection with the new share repurchase program. The Company's new share repurchase program does not obligate it to acquire any specific number of shares. Under this program, shares may be repurchased in privately negotiated and/or open market transactions, including under plans complying with Rule 10b5-1 under the Securities Exchange Act of 1934, as amended (the "Exchange Act"). Contingencies The Company is subject to various legal proceedings and claims that have arisen in the ordinary course of business and that have not been fully adjudicated. The outcome of litigation is inherently uncertain. If one or more legal matters were resolved against the Company in a reporting period for amounts in excess of management's expectations, the Company's financial condition and operating results for that reporting period could be materially adversely affected. In the opinion of management, there was not at least a reasonable possibility the Company may have incurred a material loss, or a material loss in excess of a recorded accrual, with respect to loss contingencies for asserted legal and other claims, except for the following matters: VirnetX VirnetX, Inc. filed two lawsuits in the U.S. District Court for the Eastern District of Texas against the Company alleging that certain Company products infringe four patents relating to network communications technology. The Company believes it will prevail on the merits. Qualcomm On January 20, 20 17, the Company filed a 1awsuit against Qualcomm Incorporated and affiliated parties in the U.S. District Court for the Southern District of California seeking, among other things, to enjoin Qualcomm from requiring the Company to pay royalties at the rate demanded by Qualcomm. The Company believes it will prevail on the merits of the case and has accrued its best estimate for the ultimate resolution of this matter. Gemment Tnformatinn and Cenorgnhic. Thats As of September 29, 2018 and September 30, 2017, the fair value of the Company's Notes, based on Level 2 inputs, was $103.2 billion and $106.1 billion, respectively. Share Repurchase Program During 2018, the Company repurchased 405.5 million shares of its common stock for $73.1 billion in connection Apple Inc. Notes-continued Selected Financial Data (in millions, except number of shares, which are reflected in thousands, and per share amounts). A reconciliation of the Company's segment operating income to the Consolidated Statements of Operations for 2018,2017 and 2016 is as follows: Appendlx A Financlal Statement Information Google Inc. (Alphabet Inc. )n CONSOLIDATED BALANCE SHEETS Appendx A Fhanclal Statement information Google Inc. (Alphabet Inc. )n "Google is part of Alphabet, but we loosely refor to Alphabet a "Google" because of its global familiarity and that Googlo provides 999 of Alphabet's $136,819 billion in revenues. See accompanying notes. Google Inc. (Alphabet Inc.) CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In millions) "Google is part of Alphabet, but we loosely refor to Alphabet as "Google" because of its global familiarity and that Google provides 99 F of Alphabet's $136,819 billion in revenues. See accompanying notes. Google Inc. (Alphabet Inc-)" CONSOLIDATED STATEMENTS OF STOCKHOLDERS' EQUTY (In millions, except share amounts which are reflected in thousands) "Cooglo is part of Alphabet, but we locsely refer to Alphabet as "Google" be cause of its global familiarity and that Google provides 99% of Alphabet's $136,819 billion in revenues. See accompanying notes. Appendx A Fhanclal Statement information Google Inc. (Alphabet Inc.). Appendlx A FInanclal Statement Information Appendix A Financlal Statement information Samsung Electronics Co L. Ltdand Subsidiaries CONSOLIDATED STATEMENIS OF PROFIT OR LOSS The above consolidated stabement of financial position should be ro ad in conjunction with the accompanying notes. Samsung Electronics Co., Ltda and Subsidiaries CONSOLIDATED STATEMIENTS OF COMPREHENSIVE INCOME The above consolidated stabement of financial position should be re ad in conjunction with the accompanying notes. 72 DPI FIRST PAGES aptara A-16 Appendix A FInancial Statement Information Samsung Electronics Co. Ltd. and Subsidiaries CONSOLIDATED STATEMENTS OF CHANGES IN EQUTT (In millions of Korean won) The above consolidated stabement of finsncial position should be read in conjunction with the accompanying notes. 32019 11:38 FM Appendlx A Fhanclal Statement information

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts