Question: Use Apple's financial statements in Appendix A to answer the following. 1. How many shares of Apple common stock are issued and outstanding at (a)

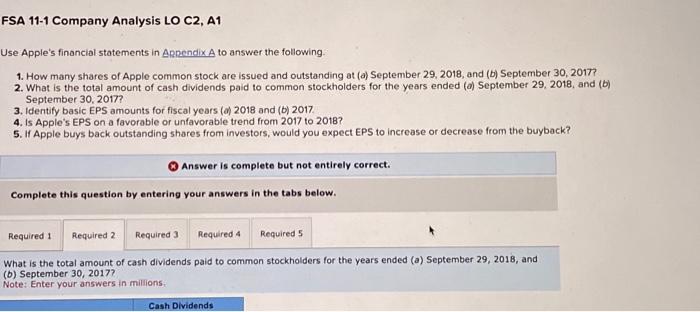

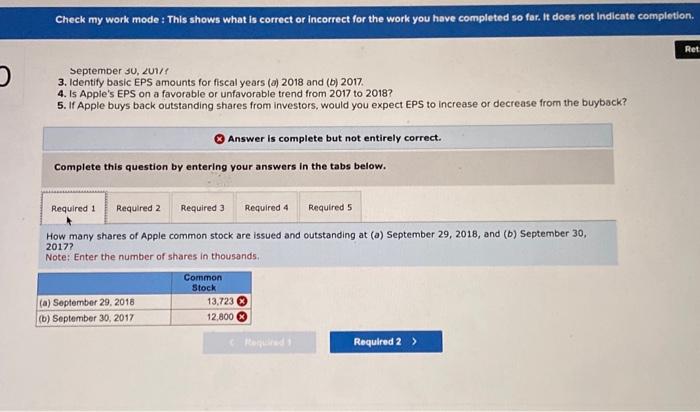

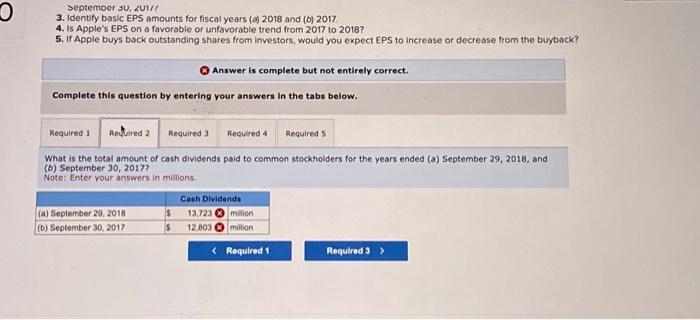

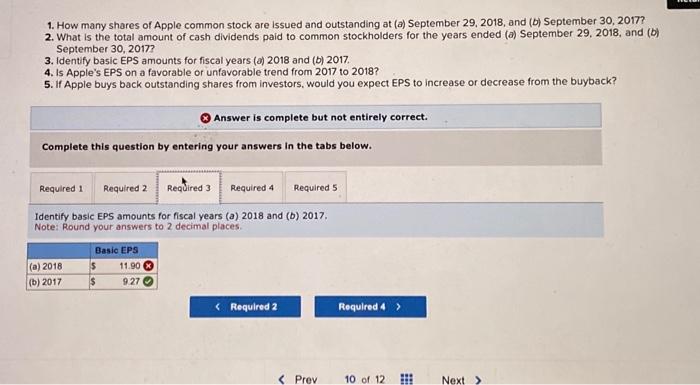

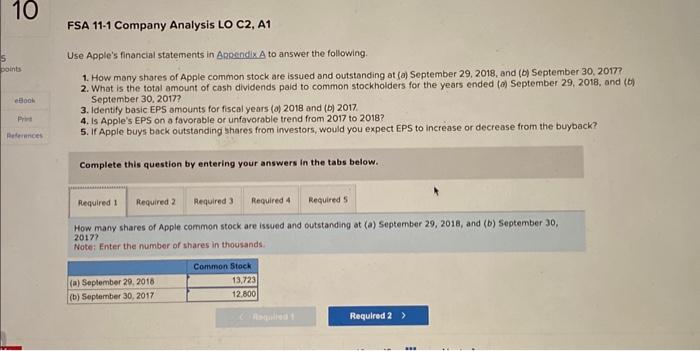

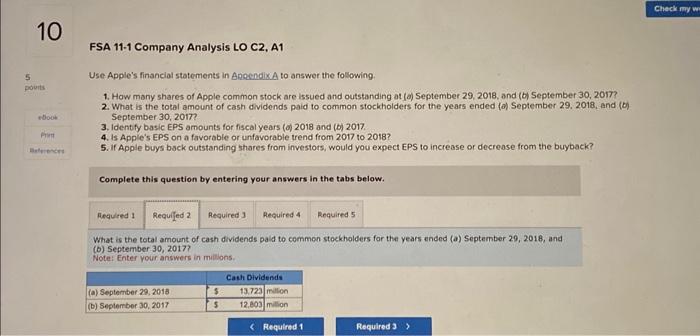

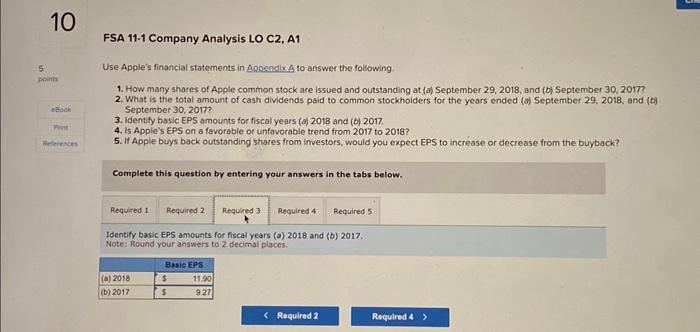

Use Apple's financial statements in Appendix A to answer the following. 1. How many shares of Apple common stock are issued and outstanding at (a) September 29,2018 , and (b) September 30 , 2017? 2. What is the total amount of cash dividends paid to common stockholders for the years ended (a) September 29, 2018, and (b) September 30, 2017? 3. Identify basic EPS amounts for fiscal years (i) 2018 and (b)2017 4. Is Apple's EPS on a favorable or unfavorable trend from 2017 to 2018? 5. If Apple buys back outstanding shares from investors, would you expect EPS to increase or decrease from the buyback? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. What is the total amount of cash dividends paid to common stockholders for the years ended (a) September 29, 2018, and (b) September 30, 2017? Note: Enter your answers in millions. September 30,2 Li/f 3. Identify basic EPS amounts for fiscal years (a) 2018 and (b) 2017. 4. 15 Apple's EPS on a favorable or unfavorable trend from 2017 to 2018? 5. If Apple buys back outstanding shares from investors, would you expect EPS to increase or decrease from the buyback? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. How many shares of Apple common stock are issued and outstanding at (a) September 29, 2018, and (b) September 30, 2017? Note: Enter the number of shares in thousands. Septemoer sU, LUI/r 3. Identify baskc EPS amounts for fiscal years (a) 2018 and (b) 2017 4. Is Apple's EPS on a favorable or unfavorable trend from 2017 to 2018 ? 5. If Apple buys bock outstanding shares from investors, would you expect EPS to increase or decrease from the buyback? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. What is the total amount of cash dividends paid to common stockholders for the years ended (a) September 29, 2018, and (b) September 30, 2017? Note: Enter your answers in millions, 1. How many shares of Apple common stock are issued and outstanding at (a) September 29, 2018, and (b) September 30, 2017? 2. What is the total amount of cash dividends paid to common stockholders for the years ended (a) September 29, 2018, and (b) September 30,2017? 3. Identify basic EPS amounts for fiscal years (d) 2018 and (b) 2017. 4. Is Apple's EPS on a favorable or unfavorable trend from 2017 to 2018? 5. If Apple buys back outstanding shares from investors, would you expect EPS to increase or decrease from the buyback? Answer is complete but not entirely correct. Complete this question by entering your answers in the tabs below. Identify basic EPS amounts for fiscal years (a) 2018 and (b) 2017. Note: Round your answers to 2 decimal places. FSA 11-1 Company Analysis LO C2, A1 Use Apple's financial statements in Appendix A to answer the following. 1. How many shates of Apple common stock are issued and outstanding at (a) September 29, 2018, and (b) September 30, 2017? 2. What is the total amount of cash dividends paid to common stockholders for the years ended (o) September 29, 2018, and (b) September 30, 2017? 3. Identify basic EPS omounts for fiscal years (b) 2018 and (b) 2017 4. Is Apple's EPS on a favorable or unfavorable trend from 2017 to 2018 ? 5. If Apple buys bock outstanding shares from investors, would you expect EPS to increase or decrease from the buyback? Complete this question by entering your answers in the tabs below. How many shares of Apple common stock are issued and outstanding at (a) September 29, 2018, and (b) September 30. 2017? Note: Enter the number of shares in thousands. Use. Apple's financial statements in AngendixA to answer the following. 1. How many shares of Apple common stock are issued and outstanding at (o) September 29, 2018, and (b) September 30, 2017? 2. What is the total amount of cash dividends paid to common stockholders for the years ended (o) September 29, 2018, and (b) September 30,2017? 3. Identfy basic EPS amounts for fiscal years (o) 2018 and (o) 2017. 4. is Appie's EPS on a favorable or unfavorable trend from 2017 to 2018? 5. If Apple buys bsck outstanding thares from investors, would you expect EPS to increase or decrease from the buyback? Complete this question by entering your answers in the tabs below. What is the total amount of cash dividends paid to common stockholders for the years ended (a) September 29, 2.018, and (b) September 30, 2017? Note: Enter your answers in millons. Use Apple's financial statements in Apeondix.A to answer the following. 1. How many shares of Apple common stock are issued and outstanding at (a) September 29, 2018, and (b) September 30, 2017? 2. What is the total amount of cash dividends paid to common stockholders for the years ended (a) September 29, 2018, and (b) September 30,2017? 3. Identify basic EPS amounts for fiscal years (o) 2018 and (b) 2017. 4. Is Apple's EPS on a tavorable or unfavorabie trend from 2017 to 2018? 5. If Apple buys back outstanding shares from investors, would you expect EPS to increase or decrease from the buyback? Complete this question by entering your answers in the tabs below. Identify basic EPS amounts for fiscal years (o) 2018 and (b) 2017. Note: Round your answers to 2 decimat places

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts