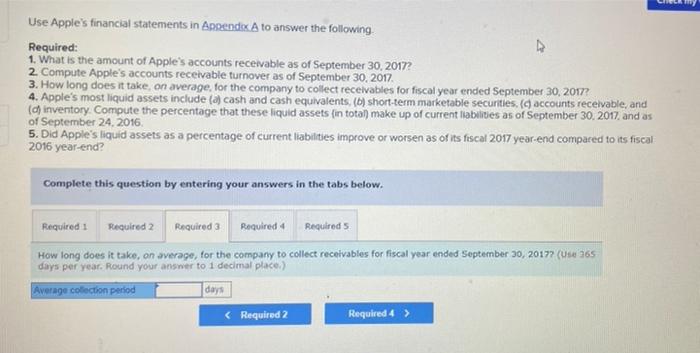

Question: Use Apple's financial statements in Argendix A to answer the following Required: 1. What is the amount of Apple's accounts receivable as of September 30,

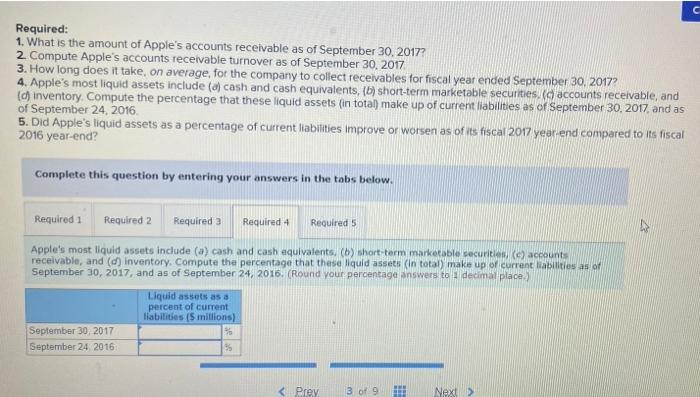

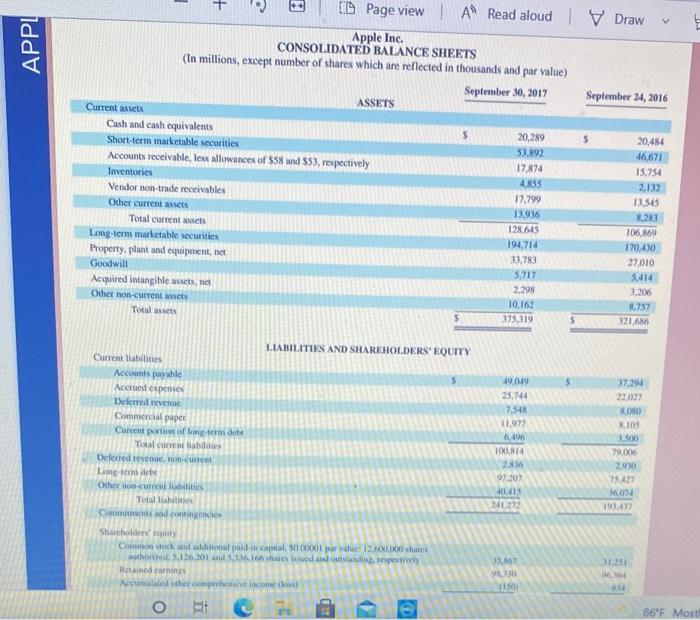

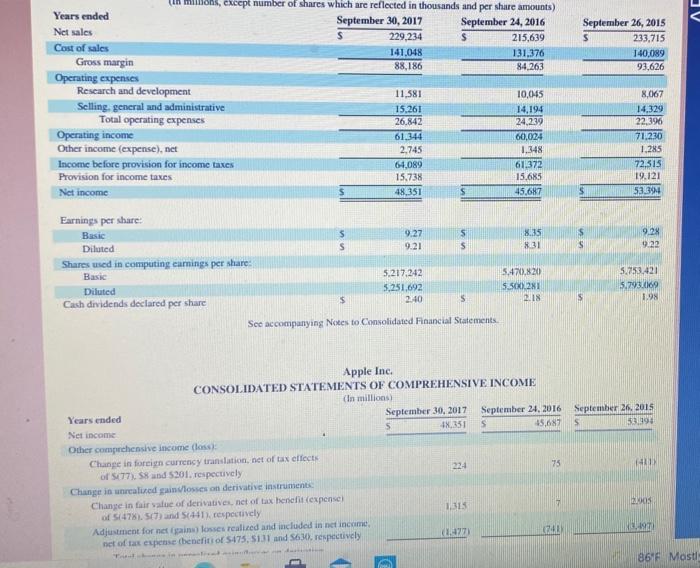

Use Apple's financial statements in Argendix A to answer the following Required: 1. What is the amount of Apple's accounts receivable as of September 30, 2017 2. Compute Apple's accounts receivable turnover as of September 30, 2017 3. How long does it take, on average for the company to collect receivables for fiscal year ended September 30, 2017 4. Apple's most liquid assets include (a) cash and cash equivalents, (b) short-term marketable securities, ( accounts receivable, and (inventory. Compute the percentage that these liquid assets in total) make up of current liabilities as of September 30, 2017 and as 5. Did Apple's liquid assets as a percentage of current liabilities improve or worsen as of its fiscal 2017 year-end compared to its fiscal 2016 year-end? Complete this question by entering your answers in the tabs below. Required Required 2 Required 3 Required 4 Required 5 How long does it take, on average, for the company to collect receivables for fiscal year ended September 30, 2017? (Use 965 days per year. Round your answer to i decimal place) Average collection period days c Required: 1. What is the amount of Apple's accounts receivable as of September 30, 2017? 2. Compute Apple's accounts receivable turnover as of September 30, 2017 3. How long does it take, on average for the company to collect receivables for fiscal year ended September 30, 2017? 4. Apple's most liquid assets include() cash and cash equivalents, (b) short-term marketable securities, accounts receivable, and (c) inventory, Compute the percentage that these liquid assets (in total make up of current liabilities as of September 30, 2017 and as of September 24, 2016 5. Did Apple's liquid assets as a percentage of current liabilities Improve or worsen as of its fiscal 2017 year end compared to its fiscal 2016 year-end? Complete this question by entering your answers in the tobs below. Required 1 Required 2 Required Required 4 Required 5 Apple's most liquid assets include(a) cash and cash equivalents, (o) short-term marketable securities accounts receivable, and (d) inventory. Compute the percentage that these liquid assets in total) make up or corrent buities as of September 30, 2017, and as of September 24, 2016. (Round your percentage answers to decimal place) Liquid assets as a percent of current liabilities (5 millions) September 30, 2017 35 September 24, 2016 5 + APPL O Page view | A Read aloud Draw Apple Inc. CONSOLIDATED BALANCE SHEETS (In millions, except number of shares which are reflected in thousands and par value) September 30, 2017 September 24, 2016 ASSETS Current assets Cush and cash oquivalents 20.289 $ 20,484 Short-term marketable securities 53,892 46,671 Accounts receivable, les allowances of $58 and 553, respectively 17.874 15.754 Inventories 4.855 2,132 Vendor non-trade receivables 17,799 13.515 Other current assets 13,936 1,283 Total current assets 128.645 106.69 Long-term marketable securities 194.714 170.430 Property, plant and equipment, net 33.783 27,010 Goodwill 5,717 5414 Acquired intangible assets, net 2.298 3.206 Other non-current sets 10,162 8.757 Total asets 375.319 321.686 LIABILITIES AND SHAREHOLDERS' EQUITY Current liabilities Accounts payable Acered expenses Deferred revenue Commercial paper Current portion of long-term dels Total corrent des Deferred revenue, non cunet Lun debit Other to-current abilities Tocal abilities Corominand contingencies Shareholders' quity Com stock and additional paid 50.000 v 12.001.000 shares auto 5.126,301 336.16 shares and outstanding Rated earning Accumulher comprehensive income 49.019 25.744 7.548 11.977 6.490 14 2.836 97.302 40415 37,194 22.022 XONO R.104 1.500 79.006 2.930 7542 074 193417 11351 0130 1503 14 O 86F Most V September 26, 2015 s 233,715 140,089 93,626 tih mions, except number of shares which are reflected in thousands and per shure amounts) Years ended September 30, 2017 September 24, 2016 Net sales 229,234 $ 215,639 Cost of sales 141.048 131,376 Gross margin 88,186 84.263 Operating expenses Research and development 11,581 10,045 Selling, general and administrative 15.261 14,194 Total operating expenses 26.842 24.239 Operating income 61.344 60,024 Other income (expense), net 2.745 1.348 Income before provision for income taxes 64,089 61.372 Provision for income taxes 15.738 15.685 Net income 48,351 45,687 Earnings per share: Basic 9.27 S 8.35 Diluted 9.21 8.31 Shares used in computing earnings per share Basic 5.217.242 15.47,820 Diluted 5.251,692 5.5021 Cash dividends declared per share $ 2.40 $ See accompanying Notes to Consolidated Financial Statements 8,067 14,329 22.396 71.230 1.285 72,513 19.121 53.394 un S S 9.28 9.22 5.753.421 5.793169 1.98 2.18 Apple Inc. CONSOLIDATED STATEMENTS OF COMPREHENSIVE INCOME (In millions Years ended September 30, 2017 September 24, 2016 September 26, 2015 Net income 48.351 S 45,67 33.994 Other comprehensive income (los) Change in foreign currency translation, net of tax elect of 5077) S8 and 5201, respectively 224 75 Change in unrclined gaindlosscon derivative Instruments Change in fair value of derivatives net of tax benefit expense of 1478 507) and 56451), respectively IS Adjustment for net gain losses realized and included in net income (71 (1.77 net of tax expense benefit of $175, 131 and 563), respectively INC SOS 86 F Most

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts